Aritzia (TSE:ATZ - Get Free Report) had its price target lowered by stock analysts at CIBC from C$1.80 to C$1.20 in a report released on Friday,BayStreet.CA reports. The brokerage currently has an "underperform" rating on the stock. CIBC's target price would suggest a potential downside of 97.71% from the company's current price.

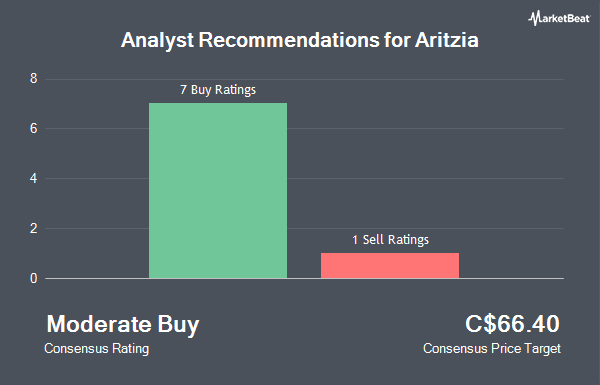

Several other analysts have also recently issued reports on ATZ. TD Securities increased their price objective on Aritzia from C$68.00 to C$75.00 and gave the company a "buy" rating in a research note on Sunday, January 12th. Stifel Nicolaus set a C$73.00 price target on Aritzia and gave the company a "buy" rating in a research note on Thursday, March 13th. Raymond James raised their price target on Aritzia from C$58.00 to C$65.00 and gave the company a "market perform" rating in a research note on Monday, January 13th. Desjardins set a C$82.00 price target on Aritzia and gave the company a "buy" rating in a research note on Wednesday, February 26th. Finally, BMO Capital Markets raised their price target on Aritzia from C$68.00 to C$80.00 in a research note on Friday, February 14th. One research analyst has rated the stock with a sell rating, one has given a hold rating and six have issued a buy rating to the stock. According to MarketBeat.com, Aritzia presently has a consensus rating of "Moderate Buy" and a consensus price target of C$62.52.

Check Out Our Latest Stock Analysis on ATZ

Aritzia Stock Up 1.3 %

Shares of TSE ATZ traded up C$0.65 during mid-day trading on Friday, hitting C$52.46. The company had a trading volume of 621,688 shares, compared to its average volume of 706,479. The company has a market capitalization of C$6.26 billion, a PE ratio of 46.09, a price-to-earnings-growth ratio of 1.19 and a beta of 1.83. The company has a debt-to-equity ratio of 93.51, a current ratio of 1.29 and a quick ratio of 0.19. Aritzia has a 1-year low of C$31.82 and a 1-year high of C$73.44. The business's 50-day simple moving average is C$65.58 and its 200 day simple moving average is C$54.09.

Insiders Place Their Bets

In related news, Senior Officer Karen Kwan sold 29,966 shares of the firm's stock in a transaction dated Tuesday, January 14th. The stock was sold at an average price of C$65.96, for a total transaction of C$1,976,557.36. Also, Director Jennifer Wong sold 12,609 shares of the firm's stock in a transaction dated Friday, January 17th. The stock was sold at an average price of C$68.75, for a total value of C$866,868.75. Over the last 90 days, insiders have sold 56,298 shares of company stock valued at $3,801,028. 0.94% of the stock is currently owned by insiders.

Aritzia Company Profile

(

Get Free Report)

Aritzia Inc is an integrated design house of exclusive fashion brands. It designs apparel and accessories for its collection of exclusive brands and sells them under the Aritzia banner. The category of products offered by the firm is blouses, T-shirts, pants, dresses, sweaters, jackets and coats, skirts, shorts, jumpsuits, and accessories.

See Also

Before you consider Aritzia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aritzia wasn't on the list.

While Aritzia currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.