ARK Investment Management LLC lessened its stake in shares of Quantum-Si incorporated (NASDAQ:QSI - Free Report) by 4.6% during the third quarter, according to the company in its most recent disclosure with the SEC. The fund owned 11,842,609 shares of the company's stock after selling 567,320 shares during the quarter. ARK Investment Management LLC owned approximately 8.32% of Quantum-Si worth $10,448,000 as of its most recent SEC filing.

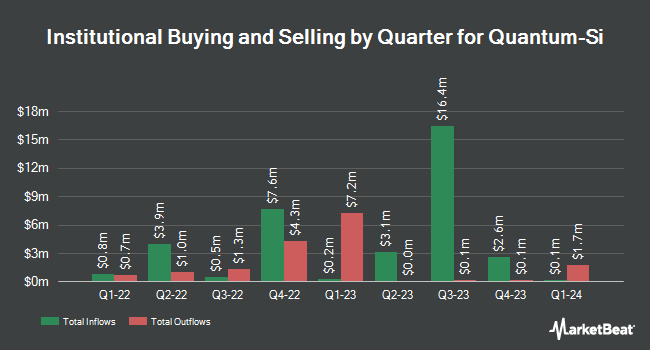

A number of other hedge funds and other institutional investors have also recently modified their holdings of the stock. Jacobs Levy Equity Management Inc. bought a new stake in shares of Quantum-Si in the first quarter worth $998,000. Vanguard Group Inc. grew its stake in shares of Quantum-Si by 1.6% in the first quarter. Vanguard Group Inc. now owns 5,300,685 shares of the company's stock worth $10,442,000 after purchasing an additional 82,463 shares during the last quarter. SG Americas Securities LLC bought a new stake in shares of Quantum-Si in the third quarter worth $53,000. Virtu Financial LLC bought a new stake in shares of Quantum-Si in the first quarter worth $98,000. Finally, Green Alpha Advisors LLC grew its stake in shares of Quantum-Si by 35.4% in the third quarter. Green Alpha Advisors LLC now owns 175,055 shares of the company's stock worth $154,000 after purchasing an additional 45,796 shares during the last quarter. Institutional investors own 39.90% of the company's stock.

Insider Buying and Selling at Quantum-Si

In related news, Director Charles R. Kummeth acquired 31,100 shares of the company's stock in a transaction dated Monday, August 12th. The shares were purchased at an average price of $0.89 per share, for a total transaction of $27,679.00. Following the completion of the acquisition, the director now owns 355,000 shares of the company's stock, valued at approximately $315,950. This trade represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 30.04% of the company's stock.

Quantum-Si Price Performance

Shares of Quantum-Si stock traded up $0.04 during trading on Friday, hitting $0.94. The company's stock had a trading volume of 528,188 shares, compared to its average volume of 674,384. Quantum-Si incorporated has a 52 week low of $0.70 and a 52 week high of $2.43. The stock has a market cap of $133.80 million, a price-to-earnings ratio of -1.44 and a beta of 2.89. The stock has a 50-day moving average price of $0.86 and a two-hundred day moving average price of $1.14.

Quantum-Si (NASDAQ:QSI - Get Free Report) last issued its quarterly earnings results on Wednesday, August 7th. The company reported ($0.16) EPS for the quarter, beating analysts' consensus estimates of ($0.21) by $0.05. The business had revenue of $0.62 million for the quarter, compared to analysts' expectations of $0.66 million. Quantum-Si had a negative net margin of 5,249.65% and a negative return on equity of 33.02%. On average, equities analysts predict that Quantum-Si incorporated will post -0.71 EPS for the current fiscal year.

Quantum-Si Profile

(

Free Report)

Quantum-Si incorporated, a life sciences company, engages in the development of single-molecule detection platform to enable Next Generation Protein Sequencing (NGPS). The company's platform is comprised of the Platinum NGPS instrument; the Platinum Analysis Software service; and reagent kits and semiconductor chips for use with its instruments.

Featured Articles

Before you consider Quantum-Si, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Quantum-Si wasn't on the list.

While Quantum-Si currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.