ARK Investment Management LLC grew its stake in Xometry, Inc. (NASDAQ:XMTR - Free Report) by 7.2% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 284,134 shares of the company's stock after acquiring an additional 19,197 shares during the period. ARK Investment Management LLC owned 0.58% of Xometry worth $5,220,000 at the end of the most recent quarter.

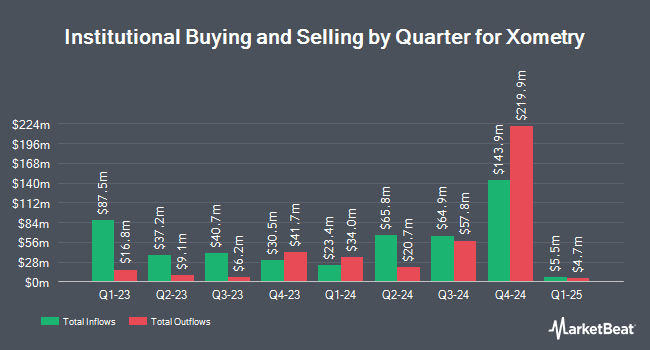

A number of other hedge funds and other institutional investors have also modified their holdings of XMTR. US Bancorp DE grew its stake in shares of Xometry by 57.7% in the third quarter. US Bancorp DE now owns 5,570 shares of the company's stock valued at $102,000 after buying an additional 2,037 shares in the last quarter. Palumbo Wealth Management LLC bought a new position in shares of Xometry in the 3rd quarter valued at about $191,000. Allspring Global Investments Holdings LLC grew its position in shares of Xometry by 191.1% in the 3rd quarter. Allspring Global Investments Holdings LLC now owns 216,700 shares of the company's stock valued at $3,981,000 after acquiring an additional 142,262 shares during the period. Raymond James & Associates increased its stake in shares of Xometry by 0.6% during the 3rd quarter. Raymond James & Associates now owns 287,986 shares of the company's stock worth $5,290,000 after purchasing an additional 1,586 shares during the last quarter. Finally, SG Americas Securities LLC bought a new stake in shares of Xometry in the 3rd quarter valued at about $153,000. Institutional investors and hedge funds own 97.31% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts recently commented on XMTR shares. Cantor Fitzgerald reiterated an "underweight" rating and set a $12.00 price target on shares of Xometry in a report on Wednesday. Citigroup boosted their target price on Xometry from $25.00 to $33.00 and gave the stock a "buy" rating in a report on Wednesday. JMP Securities increased their price target on Xometry from $27.00 to $32.00 and gave the company a "market outperform" rating in a research note on Friday, October 18th. Royal Bank of Canada lifted their price objective on shares of Xometry from $23.00 to $27.00 and gave the stock a "sector perform" rating in a research report on Wednesday. Finally, The Goldman Sachs Group upped their price objective on shares of Xometry from $24.00 to $28.00 and gave the company a "buy" rating in a report on Wednesday. One equities research analyst has rated the stock with a sell rating, two have given a hold rating and four have assigned a buy rating to the company's stock. According to MarketBeat, Xometry presently has a consensus rating of "Hold" and an average price target of $26.29.

Get Our Latest Report on Xometry

Xometry Stock Performance

NASDAQ XMTR traded down $0.01 on Friday, reaching $30.59. The stock had a trading volume of 702,859 shares, compared to its average volume of 606,221. The company has a debt-to-equity ratio of 0.90, a current ratio of 4.59 and a quick ratio of 4.60. The company has a market cap of $1.51 billion, a P/E ratio of -29.13 and a beta of 0.55. The firm has a fifty day moving average of $19.77 and a two-hundred day moving average of $16.84. Xometry, Inc. has a 1-year low of $11.08 and a 1-year high of $38.74.

Xometry (NASDAQ:XMTR - Get Free Report) last released its quarterly earnings results on Thursday, August 8th. The company reported ($0.01) EPS for the quarter, beating the consensus estimate of ($0.14) by $0.13. The business had revenue of $132.60 million for the quarter, compared to the consensus estimate of $128.65 million. Xometry had a negative net margin of 9.72% and a negative return on equity of 10.16%. Xometry's revenue was up 19.5% compared to the same quarter last year. During the same period in the prior year, the company posted ($0.55) earnings per share. On average, equities research analysts anticipate that Xometry, Inc. will post -0.81 EPS for the current year.

Insiders Place Their Bets

In other Xometry news, CTO Matthew Leibel sold 3,400 shares of the firm's stock in a transaction on Friday, September 13th. The stock was sold at an average price of $18.45, for a total transaction of $62,730.00. Following the transaction, the chief technology officer now owns 82,918 shares in the company, valued at $1,529,837.10. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Company insiders own 16.79% of the company's stock.

About Xometry

(

Free Report)

Xometry, Inc operates an online marketplace that enables buyers to source custom-manufactured parts and assemblies in the United States and internationally. It provides computer numerical control manufacturing, sheet metal forming, and sheet cutting; 3D printing, including fused deposition modeling, direct metal laser sintering, PolyJet, stereolithography, selective laser sintering, binder jetting, carbon digital light synthesis, multi jet fusion, and lubricant sublayer photo-curing; and die casting, stamping, injection molding, urethane casting, tube cutting, and tube bending, as well as finishing services, rapid prototyping, and high-volume production services.

Read More

Before you consider Xometry, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xometry wasn't on the list.

While Xometry currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.