ARK Investment Management LLC decreased its holdings in shares of Accolade, Inc. (NASDAQ:ACCD - Free Report) by 4.6% in the 3rd quarter, according to its most recent 13F filing with the SEC. The fund owned 5,382,533 shares of the company's stock after selling 258,915 shares during the period. ARK Investment Management LLC owned approximately 6.68% of Accolade worth $20,723,000 at the end of the most recent reporting period.

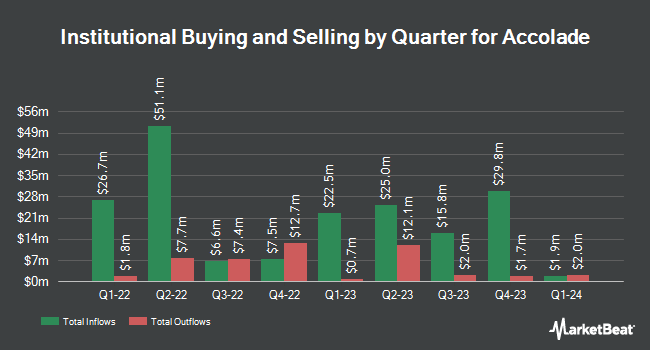

Several other institutional investors and hedge funds also recently made changes to their positions in ACCD. Allspring Global Investments Holdings LLC acquired a new position in shares of Accolade in the 1st quarter valued at $87,000. IQ EQ FUND MANAGEMENT IRELAND Ltd acquired a new position in Accolade in the 3rd quarter worth $46,000. SG Americas Securities LLC acquired a new position in Accolade in the 2nd quarter worth $43,000. GGV Capital LLC boosted its stake in Accolade by 242.9% in the 1st quarter. GGV Capital LLC now owns 18,063 shares of the company's stock worth $189,000 after purchasing an additional 12,795 shares during the period. Finally, Price T Rowe Associates Inc. MD boosted its stake in Accolade by 15.3% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 19,540 shares of the company's stock worth $205,000 after purchasing an additional 2,586 shares during the period. Institutional investors own 84.99% of the company's stock.

Analyst Ratings Changes

A number of research firms have recently commented on ACCD. Needham & Company LLC restated a "buy" rating and set a $8.00 price objective on shares of Accolade in a research note on Monday, October 7th. Truist Financial reduced their price objective on shares of Accolade from $9.00 to $7.50 and set a "buy" rating for the company in a research note on Wednesday, October 9th. Canaccord Genuity Group reduced their price objective on shares of Accolade from $13.00 to $7.00 and set a "buy" rating for the company in a research note on Wednesday, October 9th. Barclays reduced their price objective on shares of Accolade from $5.50 to $5.00 and set an "equal weight" rating for the company in a research note on Wednesday, October 9th. Finally, Stephens dropped their target price on shares of Accolade from $10.00 to $8.00 and set an "overweight" rating on the stock in a report on Wednesday, October 9th. Three research analysts have rated the stock with a hold rating and twelve have given a buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $9.04.

Check Out Our Latest Stock Analysis on ACCD

Accolade Price Performance

Shares of ACCD stock remained flat at $3.56 during mid-day trading on Friday. 1,129,012 shares of the stock traded hands, compared to its average volume of 1,085,960. Accolade, Inc. has a 1 year low of $3.08 and a 1 year high of $15.36. The company has a 50-day simple moving average of $3.75 and a 200 day simple moving average of $4.91. The company has a debt-to-equity ratio of 0.49, a current ratio of 2.72 and a quick ratio of 2.72. The stock has a market capitalization of $286.72 million, a P/E ratio of -3.46 and a beta of 2.02.

Accolade (NASDAQ:ACCD - Get Free Report) last announced its earnings results on Tuesday, October 8th. The company reported ($0.30) earnings per share for the quarter, beating the consensus estimate of ($0.44) by $0.14. The business had revenue of $106.40 million for the quarter, compared to the consensus estimate of $104.87 million. Accolade had a negative net margin of 18.16% and a negative return on equity of 18.43%. The business's revenue for the quarter was up 9.8% on a year-over-year basis. During the same quarter in the prior year, the firm posted ($0.43) earnings per share. On average, equities research analysts expect that Accolade, Inc. will post -0.92 earnings per share for the current year.

Accolade Profile

(

Free Report)

Accolade, Inc, together with its subsidiaries, engages in the development and provision of personalized and technology-enabled solutions that help people to understand, navigate, and utilize the healthcare system and their workplace benefits in the United States. The company offers a platform with cloud-based intelligent technology and multimodal support from a team of advocates and clinicians, including registered nurses, physician medical directors, pharmacists, behavioral health specialists, women's health specialists, case management specialists, expert medical opinion providers, and primary care physicians.

See Also

Before you consider Accolade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Accolade wasn't on the list.

While Accolade currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.