ARK Investment Management LLC lessened its stake in Beam Therapeutics Inc. (NASDAQ:BEAM - Free Report) by 14.4% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 6,531,099 shares of the company's stock after selling 1,095,040 shares during the quarter. Beam Therapeutics makes up 1.5% of ARK Investment Management LLC's holdings, making the stock its 21st biggest position. ARK Investment Management LLC owned about 7.92% of Beam Therapeutics worth $160,012,000 as of its most recent filing with the Securities and Exchange Commission.

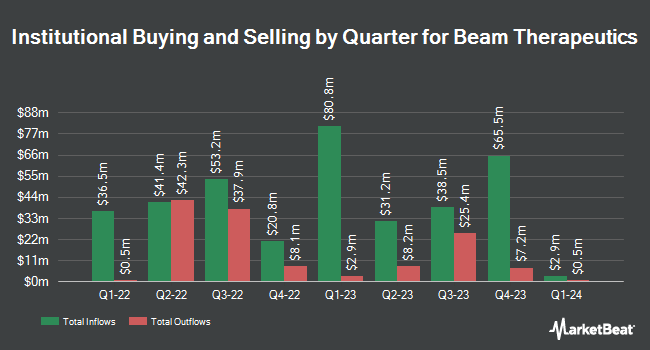

Several other large investors also recently made changes to their positions in the stock. Farallon Capital Management LLC boosted its holdings in shares of Beam Therapeutics by 75.4% in the 2nd quarter. Farallon Capital Management LLC now owns 7,913,123 shares of the company's stock valued at $185,404,000 after buying an additional 3,401,370 shares during the last quarter. Vanguard Group Inc. lifted its holdings in Beam Therapeutics by 5.8% during the 1st quarter. Vanguard Group Inc. now owns 7,578,768 shares of the company's stock valued at $250,402,000 after purchasing an additional 413,892 shares during the last quarter. ARCH Venture Management LLC acquired a new stake in Beam Therapeutics during the 2nd quarter valued at $127,530,000. Darwin Global Management Ltd. acquired a new stake in Beam Therapeutics during the 1st quarter valued at $70,032,000. Finally, Redmile Group LLC lifted its holdings in Beam Therapeutics by 31.5% during the 1st quarter. Redmile Group LLC now owns 1,879,617 shares of the company's stock valued at $62,103,000 after purchasing an additional 449,834 shares during the last quarter. Institutional investors and hedge funds own 99.68% of the company's stock.

Insider Buying and Selling

In other Beam Therapeutics news, CEO John M. Evans sold 60,000 shares of Beam Therapeutics stock in a transaction dated Monday, September 30th. The stock was sold at an average price of $24.60, for a total value of $1,476,000.00. Following the transaction, the chief executive officer now owns 938,659 shares in the company, valued at $23,091,011.40. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. In other news, President Giuseppe Ciaramella sold 51,110 shares of Beam Therapeutics stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $26.36, for a total transaction of $1,347,259.60. Following the sale, the president now directly owns 109,150 shares of the company's stock, valued at approximately $2,877,194. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CEO John M. Evans sold 60,000 shares of Beam Therapeutics stock in a transaction dated Monday, September 30th. The shares were sold at an average price of $24.60, for a total value of $1,476,000.00. Following the sale, the chief executive officer now directly owns 938,659 shares in the company, valued at $23,091,011.40. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 162,894 shares of company stock worth $4,181,745. Company insiders own 4.20% of the company's stock.

Wall Street Analyst Weigh In

BEAM has been the subject of several research reports. Stifel Nicolaus raised their price target on Beam Therapeutics from $66.00 to $69.00 and gave the company a "buy" rating in a report on Wednesday, September 11th. Leerink Partnrs raised Beam Therapeutics from a "hold" rating to a "strong-buy" rating in a report on Wednesday. Wedbush reaffirmed an "outperform" rating and set a $57.00 price target on shares of Beam Therapeutics in a report on Tuesday. Royal Bank of Canada dropped their target price on Beam Therapeutics from $27.00 to $24.00 and set a "sector perform" rating for the company in a report on Wednesday. Finally, HC Wainwright reissued a "buy" rating and set a $80.00 target price on shares of Beam Therapeutics in a report on Thursday. Four analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, Beam Therapeutics has a consensus rating of "Moderate Buy" and an average price target of $44.91.

Get Our Latest Stock Analysis on BEAM

Beam Therapeutics Stock Performance

Shares of NASDAQ BEAM traded up $0.96 during mid-day trading on Friday, reaching $27.06. The company had a trading volume of 1,265,594 shares, compared to its average volume of 1,231,241. Beam Therapeutics Inc. has a one year low of $18.85 and a one year high of $49.50. The firm has a market cap of $2.23 billion, a price-to-earnings ratio of -14.42 and a beta of 1.86. The business's 50-day simple moving average is $24.22 and its 200 day simple moving average is $24.65.

Beam Therapeutics (NASDAQ:BEAM - Get Free Report) last issued its quarterly earnings results on Tuesday, November 5th. The company reported ($1.17) EPS for the quarter, missing analysts' consensus estimates of ($1.16) by ($0.01). Beam Therapeutics had a negative return on equity of 16.22% and a negative net margin of 40.56%. The company had revenue of $14.30 million during the quarter, compared to the consensus estimate of $14.52 million. During the same quarter in the previous year, the business posted ($1.22) EPS. The firm's revenue for the quarter was down 16.9% on a year-over-year basis. On average, sell-side analysts anticipate that Beam Therapeutics Inc. will post -4.6 EPS for the current year.

Beam Therapeutics Company Profile

(

Free Report)

Beam Therapeutics Inc, a biotechnology company, engages in the development of precision genetic medicines for patients suffering from serious diseases in the United States. It develops BEAM-101 for the treatment of sickle cell disease or beta-thalassemia; and BEAM-302, a liver-targeting LNP formulation to treat severe alpha-1 antitrypsin deficiency; BEAM-201, an anti-CD7 CAR-T product candidate, which is in Phase 1/2 clinical trials for the treatment of refractory T-cell acute lymphoblastic leukemia/T cell lymphoblastic lymphoma; and BEAM-301, a liver-targeting LNP formulation for the treatment of glycogen storage disease 1a.

Further Reading

Before you consider Beam Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Beam Therapeutics wasn't on the list.

While Beam Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.