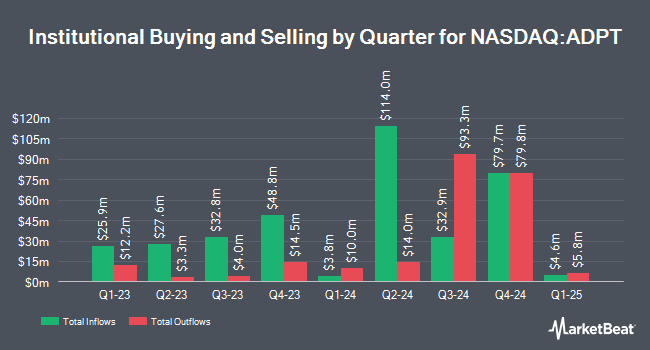

ARK Investment Management LLC lifted its stake in shares of Adaptive Biotechnologies Co. (NASDAQ:ADPT - Free Report) by 1.7% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 11,601,134 shares of the company's stock after acquiring an additional 189,134 shares during the quarter. ARK Investment Management LLC owned 7.87% of Adaptive Biotechnologies worth $59,398,000 at the end of the most recent reporting period.

Several other large investors have also modified their holdings of ADPT. JTC Employer Solutions Trustee Ltd purchased a new position in shares of Adaptive Biotechnologies during the third quarter valued at $26,000. Manchester Capital Management LLC purchased a new position in Adaptive Biotechnologies in the first quarter valued at about $32,000. Rothschild Investment LLC purchased a new position in Adaptive Biotechnologies in the second quarter valued at about $36,000. MQS Management LLC purchased a new position in Adaptive Biotechnologies in the second quarter valued at about $36,000. Finally, Pinnacle Wealth Planning Services Inc. purchased a new position in Adaptive Biotechnologies in the first quarter valued at about $46,000. 99.17% of the stock is owned by institutional investors.

Adaptive Biotechnologies Stock Up 3.4 %

Shares of NASDAQ:ADPT traded up $0.19 on Friday, reaching $5.82. The company had a trading volume of 1,382,653 shares, compared to its average volume of 1,409,130. Adaptive Biotechnologies Co. has a twelve month low of $2.28 and a twelve month high of $6.33. The stock has a market capitalization of $858.28 million, a P/E ratio of -3.83 and a beta of 1.45. The stock has a 50-day moving average price of $4.79 and a 200 day moving average price of $4.11.

Adaptive Biotechnologies (NASDAQ:ADPT - Get Free Report) last posted its quarterly earnings data on Thursday, November 7th. The company reported ($0.22) earnings per share for the quarter, topping the consensus estimate of ($0.30) by $0.08. Adaptive Biotechnologies had a negative return on equity of 60.99% and a negative net margin of 126.49%. The business had revenue of $46.44 million during the quarter, compared to analysts' expectations of $40.59 million. On average, sell-side analysts predict that Adaptive Biotechnologies Co. will post -1.19 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of research analysts have commented on the company. BTIG Research boosted their target price on Adaptive Biotechnologies from $7.00 to $8.00 and gave the company a "buy" rating in a research note on Wednesday, October 2nd. JPMorgan Chase & Co. boosted their target price on Adaptive Biotechnologies from $5.00 to $6.00 and gave the company an "overweight" rating in a research note on Friday, August 2nd. One equities research analyst has rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat.com, Adaptive Biotechnologies currently has an average rating of "Moderate Buy" and an average target price of $6.25.

Read Our Latest Report on ADPT

Adaptive Biotechnologies Company Profile

(

Free Report)

Adaptive Biotechnologies Corporation, a commercial-stage company, develops an immune medicine platform for the diagnosis and treatment of various diseases. The company offers immunosequencing platform which combines a suite of proprietary chemistry, computational biology, and machine learning to generate clinical immunomics data to decode the adaptive immune system.

See Also

Before you consider Adaptive Biotechnologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adaptive Biotechnologies wasn't on the list.

While Adaptive Biotechnologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.