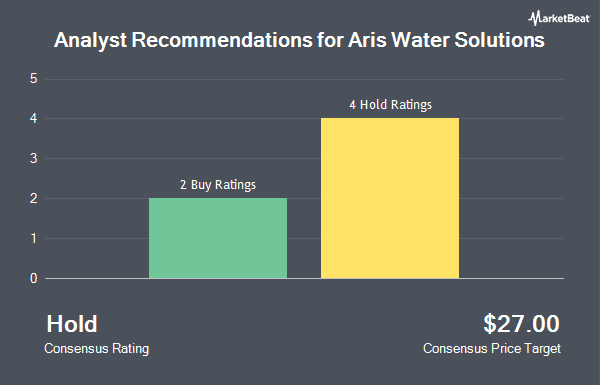

Shares of Aris Water Solutions, Inc. (NYSE:ARIS - Get Free Report) have been assigned a consensus rating of "Moderate Buy" from the eight analysts that are presently covering the firm, Marketbeat reports. Two equities research analysts have rated the stock with a hold recommendation, five have issued a buy recommendation and one has given a strong buy recommendation to the company. The average 12-month price target among brokerages that have issued a report on the stock in the last year is $18.50.

Several equities analysts have commented on the company. JPMorgan Chase & Co. downgraded Aris Water Solutions from an "overweight" rating to a "neutral" rating and increased their target price for the company from $19.00 to $22.00 in a research report on Wednesday, November 6th. US Capital Advisors upgraded shares of Aris Water Solutions from a "moderate buy" rating to a "strong-buy" rating in a report on Monday, October 28th. The Goldman Sachs Group boosted their target price on shares of Aris Water Solutions from $18.50 to $21.00 and gave the stock a "buy" rating in a report on Wednesday, November 6th. Stifel Nicolaus raised their price target on shares of Aris Water Solutions from $20.00 to $26.00 and gave the company a "buy" rating in a research note on Wednesday, November 6th. Finally, Evercore ISI boosted their price objective on shares of Aris Water Solutions from $20.00 to $25.00 and gave the stock an "outperform" rating in a research note on Wednesday, November 6th.

View Our Latest Analysis on ARIS

Insider Buying and Selling at Aris Water Solutions

In other Aris Water Solutions news, Director Debra Coy sold 1,500 shares of Aris Water Solutions stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $25.39, for a total value of $38,085.00. Following the completion of the sale, the director now directly owns 42,082 shares in the company, valued at approximately $1,068,461.98. The trade was a 3.44 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Insiders own 23.06% of the company's stock.

Institutional Trading of Aris Water Solutions

Several large investors have recently modified their holdings of ARIS. State Street Corp boosted its position in shares of Aris Water Solutions by 13.8% during the 3rd quarter. State Street Corp now owns 662,324 shares of the company's stock worth $11,173,000 after purchasing an additional 80,490 shares in the last quarter. Eagle Asset Management Inc. bought a new position in Aris Water Solutions in the third quarter worth approximately $10,828,000. Geode Capital Management LLC grew its stake in Aris Water Solutions by 3.0% in the third quarter. Geode Capital Management LLC now owns 619,349 shares of the company's stock valued at $10,450,000 after acquiring an additional 18,304 shares during the period. Kennedy Capital Management LLC increased its holdings in shares of Aris Water Solutions by 3.8% during the first quarter. Kennedy Capital Management LLC now owns 594,686 shares of the company's stock valued at $8,415,000 after acquiring an additional 21,515 shares in the last quarter. Finally, Dimensional Fund Advisors LP raised its position in shares of Aris Water Solutions by 32.8% during the second quarter. Dimensional Fund Advisors LP now owns 563,976 shares of the company's stock worth $8,836,000 after purchasing an additional 139,259 shares during the period. Institutional investors and hedge funds own 39.71% of the company's stock.

Aris Water Solutions Price Performance

Shares of ARIS traded down $0.44 during trading hours on Friday, reaching $26.99. The stock had a trading volume of 568,704 shares, compared to its average volume of 577,002. The company has a debt-to-equity ratio of 0.62, a quick ratio of 1.72 and a current ratio of 1.72. Aris Water Solutions has a 12 month low of $7.22 and a 12 month high of $27.58. The stock has a market capitalization of $1.57 billion, a PE ratio of 33.74 and a beta of 1.62. The company's 50-day moving average is $18.83 and its two-hundred day moving average is $16.81.

Aris Water Solutions Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Thursday, December 19th. Investors of record on Thursday, December 5th will be issued a $0.105 dividend. The ex-dividend date is Thursday, December 5th. This represents a $0.42 annualized dividend and a yield of 1.56%. Aris Water Solutions's payout ratio is 52.50%.

About Aris Water Solutions

(

Get Free ReportAris Water Solutions, Inc, an environmental infrastructure and solutions company, provides water handling and recycling solutions. The company's produced water handling business gathers, transports, unless recycled, and handles produced water generated from oil and natural gas production. Its water solutions business develops and operates recycling facilities to treat, store, and recycle produced water.

Featured Stories

Before you consider Aris Water Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aris Water Solutions wasn't on the list.

While Aris Water Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.