John G Ullman & Associates Inc. trimmed its position in Argan, Inc. (NYSE:AGX - Free Report) by 93.1% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 4,400 shares of the construction company's stock after selling 59,600 shares during the quarter. John G Ullman & Associates Inc.'s holdings in Argan were worth $446,000 at the end of the most recent reporting period.

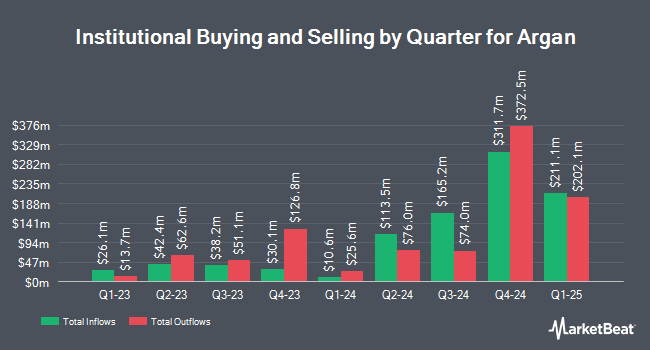

Several other hedge funds have also made changes to their positions in the company. American Century Companies Inc. grew its holdings in Argan by 31.8% during the 2nd quarter. American Century Companies Inc. now owns 305,298 shares of the construction company's stock worth $22,336,000 after acquiring an additional 73,658 shares in the last quarter. Hood River Capital Management LLC purchased a new stake in shares of Argan in the 2nd quarter worth approximately $5,245,000. Connor Clark & Lunn Investment Management Ltd. boosted its stake in shares of Argan by 72.2% during the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 114,224 shares of the construction company's stock valued at $11,586,000 after purchasing an additional 47,881 shares in the last quarter. Sapient Capital LLC purchased a new position in Argan during the third quarter valued at approximately $4,783,000. Finally, Deprince Race & Zollo Inc. purchased a new stake in Argan during the second quarter worth $3,168,000. 79.43% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at Argan

In other Argan news, Director Rainer H. Bosselmann sold 10,105 shares of the firm's stock in a transaction on Monday, October 21st. The shares were sold at an average price of $130.10, for a total value of $1,314,660.50. Following the completion of the transaction, the director now owns 219,879 shares of the company's stock, valued at approximately $28,606,257.90. This trade represents a 4.39 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director Cynthia Flanders sold 5,000 shares of the business's stock in a transaction on Wednesday, September 25th. The shares were sold at an average price of $96.39, for a total transaction of $481,950.00. Following the sale, the director now directly owns 17,332 shares in the company, valued at $1,670,631.48. This trade represents a 22.39 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 39,703 shares of company stock worth $4,257,794. Insiders own 11.85% of the company's stock.

Argan Trading Up 4.9 %

Shares of NYSE:AGX traded up $7.21 during trading on Thursday, reaching $154.08. The stock had a trading volume of 252,578 shares, compared to its average volume of 172,097. Argan, Inc. has a one year low of $39.74 and a one year high of $162.78. The company has a market capitalization of $2.08 billion, a P/E ratio of 46.12 and a beta of 0.49. The firm's 50-day simple moving average is $120.93 and its 200 day simple moving average is $90.07.

Argan (NYSE:AGX - Get Free Report) last issued its quarterly earnings results on Thursday, September 5th. The construction company reported $1.31 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.97 by $0.34. The business had revenue of $227.02 million for the quarter, compared to the consensus estimate of $191.05 million. Argan had a return on equity of 14.80% and a net margin of 6.11%. Argan's revenue was up 60.6% on a year-over-year basis.

Argan Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, October 31st. Shareholders of record on Wednesday, October 23rd were issued a $0.375 dividend. This represents a $1.50 annualized dividend and a yield of 0.97%. The ex-dividend date of this dividend was Wednesday, October 23rd. This is an increase from Argan's previous quarterly dividend of $0.30. Argan's dividend payout ratio (DPR) is currently 47.17%.

Wall Street Analysts Forecast Growth

Separately, StockNews.com cut Argan from a "buy" rating to a "hold" rating in a research report on Tuesday, October 29th.

Read Our Latest Stock Report on AGX

Argan Company Profile

(

Free Report)

Argan, Inc, through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market. The company operates through Power Services, Industrial Services, and Telecom Services segments. The Power Services segment offers engineering, procurement, and construction, as well as designing, building, and commissioning of large-scale energy projects to the owners of alternative energy facilities, such as biomass plants, wind farms, and solar fields; and design, construction, project management, start-up, and operation services for projects with approximately 18 gigawatts of power-generating capacity.

Read More

Before you consider Argan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Argan wasn't on the list.

While Argan currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.