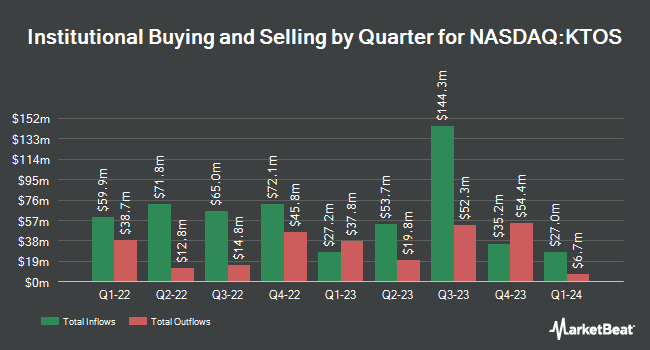

ARK Investment Management LLC lessened its holdings in shares of Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS - Free Report) by 14.7% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 3,975,028 shares of the aerospace company's stock after selling 685,780 shares during the period. Kratos Defense & Security Solutions makes up 0.8% of ARK Investment Management LLC's holdings, making the stock its 29th biggest position. ARK Investment Management LLC owned approximately 2.63% of Kratos Defense & Security Solutions worth $92,618,000 as of its most recent SEC filing.

Several other institutional investors have also recently made changes to their positions in the business. Westwood Holdings Group Inc. purchased a new position in shares of Kratos Defense & Security Solutions in the first quarter worth about $46,177,000. Vanguard Group Inc. raised its stake in shares of Kratos Defense & Security Solutions by 14.9% in the 1st quarter. Vanguard Group Inc. now owns 13,972,406 shares of the aerospace company's stock valued at $256,813,000 after acquiring an additional 1,807,580 shares during the period. Hood River Capital Management LLC grew its holdings in shares of Kratos Defense & Security Solutions by 108.7% in the first quarter. Hood River Capital Management LLC now owns 2,556,787 shares of the aerospace company's stock valued at $46,994,000 after purchasing an additional 1,331,499 shares in the last quarter. Element Capital Management LLC acquired a new position in shares of Kratos Defense & Security Solutions in the first quarter valued at approximately $11,198,000. Finally, Bamco Inc. NY grew its holdings in Kratos Defense & Security Solutions by 13.2% during the 1st quarter. Bamco Inc. NY now owns 4,374,077 shares of the aerospace company's stock worth $80,396,000 after acquiring an additional 511,538 shares in the last quarter. Hedge funds and other institutional investors own 75.92% of the company's stock.

Insider Transactions at Kratos Defense & Security Solutions

In related news, CEO Eric M. Demarco acquired 12,396 shares of the business's stock in a transaction dated Thursday, August 15th. The shares were acquired at an average cost of $20.19 per share, for a total transaction of $250,275.24. Following the acquisition, the chief executive officer now directly owns 1,058,264 shares in the company, valued at approximately $21,366,350.16. The trade was a 0.00 % increase in their position. The acquisition was disclosed in a legal filing with the SEC, which is available at the SEC website. In other Kratos Defense & Security Solutions news, CEO Eric M. Demarco purchased 12,396 shares of the business's stock in a transaction that occurred on Thursday, August 15th. The shares were purchased at an average price of $20.19 per share, for a total transaction of $250,275.24. Following the completion of the acquisition, the chief executive officer now owns 1,058,264 shares of the company's stock, valued at approximately $21,366,350.16. This represents a 0.00 % increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, SVP Marie Mendoza sold 1,355 shares of the firm's stock in a transaction that occurred on Thursday, August 15th. The shares were sold at an average price of $20.07, for a total transaction of $27,194.85. Following the completion of the transaction, the senior vice president now owns 63,393 shares in the company, valued at $1,272,297.51. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 76,091 shares of company stock worth $1,739,101 in the last three months. Company insiders own 2.27% of the company's stock.

Kratos Defense & Security Solutions Trading Up 9.0 %

Shares of Kratos Defense & Security Solutions stock traded up $2.15 during mid-day trading on Friday, hitting $25.97. 2,049,392 shares of the stock were exchanged, compared to its average volume of 1,124,800. Kratos Defense & Security Solutions, Inc. has a twelve month low of $16.71 and a twelve month high of $26.21. The stock has a market capitalization of $3.92 billion, a price-to-earnings ratio of 256.70 and a beta of 1.02. The company has a 50-day simple moving average of $23.57 and a 200 day simple moving average of $21.63. The company has a current ratio of 3.13, a quick ratio of 2.56 and a debt-to-equity ratio of 0.14.

Kratos Defense & Security Solutions (NASDAQ:KTOS - Get Free Report) last released its quarterly earnings results on Wednesday, August 7th. The aerospace company reported $0.14 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.09 by $0.05. The company had revenue of $300.10 million for the quarter, compared to analysts' expectations of $276.08 million. Kratos Defense & Security Solutions had a net margin of 0.89% and a return on equity of 3.92%. The firm's revenue for the quarter was up 16.8% compared to the same quarter last year. During the same period last year, the company earned $0.05 EPS. Research analysts forecast that Kratos Defense & Security Solutions, Inc. will post 0.31 EPS for the current year.

Analyst Upgrades and Downgrades

Several research analysts have recently issued reports on KTOS shares. B. Riley cut shares of Kratos Defense & Security Solutions from a "buy" rating to a "neutral" rating and upped their target price for the company from $24.00 to $26.00 in a report on Wednesday, October 30th. Benchmark restated a "buy" rating and set a $25.00 price objective on shares of Kratos Defense & Security Solutions in a research report on Friday, September 13th. JMP Securities restated a "market outperform" rating and set a $27.00 price objective on shares of Kratos Defense & Security Solutions in a research report on Tuesday, October 1st. Truist Financial restated a "buy" rating and set a $27.00 price objective (up previously from $25.00) on shares of Kratos Defense & Security Solutions in a research report on Thursday, September 26th. Finally, Robert W. Baird upped their price objective on shares of Kratos Defense & Security Solutions from $22.00 to $35.00 and gave the stock an "outperform" rating in a research report on Monday, September 23rd. Five equities research analysts have rated the stock with a hold rating, five have assigned a buy rating and one has given a strong buy rating to the company. According to MarketBeat, Kratos Defense & Security Solutions has a consensus rating of "Moderate Buy" and an average target price of $25.10.

View Our Latest Stock Analysis on KTOS

Kratos Defense & Security Solutions Profile

(

Free Report)

Kratos Defense & Security Solutions, Inc operates as a technology company that addresses the defense, national security, and commercial markets. It operates through two segments, Kratos Government Solutions and Unmanned Systems. The company offers ground systems for satellites and space vehicles, including software for command and control, telemetry, and tracking and control; jet-powered unmanned aerial drone systems, hypersonic vehicles, and rocket systems; propulsion systems for drones, missiles, loitering munitions, supersonic systems, spacecraft, and launch systems; command, control, communication, computing, combat, intelligence surveillance and reconnaissance; and microwave electronic products for missile, radar, missile defense, space, and satellite; counter unmanned aircraft systems, directed energy, communication and other systems, and virtual and augmented reality training systems for the warfighter.

Featured Stories

Before you consider Kratos Defense & Security Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kratos Defense & Security Solutions wasn't on the list.

While Kratos Defense & Security Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report