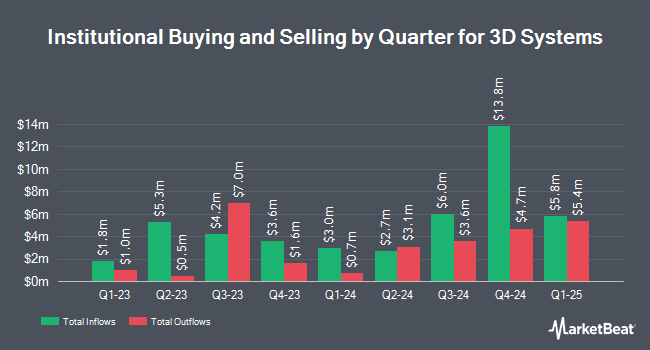

ARK Investment Management LLC increased its holdings in shares of 3D Systems Co. (NYSE:DDD - Free Report) by 26.0% in the 3rd quarter, according to its most recent filing with the SEC. The fund owned 3,878,628 shares of the 3D printing company's stock after purchasing an additional 799,157 shares during the period. ARK Investment Management LLC owned approximately 2.90% of 3D Systems worth $11,015,000 at the end of the most recent reporting period.

Other large investors have also made changes to their positions in the company. Inspire Investing LLC acquired a new position in shares of 3D Systems during the 2nd quarter worth about $35,000. Foundations Investment Advisors LLC acquired a new position in shares of 3D Systems during the 2nd quarter worth about $37,000. Mizuho Securities Co. Ltd. acquired a new position in shares of 3D Systems during the 2nd quarter worth about $38,000. Ballentine Partners LLC acquired a new position in shares of 3D Systems during the 3rd quarter worth about $36,000. Finally, Algert Global LLC acquired a new position in shares of 3D Systems during the 2nd quarter worth about $41,000. Institutional investors and hedge funds own 64.49% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms have commented on DDD. StockNews.com cut 3D Systems from a "hold" rating to a "sell" rating in a report on Tuesday, September 10th. Loop Capital cut their price target on 3D Systems from $4.50 to $2.00 and set a "hold" rating for the company in a report on Thursday, September 5th. Needham & Company LLC reaffirmed a "hold" rating on shares of 3D Systems in a report on Friday, August 30th. Cantor Fitzgerald cut their price target on 3D Systems from $5.50 to $3.75 and set an "overweight" rating for the company in a report on Friday, August 30th. Finally, Lake Street Capital cut their price target on 3D Systems from $6.00 to $4.00 and set a "buy" rating for the company in a report on Thursday, September 5th. One analyst has rated the stock with a sell rating, two have given a hold rating and two have given a buy rating to the company. According to MarketBeat, the stock has an average rating of "Hold" and a consensus target price of $3.25.

Check Out Our Latest Stock Analysis on DDD

3D Systems Price Performance

Shares of DDD traded down $0.06 during mid-day trading on Friday, reaching $3.34. The company had a trading volume of 1,397,444 shares, compared to its average volume of 2,202,034. 3D Systems Co. has a twelve month low of $1.72 and a twelve month high of $6.85. The company has a debt-to-equity ratio of 0.55, a current ratio of 3.46 and a quick ratio of 2.42. The company's 50-day moving average is $2.74 and its 200-day moving average is $3.16. The company has a market capitalization of $445.47 million, a P/E ratio of -1.23 and a beta of 1.65.

3D Systems (NYSE:DDD - Get Free Report) last issued its earnings results on Thursday, August 29th. The 3D printing company reported ($0.17) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.06) by ($0.11). 3D Systems had a negative return on equity of 15.29% and a negative net margin of 78.14%. The company had revenue of $113.25 million during the quarter, compared to analyst estimates of $125.15 million. On average, equities analysts anticipate that 3D Systems Co. will post -0.67 EPS for the current year.

About 3D Systems

(

Free Report)

3D Systems Corporation provides 3D printing and digital manufacturing solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and internationally. The company offers 3D printers technologies, such as stereolithography, selective laser sintering, direct metal printing, multi jet printing, color jet printing, polymer extrusion, and extrusion and SLA based bioprinting that transform digital data input generated by 3D design software, computer aided design (CAD) software, or other 3D design tools into printed parts.

Featured Articles

Before you consider 3D Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 3D Systems wasn't on the list.

While 3D Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.