Electronic Arts (NASDAQ:EA - Get Free Report) had its target price hoisted by analysts at Argus from $161.00 to $183.00 in a research report issued on Thursday,Benzinga reports. The firm currently has a "buy" rating on the game software company's stock. Argus' price objective would indicate a potential upside of 15.06% from the company's current price.

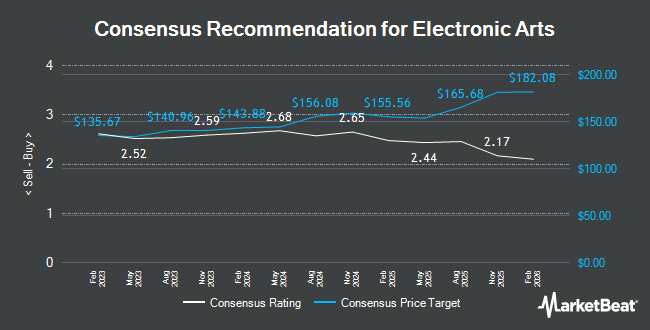

Other equities analysts have also recently issued reports about the company. Roth Mkm upped their price objective on Electronic Arts from $154.00 to $158.00 and gave the company a "neutral" rating in a research report on Wednesday, October 30th. Robert W. Baird upped their price objective on Electronic Arts from $170.00 to $175.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 30th. Raymond James increased their price objective on shares of Electronic Arts from $155.00 to $170.00 and gave the company an "outperform" rating in a report on Wednesday, July 31st. Stifel Nicolaus increased their target price on Electronic Arts from $165.00 to $167.00 and gave the company a "buy" rating in a research report on Wednesday, July 31st. Finally, Jefferies Financial Group started coverage on shares of Electronic Arts in a research note on Thursday, July 11th. They issued a "buy" rating and a $165.00 price objective for the company. Eight investment analysts have rated the stock with a hold rating, twelve have given a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $165.37.

Check Out Our Latest Stock Analysis on EA

Electronic Arts Price Performance

Shares of EA stock traded up $1.09 during trading hours on Thursday, hitting $159.05. 674,598 shares of the company's stock were exchanged, compared to its average volume of 2,054,974. The company has a market capitalization of $41.71 billion, a PE ratio of 40.85, a PEG ratio of 2.00 and a beta of 0.78. The company has a current ratio of 1.43, a quick ratio of 1.45 and a debt-to-equity ratio of 0.25. Electronic Arts has a 12-month low of $124.92 and a 12-month high of $159.34. The business's 50 day simple moving average is $145.35 and its 200-day simple moving average is $140.90.

Insider Activity

In other Electronic Arts news, CEO Andrew Wilson sold 2,500 shares of the business's stock in a transaction on Wednesday, September 25th. The stock was sold at an average price of $141.50, for a total transaction of $353,750.00. Following the sale, the chief executive officer now directly owns 54,247 shares in the company, valued at approximately $7,675,950.50. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. In other Electronic Arts news, CEO Andrew Wilson sold 2,500 shares of the company's stock in a transaction dated Wednesday, September 25th. The stock was sold at an average price of $141.50, for a total transaction of $353,750.00. Following the completion of the sale, the chief executive officer now directly owns 54,247 shares in the company, valued at $7,675,950.50. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, insider Vijayanthimala Singh sold 1,000 shares of the business's stock in a transaction dated Friday, November 1st. The stock was sold at an average price of $150.83, for a total value of $150,830.00. Following the transaction, the insider now owns 28,190 shares in the company, valued at approximately $4,251,897.70. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 26,144 shares of company stock valued at $3,886,282 in the last ninety days. 0.22% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Electronic Arts

A number of institutional investors and hedge funds have recently modified their holdings of the stock. Duality Advisers LP acquired a new position in Electronic Arts in the 1st quarter valued at approximately $1,711,000. State Board of Administration of Florida Retirement System increased its stake in shares of Electronic Arts by 13.5% in the 1st quarter. State Board of Administration of Florida Retirement System now owns 348,670 shares of the game software company's stock valued at $46,258,000 after acquiring an additional 41,567 shares during the last quarter. Vanguard Group Inc. grew its holdings in shares of Electronic Arts by 14.7% in the 1st quarter. Vanguard Group Inc. now owns 29,159,718 shares of the game software company's stock valued at $3,868,620,000 after buying an additional 3,727,251 shares during the period. Park Avenue Securities LLC grew its stake in Electronic Arts by 34.9% in the second quarter. Park Avenue Securities LLC now owns 14,227 shares of the game software company's stock valued at $1,982,000 after acquiring an additional 3,681 shares during the period. Finally, Greenwood Capital Associates LLC bought a new stake in Electronic Arts during the 3rd quarter worth approximately $5,597,000. Institutional investors and hedge funds own 90.23% of the company's stock.

About Electronic Arts

(

Get Free Report)

Electronic Arts Inc develops, markets, publishes, and distributes games, content, and services for game consoles, PCs, mobile phones, and tablets worldwide. It develops and publishes games and services across various genres, such as sports, racing, first-person shooter, action, role-playing, and simulation primarily under the Battlefield, The Sims, Apex Legends, Need for Speed, and license games from others, including FIFA, Madden NFL, UFC, and Star Wars brands.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Electronic Arts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Electronic Arts wasn't on the list.

While Electronic Arts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.