Moderna (NASDAQ:MRNA - Get Free Report) was downgraded by equities research analysts at Argus from a "buy" rating to a "hold" rating in a note issued to investors on Wednesday, Marketbeat Ratings reports.

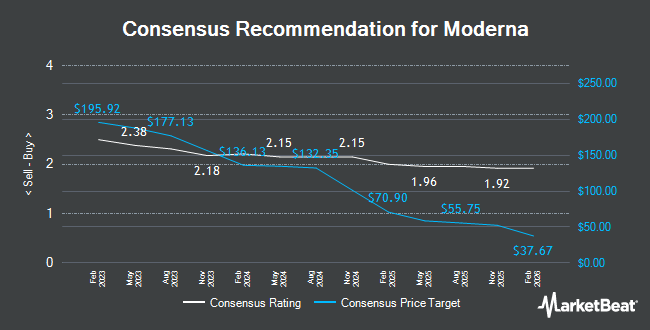

Several other analysts have also recently weighed in on the company. Leerink Partners dropped their price target on Moderna from $60.00 to $48.00 and set an "underperform" rating for the company in a report on Tuesday, September 17th. UBS Group reduced their target price on shares of Moderna from $140.00 to $108.00 and set a "buy" rating for the company in a research report on Thursday, October 24th. Berenberg Bank started coverage on shares of Moderna in a research note on Tuesday, November 19th. They issued a "hold" rating and a $42.00 price target on the stock. TD Cowen dropped their price objective on shares of Moderna from $70.00 to $60.00 and set a "hold" rating for the company in a research note on Friday, September 13th. Finally, Needham & Company LLC restated a "hold" rating on shares of Moderna in a research report on Friday, November 8th. Four equities research analysts have rated the stock with a sell rating, twelve have assigned a hold rating, five have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $79.50.

View Our Latest Stock Analysis on MRNA

Moderna Stock Performance

Shares of NASDAQ:MRNA traded down $2.40 on Wednesday, hitting $38.36. The company had a trading volume of 8,531,538 shares, compared to its average volume of 5,009,812. The stock has a 50 day moving average price of $47.57 and a 200 day moving average price of $81.73. The company has a current ratio of 4.39, a quick ratio of 4.20 and a debt-to-equity ratio of 0.05. The stock has a market cap of $14.76 billion, a price-to-earnings ratio of -6.59 and a beta of 1.58. Moderna has a 1-year low of $35.80 and a 1-year high of $170.47.

Moderna (NASDAQ:MRNA - Get Free Report) last released its quarterly earnings results on Thursday, November 7th. The company reported $0.03 earnings per share for the quarter, beating the consensus estimate of ($1.89) by $1.92. Moderna had a negative net margin of 43.77% and a negative return on equity of 17.68%. The firm had revenue of $1.90 billion for the quarter, compared to analysts' expectations of $1.25 billion. During the same period in the prior year, the firm earned ($1.39) EPS. The business's revenue was up 3.8% on a year-over-year basis. Analysts expect that Moderna will post -9.3 EPS for the current year.

Insider Activity at Moderna

In other Moderna news, insider Shannon Thyme Klinger sold 1,418 shares of the stock in a transaction dated Friday, November 29th. The stock was sold at an average price of $42.79, for a total value of $60,676.22. Following the completion of the transaction, the insider now directly owns 19,717 shares in the company, valued at approximately $843,690.43. This trade represents a 6.71 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CFO James M. Mock sold 715 shares of the business's stock in a transaction dated Monday, October 7th. The stock was sold at an average price of $60.12, for a total value of $42,985.80. Following the sale, the chief financial officer now owns 9,505 shares in the company, valued at approximately $571,440.60. This trade represents a 7.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 3,379 shares of company stock valued at $158,195. 15.20% of the stock is owned by insiders.

Institutional Inflows and Outflows

Large investors have recently added to or reduced their stakes in the business. Inspire Trust Co. N.A. grew its position in shares of Moderna by 73.5% in the 3rd quarter. Inspire Trust Co. N.A. now owns 16,525 shares of the company's stock valued at $1,104,000 after buying an additional 7,000 shares during the last quarter. Teachers Retirement System of The State of Kentucky lifted its stake in shares of Moderna by 1.4% in the third quarter. Teachers Retirement System of The State of Kentucky now owns 287,887 shares of the company's stock worth $19,239,000 after acquiring an additional 3,978 shares during the period. Toronto Dominion Bank boosted its holdings in Moderna by 23.7% in the third quarter. Toronto Dominion Bank now owns 131,477 shares of the company's stock valued at $8,787,000 after acquiring an additional 25,177 shares during the last quarter. Geode Capital Management LLC increased its position in Moderna by 2.6% during the 3rd quarter. Geode Capital Management LLC now owns 7,069,580 shares of the company's stock valued at $470,670,000 after purchasing an additional 178,115 shares during the period. Finally, Groupama Asset Managment raised its holdings in Moderna by 29.1% during the 3rd quarter. Groupama Asset Managment now owns 21,838 shares of the company's stock worth $1,459,000 after purchasing an additional 4,920 shares during the last quarter. Institutional investors own 75.33% of the company's stock.

About Moderna

(

Get Free Report)

Moderna, Inc, a biotechnology company, discovers, develops, and commercializes messenger RNA therapeutics and vaccines for the treatment of infectious diseases, immuno-oncology, rare diseases, autoimmune, and cardiovascular diseases in the United States, Europe, and internationally. Its respiratory vaccines include COVID-19, influenza, and respiratory syncytial virus, spikevax, and hMPV/PIV3 vaccines; latent vaccines comprise cytomegalovirus, epstein-barr virus, herpes simplex virus, varicella zoster virus, and human immunodeficiency virus vaccines; public health vaccines consists of Zika, Nipah, Mpox vaccines; and infectious diseases vaccines, such as lyme and norovirus vaccines.

Recommended Stories

Before you consider Moderna, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Moderna wasn't on the list.

While Moderna currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.