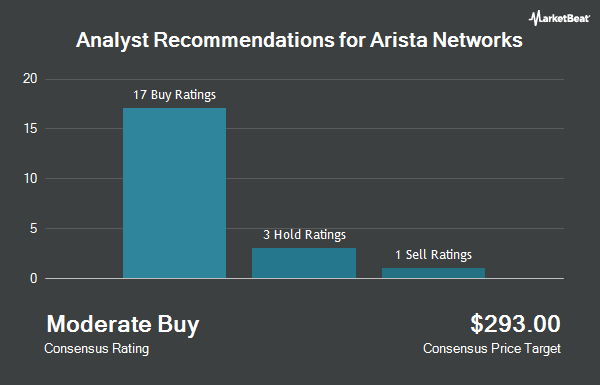

Shares of Arista Networks, Inc. (NYSE:ANET - Get Free Report) have been given an average rating of "Moderate Buy" by the nineteen analysts that are currently covering the firm, Marketbeat reports. One analyst has rated the stock with a sell rating, three have given a hold rating and fifteen have issued a buy rating on the company. The average 12 month target price among brokerages that have covered the stock in the last year is $395.19.

A number of brokerages recently commented on ANET. Wells Fargo & Company boosted their target price on Arista Networks from $390.00 to $460.00 and gave the company an "overweight" rating in a research report on Wednesday, October 30th. Citigroup boosted their price objective on Arista Networks from $385.00 to $460.00 and gave the stock a "buy" rating in a report on Tuesday, October 8th. Needham & Company LLC reissued a "buy" rating and set a $375.00 price objective on shares of Arista Networks in a report on Wednesday, July 31st. Rosenblatt Securities boosted their price objective on Arista Networks from $265.00 to $320.00 and gave the stock a "sell" rating in a report on Friday, November 8th. Finally, Jefferies Financial Group boosted their price objective on Arista Networks from $340.00 to $380.00 and gave the stock a "buy" rating in a report on Wednesday, July 31st.

View Our Latest Analysis on Arista Networks

Arista Networks Price Performance

Shares of NYSE:ANET opened at $406.48 on Friday. The company has a market capitalization of $128.02 billion, a price-to-earnings ratio of 48.86, a P/E/G ratio of 3.26 and a beta of 1.08. The business's 50-day moving average is $393.20 and its 200-day moving average is $353.50. Arista Networks has a 1 year low of $210.69 and a 1 year high of $431.97.

Arista Networks's stock is scheduled to split on the morning of Wednesday, December 4th. The 4-1 split was announced on Thursday, November 7th. The newly minted shares will be distributed to shareholders after the market closes on Tuesday, December 3rd.

Arista Networks (NYSE:ANET - Get Free Report) last issued its earnings results on Thursday, November 7th. The technology company reported $2.40 EPS for the quarter, beating analysts' consensus estimates of $2.08 by $0.32. Arista Networks had a return on equity of 30.52% and a net margin of 40.29%. The business had revenue of $1.81 billion during the quarter, compared to analyst estimates of $1.76 billion. During the same period in the previous year, the company posted $1.63 EPS. The firm's revenue was up 20.0% compared to the same quarter last year. Analysts anticipate that Arista Networks will post 7.75 EPS for the current year.

Insider Buying and Selling at Arista Networks

In other news, SVP Kenneth Duda sold 1,592 shares of Arista Networks stock in a transaction dated Monday, August 26th. The stock was sold at an average price of $349.55, for a total value of $556,483.60. Following the transaction, the senior vice president now owns 186,600 shares in the company, valued at approximately $65,226,030. The trade was a 0.85 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, SVP Marc Taxay sold 4,497 shares of Arista Networks stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $336.32, for a total value of $1,512,431.04. The disclosure for this sale can be found here. Insiders have sold 58,019 shares of company stock worth $22,819,548 over the last 90 days. Corporate insiders own 3.54% of the company's stock.

Institutional Trading of Arista Networks

Large investors have recently modified their holdings of the business. GW Henssler & Associates Ltd. grew its stake in shares of Arista Networks by 3.6% in the third quarter. GW Henssler & Associates Ltd. now owns 63,244 shares of the technology company's stock worth $24,274,000 after purchasing an additional 2,219 shares during the last quarter. Deepwater Asset Management LLC bought a new stake in Arista Networks during the 2nd quarter valued at approximately $15,084,000. Sumitomo Life Insurance Co. boosted its position in Arista Networks by 69.8% during the 3rd quarter. Sumitomo Life Insurance Co. now owns 9,028 shares of the technology company's stock valued at $3,465,000 after acquiring an additional 3,711 shares in the last quarter. Walkner Condon Financial Advisors LLC bought a new stake in Arista Networks during the 3rd quarter valued at approximately $2,318,000. Finally, Cetera Advisors LLC boosted its position in Arista Networks by 185.8% during the 1st quarter. Cetera Advisors LLC now owns 17,032 shares of the technology company's stock valued at $4,939,000 after acquiring an additional 11,073 shares in the last quarter. 82.47% of the stock is owned by institutional investors.

Arista Networks Company Profile

(

Get Free ReportArista Networks, Inc engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. Its cloud networking solutions consist of Extensible Operating System (EOS), a publish-subscribe state-sharing networking operating system offered in combination with a set of network applications.

Read More

Before you consider Arista Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arista Networks wasn't on the list.

While Arista Networks currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.