Arrowhead Pharmaceuticals (NASDAQ:ARWR - Get Free Report) had its price objective decreased by equities research analysts at Sanford C. Bernstein from $27.00 to $24.00 in a research report issued to clients and investors on Friday,Benzinga reports. The firm presently has a "market perform" rating on the biotechnology company's stock. Sanford C. Bernstein's price target suggests a potential downside of 7.80% from the stock's previous close.

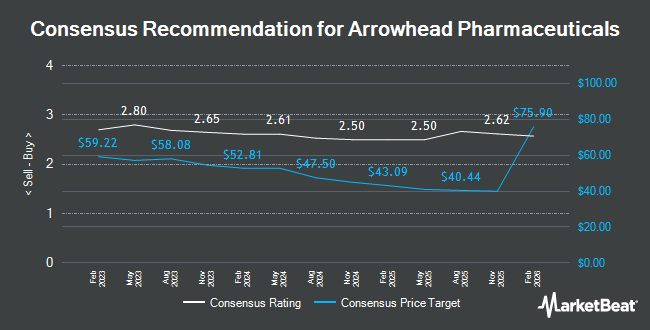

Several other brokerages have also recently commented on ARWR. Royal Bank of Canada reiterated an "outperform" rating and issued a $42.00 price target on shares of Arrowhead Pharmaceuticals in a research report on Thursday, September 26th. Cantor Fitzgerald reiterated an "overweight" rating on shares of Arrowhead Pharmaceuticals in a report on Monday, September 9th. Citigroup reduced their target price on shares of Arrowhead Pharmaceuticals from $27.00 to $26.00 and set a "neutral" rating for the company in a report on Wednesday. HC Wainwright restated a "buy" rating and issued a $60.00 price target on shares of Arrowhead Pharmaceuticals in a research report on Wednesday, November 20th. Finally, Chardan Capital reiterated a "buy" rating and set a $60.00 price objective on shares of Arrowhead Pharmaceuticals in a research report on Wednesday. One investment analyst has rated the stock with a sell rating, four have issued a hold rating and seven have issued a buy rating to the company's stock. According to MarketBeat, Arrowhead Pharmaceuticals presently has a consensus rating of "Moderate Buy" and a consensus price target of $40.70.

Read Our Latest Stock Analysis on ARWR

Arrowhead Pharmaceuticals Trading Down 0.5 %

ARWR traded down $0.12 on Friday, reaching $26.03. 1,899,366 shares of the company's stock were exchanged, compared to its average volume of 1,254,600. The company's 50 day moving average is $20.16 and its 200-day moving average is $23.23. The company has a debt-to-equity ratio of 2.06, a quick ratio of 4.65 and a current ratio of 6.74. The company has a market cap of $3.24 billion, a price-to-earnings ratio of -5.19 and a beta of 0.93. Arrowhead Pharmaceuticals has a twelve month low of $17.05 and a twelve month high of $39.83.

Institutional Trading of Arrowhead Pharmaceuticals

Several hedge funds and other institutional investors have recently modified their holdings of ARWR. Fifth Third Bancorp increased its stake in shares of Arrowhead Pharmaceuticals by 42.5% during the 2nd quarter. Fifth Third Bancorp now owns 1,186 shares of the biotechnology company's stock worth $31,000 after purchasing an additional 354 shares during the last quarter. Values First Advisors Inc. acquired a new position in Arrowhead Pharmaceuticals during the third quarter worth $52,000. Meeder Asset Management Inc. raised its holdings in Arrowhead Pharmaceuticals by 4,629.2% during the second quarter. Meeder Asset Management Inc. now owns 3,405 shares of the biotechnology company's stock valued at $88,000 after buying an additional 3,333 shares in the last quarter. nVerses Capital LLC acquired a new stake in shares of Arrowhead Pharmaceuticals in the second quarter worth about $96,000. Finally, Mirae Asset Global Investments Co. Ltd. boosted its stake in shares of Arrowhead Pharmaceuticals by 21.3% during the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 4,496 shares of the biotechnology company's stock worth $88,000 after acquiring an additional 788 shares in the last quarter. 62.61% of the stock is currently owned by hedge funds and other institutional investors.

Arrowhead Pharmaceuticals Company Profile

(

Get Free Report)

Arrowhead Pharmaceuticals, Inc develops medicines for the treatment of intractable diseases in the United States. The company's products in pipeline includes Plozasiran, which is in Phase 2b and one Phase 3 clinical trial to treat hypertriglyceridemia, mixed dyslipidemia, and chylomicronemia syndrome; Zodasiran that is in Phase 2b clinical trial for the treatment of dyslipidemia and hypertriglyceridemia; ARO-PNPLA3, which is in Phase 1 clinical trial to treat patients with non-alcoholic steatohepatitis; ARO-RAGE that is in Phase 1/2a clinical trial to treat inflammatory pulmonary conditions; and ARO-MUC5AC, which is in Phase 1/2a clinical trial to treat muco-obstructive pulmonary diseases.

Recommended Stories

Before you consider Arrowhead Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arrowhead Pharmaceuticals wasn't on the list.

While Arrowhead Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.