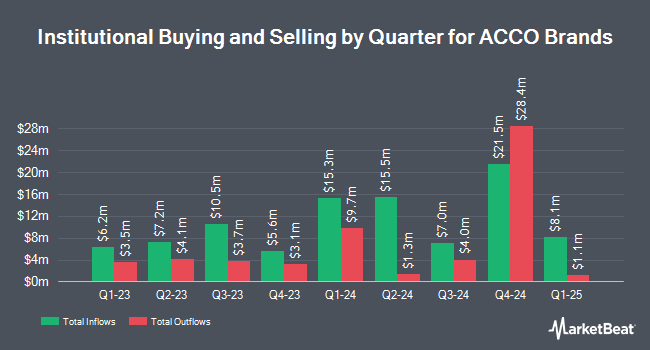

Arrowstreet Capital Limited Partnership grew its holdings in shares of ACCO Brands Co. (NYSE:ACCO - Free Report) by 28.0% in the 4th quarter, according to its most recent disclosure with the SEC. The fund owned 1,096,273 shares of the industrial products company's stock after purchasing an additional 239,997 shares during the period. Arrowstreet Capital Limited Partnership owned approximately 1.18% of ACCO Brands worth $5,755,000 as of its most recent SEC filing.

Other hedge funds have also recently made changes to their positions in the company. FMR LLC increased its stake in ACCO Brands by 123.0% during the 3rd quarter. FMR LLC now owns 5,911 shares of the industrial products company's stock valued at $32,000 after purchasing an additional 3,260 shares in the last quarter. EP Wealth Advisors LLC bought a new stake in shares of ACCO Brands during the third quarter valued at approximately $61,000. Y Intercept Hong Kong Ltd purchased a new position in ACCO Brands in the 3rd quarter worth approximately $63,000. Burns Matteson Capital Management LLC bought a new position in ACCO Brands in the 4th quarter valued at approximately $61,000. Finally, Xponance Inc. purchased a new stake in ACCO Brands during the 4th quarter valued at $65,000. 84.56% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

ACCO has been the subject of several recent analyst reports. Barrington Research decreased their price target on ACCO Brands from $7.50 to $7.00 and set an "outperform" rating for the company in a research note on Tuesday, February 25th. StockNews.com raised ACCO Brands from a "hold" rating to a "buy" rating in a research report on Friday, March 28th.

View Our Latest Report on ACCO Brands

ACCO Brands Stock Performance

ACCO stock traded up $0.03 on Friday, hitting $3.66. The company had a trading volume of 737,141 shares, compared to its average volume of 680,169. The stock's 50-day simple moving average is $4.55 and its 200 day simple moving average is $5.14. The stock has a market cap of $329.31 million, a price-to-earnings ratio of -3.45, a P/E/G ratio of 0.37 and a beta of 1.60. The company has a current ratio of 1.60, a quick ratio of 0.94 and a debt-to-equity ratio of 1.38. ACCO Brands Co. has a 12-month low of $3.47 and a 12-month high of $6.44.

ACCO Brands (NYSE:ACCO - Get Free Report) last posted its earnings results on Thursday, February 20th. The industrial products company reported $0.39 earnings per share for the quarter, missing analysts' consensus estimates of $0.40 by ($0.01). The firm had revenue of $448.10 million during the quarter, compared to the consensus estimate of $455.06 million. ACCO Brands had a negative net margin of 6.10% and a positive return on equity of 14.96%. As a group, equities research analysts expect that ACCO Brands Co. will post 1.02 earnings per share for the current fiscal year.

ACCO Brands Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Wednesday, March 26th. Investors of record on Friday, March 14th were given a dividend of $0.075 per share. The ex-dividend date was Friday, March 14th. This represents a $0.30 annualized dividend and a yield of 8.21%. ACCO Brands's dividend payout ratio (DPR) is -28.30%.

About ACCO Brands

(

Free Report)

ACCO Brands Corporation designs, manufactures, and markets consumer, school, technology, and office products. It operates through three segments: ACCO Brands North America, ACCO Brands EMEA, and ACCO Brands International. The company provides computer and gaming accessories, planners, dry erase boards, school notebooks, and janitorial supplies; storage and organization products, such as lever-arch binders, sheet protectors, and indexes; sheet protectors and indexes; laminating, binding, and shredding machines; writing instruments and art products; stapling and punching products; and do-it-yourself tools.

Read More

Before you consider ACCO Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACCO Brands wasn't on the list.

While ACCO Brands currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.