ArrowMark Colorado Holdings LLC grew its stake in shares of Ambarella, Inc. (NASDAQ:AMBA - Free Report) by 21.4% during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 85,000 shares of the semiconductor company's stock after purchasing an additional 15,000 shares during the quarter. ArrowMark Colorado Holdings LLC owned about 0.21% of Ambarella worth $4,794,000 at the end of the most recent quarter.

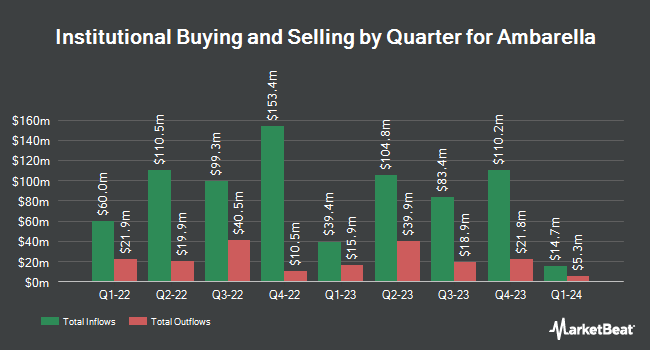

Several other institutional investors have also recently made changes to their positions in the stock. Meeder Asset Management Inc. acquired a new position in shares of Ambarella during the 2nd quarter worth approximately $26,000. Blue Trust Inc. increased its holdings in shares of Ambarella by 180.3% during the 3rd quarter. Blue Trust Inc. now owns 499 shares of the semiconductor company's stock worth $27,000 after acquiring an additional 321 shares during the last quarter. CWM LLC increased its holdings in shares of Ambarella by 127.7% during the 2nd quarter. CWM LLC now owns 542 shares of the semiconductor company's stock worth $29,000 after acquiring an additional 304 shares during the last quarter. Signaturefd LLC increased its holdings in shares of Ambarella by 389.6% during the 3rd quarter. Signaturefd LLC now owns 661 shares of the semiconductor company's stock worth $37,000 after acquiring an additional 526 shares during the last quarter. Finally, Larson Financial Group LLC increased its holdings in shares of Ambarella by 6,014.3% during the 3rd quarter. Larson Financial Group LLC now owns 856 shares of the semiconductor company's stock worth $48,000 after acquiring an additional 842 shares during the last quarter. Institutional investors and hedge funds own 82.09% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts recently issued reports on AMBA shares. Morgan Stanley boosted their price target on Ambarella from $73.00 to $90.00 and gave the company an "overweight" rating in a research note on Wednesday, November 27th. Roth Mkm reiterated a "neutral" rating and set a $60.00 target price on shares of Ambarella in a research report on Wednesday, August 28th. Northland Securities restated an "outperform" rating and set a $95.00 price objective (up from $75.00) on shares of Ambarella in a research report on Wednesday, November 27th. Bank of America upped their price objective on Ambarella from $57.00 to $65.00 and gave the stock an "underperform" rating in a research report on Wednesday, November 27th. Finally, Westpark Capital restated a "buy" rating and set a $85.00 price objective on shares of Ambarella in a research report on Monday, August 26th. One analyst has rated the stock with a sell rating, four have assigned a hold rating and eight have given a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $81.67.

View Our Latest Report on AMBA

Ambarella Stock Up 1.9 %

Shares of Ambarella stock traded up $1.34 on Tuesday, hitting $71.51. 321,823 shares of the company's stock traded hands, compared to its average volume of 600,383. The company has a fifty day moving average of $59.60 and a two-hundred day moving average of $55.59. Ambarella, Inc. has a one year low of $39.69 and a one year high of $81.32.

Insiders Place Their Bets

In other Ambarella news, CEO Feng-Ming Wang sold 4,382 shares of the business's stock in a transaction on Wednesday, September 4th. The stock was sold at an average price of $56.02, for a total value of $245,479.64. Following the transaction, the chief executive officer now owns 803,574 shares of the company's stock, valued at approximately $45,016,215.48. The trade was a 0.54 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, VP Christopher Day sold 483 shares of the business's stock in a transaction on Tuesday, September 17th. The stock was sold at an average price of $53.54, for a total value of $25,859.82. Following the completion of the transaction, the vice president now directly owns 21,370 shares in the company, valued at approximately $1,144,149.80. This represents a 2.21 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 18,460 shares of company stock worth $1,013,172. Corporate insiders own 5.70% of the company's stock.

Ambarella Profile

(

Free Report)

Ambarella, Inc develops semiconductor solutions that enable high-definition (HD) and ultra HD compression, image signal processing, and artificial intelligence processing worldwide. The company's system-on-a-chip designs integrated HD video processing, image processing, artificial intelligence computer vision algorithms, audio processing, and system functions onto a single chip for delivering video and image quality, differentiated functionality, and low power consumption.

Featured Stories

Before you consider Ambarella, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ambarella wasn't on the list.

While Ambarella currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.