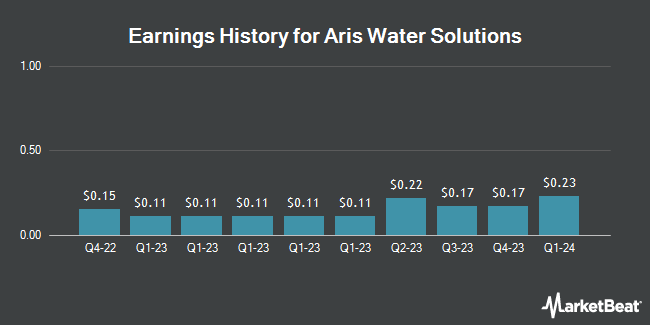

Aris Water Solutions (NYSE:ARIS - Get Free Report) is projected to post its quarterly earnings results after the market closes on Wednesday, February 26th. Analysts expect Aris Water Solutions to post earnings of $0.27 per share and revenue of $109.92 million for the quarter. Persons interested in listening to the company's earnings conference call can do so using this link.

Aris Water Solutions Price Performance

Aris Water Solutions stock traded down $2.26 during trading hours on Friday, reaching $26.58. 1,744,371 shares of the stock were exchanged, compared to its average volume of 921,961. The stock has a 50 day moving average of $26.44 and a two-hundred day moving average of $21.59. The company has a market cap of $1.55 billion, a P/E ratio of 33.22 and a beta of 1.94. The company has a current ratio of 1.72, a quick ratio of 1.72 and a debt-to-equity ratio of 0.62. Aris Water Solutions has a twelve month low of $9.38 and a twelve month high of $30.40.

Wall Street Analyst Weigh In

A number of research analysts recently issued reports on ARIS shares. Evercore ISI cut shares of Aris Water Solutions from an "outperform" rating to an "in-line" rating and lifted their price objective for the company from $25.00 to $27.00 in a research note on Wednesday, January 15th. Citigroup reissued a "neutral" rating and set a $26.00 price target (up previously from $18.00) on shares of Aris Water Solutions in a report on Wednesday, January 8th. US Capital Advisors lowered Aris Water Solutions from a "strong-buy" rating to a "moderate buy" rating in a research note on Tuesday, November 26th. Wells Fargo & Company lifted their target price on Aris Water Solutions from $21.00 to $26.00 and gave the company an "equal weight" rating in a research report on Wednesday, December 18th. Finally, JPMorgan Chase & Co. cut shares of Aris Water Solutions from an "overweight" rating to a "neutral" rating and increased their target price for the stock from $19.00 to $22.00 in a report on Wednesday, November 6th. Four equities research analysts have rated the stock with a hold rating and two have issued a buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average price target of $26.50.

Read Our Latest Stock Analysis on ARIS

Insider Activity

In other news, insider S Corp Gable sold 331,181 shares of the company's stock in a transaction on Monday, January 6th. The shares were sold at an average price of $25.16, for a total value of $8,332,513.96. Following the sale, the insider now directly owns 2,268,559 shares of the company's stock, valued at approximately $57,076,944.44. This represents a 12.74 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, major shareholder Delaware Energy Llc sold 3,223,670 shares of the stock in a transaction dated Friday, December 13th. The stock was sold at an average price of $25.81, for a total value of $83,202,922.70. The disclosure for this sale can be found here. Over the last three months, insiders have sold 4,159,678 shares of company stock valued at $106,807,774. 23.06% of the stock is currently owned by corporate insiders.

About Aris Water Solutions

(

Get Free Report)

Aris Water Solutions, Inc, an environmental infrastructure and solutions company, provides water handling and recycling solutions. The company's produced water handling business gathers, transports, unless recycled, and handles produced water generated from oil and natural gas production. Its water solutions business develops and operates recycling facilities to treat, store, and recycle produced water.

See Also

Before you consider Aris Water Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aris Water Solutions wasn't on the list.

While Aris Water Solutions currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.