ArrowMark Colorado Holdings LLC reduced its position in shares of U-Haul Holding (NASDAQ:UHAL - Free Report) by 37.3% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 75,800 shares of the transportation company's stock after selling 45,000 shares during the period. ArrowMark Colorado Holdings LLC's holdings in U-Haul were worth $5,873,000 at the end of the most recent quarter.

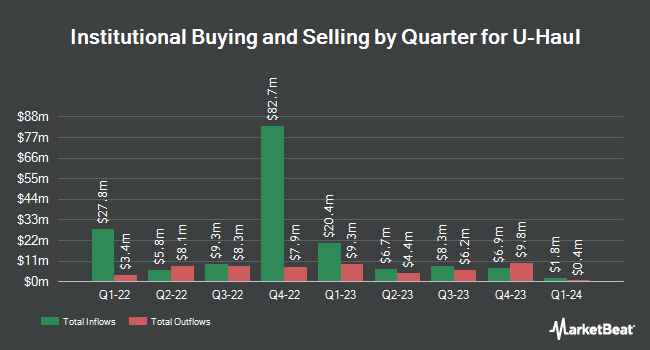

A number of other institutional investors and hedge funds also recently made changes to their positions in the business. Old West Investment Management LLC increased its stake in U-Haul by 11.7% in the 3rd quarter. Old West Investment Management LLC now owns 125,947 shares of the transportation company's stock worth $9,758,000 after acquiring an additional 13,143 shares during the last quarter. Applied Fundamental Research LLC raised its stake in U-Haul by 12.9% in the second quarter. Applied Fundamental Research LLC now owns 61,300 shares of the transportation company's stock valued at $3,784,000 after purchasing an additional 7,021 shares in the last quarter. Childress Capital Advisors LLC bought a new stake in U-Haul during the third quarter valued at approximately $387,000. Granite Bay Wealth Management LLC purchased a new position in U-Haul in the 2nd quarter worth approximately $308,000. Finally, Versor Investments LP increased its holdings in shares of U-Haul by 66.9% in the 2nd quarter. Versor Investments LP now owns 10,988 shares of the transportation company's stock worth $678,000 after buying an additional 4,406 shares during the last quarter. Hedge funds and other institutional investors own 3.63% of the company's stock.

U-Haul Price Performance

Shares of U-Haul stock traded up $0.54 on Tuesday, hitting $71.88. 28,146 shares of the company traded hands, compared to its average volume of 97,108. U-Haul Holding has a 12-month low of $57.31 and a 12-month high of $79.04. The firm's 50-day simple moving average is $73.39 and its 200 day simple moving average is $68.85. The company has a market cap of $14.09 billion, a P/E ratio of 30.84 and a beta of 1.09. The company has a current ratio of 2.33, a quick ratio of 2.16 and a debt-to-equity ratio of 0.88.

U-Haul (NASDAQ:UHAL - Get Free Report) last released its earnings results on Wednesday, November 6th. The transportation company reported $0.91 EPS for the quarter, missing the consensus estimate of $1.37 by ($0.46). U-Haul had a net margin of 8.39% and a return on equity of 6.46%. The business had revenue of $1.66 billion for the quarter, compared to the consensus estimate of $1.69 billion. During the same period in the prior year, the business posted $1.36 EPS. Analysts expect that U-Haul Holding will post 2.31 earnings per share for the current fiscal year.

About U-Haul

(

Free Report)

U-Haul Holding Company operates as a do-it-yourself moving and storage operator for household and commercial goods in the United States and Canada. The company's Moving and Storage segment rents trucks, trailers, portable moving and storage units, specialty rental items, and self-storage spaces primarily to the household movers; and sells moving supplies, towing accessories, and propane.

See Also

Before you consider U-Haul, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and U-Haul wasn't on the list.

While U-Haul currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.