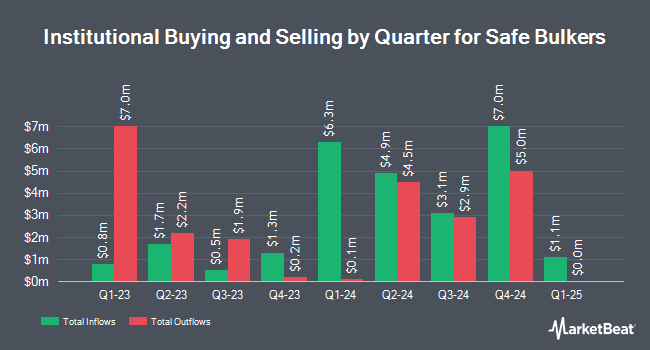

Arrowstreet Capital Limited Partnership grew its holdings in shares of Safe Bulkers, Inc. (NYSE:SB - Free Report) by 16.7% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,796,424 shares of the shipping company's stock after acquiring an additional 257,136 shares during the quarter. Arrowstreet Capital Limited Partnership owned 1.68% of Safe Bulkers worth $6,413,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. New Age Alpha Advisors LLC acquired a new stake in shares of Safe Bulkers in the fourth quarter valued at about $64,000. Koss Olinger Consulting LLC bought a new stake in shares of Safe Bulkers during the 4th quarter valued at about $99,000. Gallacher Capital Management LLC grew its stake in Safe Bulkers by 23.8% during the fourth quarter. Gallacher Capital Management LLC now owns 95,258 shares of the shipping company's stock worth $340,000 after purchasing an additional 18,324 shares during the period. Victory Capital Management Inc. increased its holdings in Safe Bulkers by 38.6% in the fourth quarter. Victory Capital Management Inc. now owns 54,812 shares of the shipping company's stock worth $196,000 after purchasing an additional 15,254 shares in the last quarter. Finally, Sage Investment Counsel LLC acquired a new position in Safe Bulkers in the fourth quarter valued at approximately $89,000. Institutional investors own 21.69% of the company's stock.

Wall Street Analyst Weigh In

A number of equities analysts have recently issued reports on SB shares. Jefferies Financial Group reissued a "buy" rating and set a $6.00 price objective on shares of Safe Bulkers in a research report on Wednesday, February 19th. Loop Capital set a $4.20 price target on shares of Safe Bulkers in a research report on Monday, January 27th. DNB Markets raised shares of Safe Bulkers from a "hold" rating to a "buy" rating and set a $4.20 price objective on the stock in a research note on Monday, January 27th. Finally, StockNews.com downgraded shares of Safe Bulkers from a "buy" rating to a "hold" rating in a research report on Monday, January 27th.

Read Our Latest Stock Analysis on Safe Bulkers

Safe Bulkers Stock Performance

Safe Bulkers stock traded up $0.27 during mid-day trading on Friday, reaching $3.48. 719,614 shares of the company's stock were exchanged, compared to its average volume of 613,752. The business's fifty day simple moving average is $3.65 and its 200 day simple moving average is $3.89. The company has a quick ratio of 1.34, a current ratio of 1.91 and a debt-to-equity ratio of 0.58. The firm has a market capitalization of $365.92 million, a PE ratio of 4.19 and a beta of 0.92. Safe Bulkers, Inc. has a one year low of $3.02 and a one year high of $6.33.

Safe Bulkers (NYSE:SB - Get Free Report) last released its quarterly earnings data on Tuesday, February 18th. The shipping company reported $0.15 EPS for the quarter, topping the consensus estimate of $0.14 by $0.01. Safe Bulkers had a net margin of 31.65% and a return on equity of 10.04%. The company had revenue of $69.16 million during the quarter, compared to the consensus estimate of $71.90 million. On average, sell-side analysts expect that Safe Bulkers, Inc. will post 0.62 earnings per share for the current year.

Safe Bulkers Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, March 21st. Investors of record on Monday, March 3rd were paid a dividend of $0.05 per share. The ex-dividend date was Monday, March 3rd. This represents a $0.20 dividend on an annualized basis and a dividend yield of 5.76%. Safe Bulkers's payout ratio is 24.10%.

About Safe Bulkers

(

Free Report)

Safe Bulkers, Inc, together with its subsidiaries, provides marine drybulk transportation services. It owns and operates drybulk vessels for transporting bulk cargoes primarily coal, grain, and iron ore. The company has a fleet of 47 drybulk vessels having an aggregate carrying capacity of 4,719,600 deadweight tons.

See Also

Before you consider Safe Bulkers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Safe Bulkers wasn't on the list.

While Safe Bulkers currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.