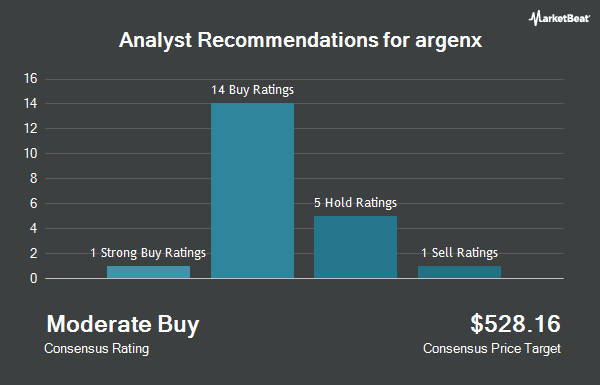

Shares of argenx SE (NASDAQ:ARGX - Get Free Report) have earned a consensus rating of "Moderate Buy" from the twenty-two brokerages that are presently covering the firm, MarketBeat.com reports. One equities research analyst has rated the stock with a sell rating, two have assigned a hold rating, eighteen have assigned a buy rating and one has issued a strong buy rating on the company. The average 12 month price objective among analysts that have updated their coverage on the stock in the last year is $687.00.

ARGX has been the topic of several recent analyst reports. Truist Financial reaffirmed a "buy" rating and issued a $700.00 price target (up from $660.00) on shares of argenx in a research report on Tuesday, January 14th. William Blair reaffirmed an "outperform" rating on shares of argenx in a research report on Friday, February 28th. Piper Sandler increased their price target on shares of argenx from $620.00 to $725.00 and gave the company an "overweight" rating in a report on Tuesday, January 7th. Citigroup reaffirmed an "outperform" rating on shares of argenx in a research report on Friday, February 28th. Finally, HC Wainwright increased their target price on shares of argenx from $717.00 to $720.00 and gave the company a "buy" rating in a research note on Friday, February 28th.

Read Our Latest Stock Analysis on ARGX

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently modified their holdings of ARGX. Janney Montgomery Scott LLC raised its position in argenx by 201.2% in the 3rd quarter. Janney Montgomery Scott LLC now owns 2,072 shares of the company's stock valued at $1,123,000 after purchasing an additional 1,384 shares during the last quarter. Keudell Morrison Wealth Management bought a new position in shares of argenx in the third quarter valued at about $207,000. Assetmark Inc. lifted its position in argenx by 8.3% during the 3rd quarter. Assetmark Inc. now owns 7,769 shares of the company's stock worth $4,211,000 after buying an additional 598 shares in the last quarter. TimesSquare Capital Management LLC grew its holdings in argenx by 8.8% during the 3rd quarter. TimesSquare Capital Management LLC now owns 109,490 shares of the company's stock worth $59,352,000 after acquiring an additional 8,840 shares during the last quarter. Finally, Crossmark Global Holdings Inc. increased its position in argenx by 100.4% in the 3rd quarter. Crossmark Global Holdings Inc. now owns 9,462 shares of the company's stock valued at $5,130,000 after acquiring an additional 4,741 shares in the last quarter. 60.32% of the stock is owned by institutional investors and hedge funds.

argenx Trading Up 1.7 %

argenx stock traded up $9.43 during trading hours on Friday, reaching $580.43. 407,992 shares of the company were exchanged, compared to its average volume of 283,957. argenx has a 12 month low of $349.86 and a 12 month high of $678.21. The stock has a 50-day moving average of $641.45 and a 200 day moving average of $594.49. The firm has a market cap of $35.27 billion, a price-to-earnings ratio of -659.58 and a beta of 0.59.

argenx (NASDAQ:ARGX - Get Free Report) last released its earnings results on Thursday, February 27th. The company reported $1.58 earnings per share for the quarter, topping analysts' consensus estimates of $0.98 by $0.60. The firm had revenue of $761.22 million during the quarter, compared to analyst estimates of $678.52 million. argenx had a negative net margin of 2.11% and a negative return on equity of 1.45%. As a group, research analysts forecast that argenx will post 3.13 EPS for the current year.

argenx Company Profile

(

Get Free Reportargenx SE, a biotechnology company, engages in the developing of various therapies for the treatment of autoimmune diseases in the United States, Japan, Europe, Middle East, Africa, and China. Its lead product candidate is efgartigimod for the treatment of patients with myasthenia gravis, immune thrombocytopenia, pemphigus vulgaris, generalized myasthenia gravis, chronic inflammatory demyelinating polyneuropathy, thyroid eye disease, bullous pemphigoid, myositis, primary sjögren's syndrome, post-covid postural orthostatic tachycardia syndrome, membranous nephropathy, lupus nephropathy, anca-associated vasculitis, and antibody mediated rejection; ENHANZE SC; Empasiprubart for multifocal motor neuropath, delayed graft function, and dermatomyositis; and ARGX-119 for congenital myasthenic syndrome and amyotrophic lateral sclerosis.

Featured Stories

Before you consider argenx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and argenx wasn't on the list.

While argenx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.