ArrowMark Colorado Holdings LLC raised its position in ORIC Pharmaceuticals, Inc. (NASDAQ:ORIC - Free Report) by 6.4% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 1,354,508 shares of the company's stock after buying an additional 80,986 shares during the quarter. ArrowMark Colorado Holdings LLC owned about 1.92% of ORIC Pharmaceuticals worth $13,884,000 at the end of the most recent quarter.

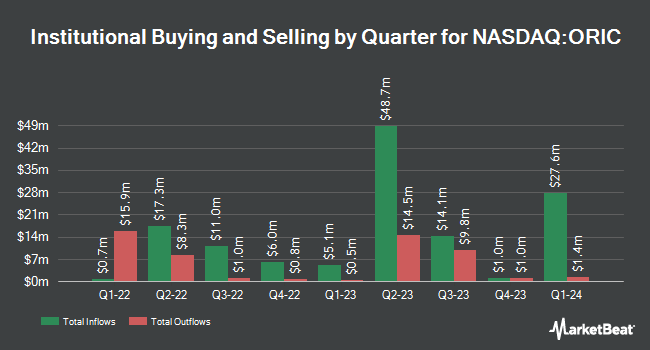

Several other hedge funds and other institutional investors also recently made changes to their positions in ORIC. Zurcher Kantonalbank Zurich Cantonalbank boosted its position in ORIC Pharmaceuticals by 162.3% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 5,152 shares of the company's stock valued at $36,000 after buying an additional 3,188 shares in the last quarter. Quest Partners LLC grew its holdings in shares of ORIC Pharmaceuticals by 253.2% during the second quarter. Quest Partners LLC now owns 10,378 shares of the company's stock worth $73,000 after purchasing an additional 7,440 shares during the last quarter. Creative Planning acquired a new position in shares of ORIC Pharmaceuticals in the third quarter valued at approximately $116,000. Connor Clark & Lunn Investment Management Ltd. bought a new position in ORIC Pharmaceuticals in the 3rd quarter valued at approximately $132,000. Finally, China Universal Asset Management Co. Ltd. boosted its position in ORIC Pharmaceuticals by 71.3% during the 3rd quarter. China Universal Asset Management Co. Ltd. now owns 13,568 shares of the company's stock worth $139,000 after buying an additional 5,646 shares during the period. 95.05% of the stock is currently owned by institutional investors and hedge funds.

ORIC Pharmaceuticals Price Performance

NASDAQ:ORIC traded down $0.52 during trading hours on Tuesday, hitting $9.65. The stock had a trading volume of 78,033 shares, compared to its average volume of 509,429. The firm has a market capitalization of $681.00 million, a price-to-earnings ratio of -5.65 and a beta of 1.13. ORIC Pharmaceuticals, Inc. has a one year low of $6.33 and a one year high of $16.65. The company has a 50 day simple moving average of $9.53 and a two-hundred day simple moving average of $9.35.

ORIC Pharmaceuticals (NASDAQ:ORIC - Get Free Report) last issued its quarterly earnings data on Tuesday, November 12th. The company reported ($0.49) EPS for the quarter, missing the consensus estimate of ($0.48) by ($0.01). Equities research analysts anticipate that ORIC Pharmaceuticals, Inc. will post -1.84 earnings per share for the current year.

Analysts Set New Price Targets

Several research analysts have commented on the company. Stifel Nicolaus initiated coverage on ORIC Pharmaceuticals in a report on Friday, September 6th. They set a "buy" rating and a $20.00 target price on the stock. Wells Fargo & Company initiated coverage on ORIC Pharmaceuticals in a report on Thursday, October 31st. They issued an "overweight" rating and a $20.00 target price on the stock. Oppenheimer lowered their price target on shares of ORIC Pharmaceuticals from $17.00 to $15.00 and set an "outperform" rating for the company in a report on Tuesday, August 13th. Wedbush reaffirmed an "outperform" rating and issued a $20.00 price objective on shares of ORIC Pharmaceuticals in a research note on Tuesday, November 12th. Finally, HC Wainwright reissued a "buy" rating and set a $21.00 target price on shares of ORIC Pharmaceuticals in a research note on Monday, November 4th. Eight research analysts have rated the stock with a buy rating, According to MarketBeat, the stock presently has an average rating of "Buy" and a consensus target price of $18.29.

Get Our Latest Analysis on ORIC Pharmaceuticals

About ORIC Pharmaceuticals

(

Free Report)

ORIC Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, engages in the discovery and development of therapies for treatment of cancers in the United States. Its clinical stage product candidates include ORIC-114, a brain penetrant orally bioavailable irreversible inhibitor, currently under Phase 1b study, which is designed to selectively target epidermal growth factor receptor and human epidermal growth factor receptor 2 with high potency towards exon 20 insertion mutations; ORIC-944, an allosteric inhibitor of the polycomb repressive complex 2 for prostate cancer, currently under Phase 1b study; and ORIC-533, an orally bioavailable small molecule inhibitor of CD73, currently under Phase 1b study, being developed for resistance to chemotherapy- and immunotherapy-based treatment regimens.

Recommended Stories

Before you consider ORIC Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ORIC Pharmaceuticals wasn't on the list.

While ORIC Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.