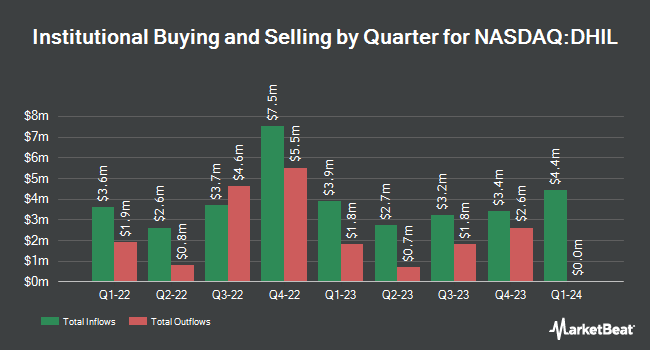

Arrowstreet Capital Limited Partnership boosted its stake in shares of Diamond Hill Investment Group, Inc. (NASDAQ:DHIL - Free Report) by 48.2% during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 19,968 shares of the asset manager's stock after acquiring an additional 6,490 shares during the quarter. Arrowstreet Capital Limited Partnership owned about 0.73% of Diamond Hill Investment Group worth $3,097,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Y Intercept Hong Kong Ltd boosted its stake in shares of Diamond Hill Investment Group by 5.2% during the 3rd quarter. Y Intercept Hong Kong Ltd now owns 1,926 shares of the asset manager's stock worth $311,000 after purchasing an additional 96 shares during the period. R Squared Ltd bought a new stake in Diamond Hill Investment Group in the fourth quarter worth about $54,000. SG Americas Securities LLC boosted its position in shares of Diamond Hill Investment Group by 23.4% during the fourth quarter. SG Americas Securities LLC now owns 2,244 shares of the asset manager's stock valued at $348,000 after buying an additional 426 shares during the period. Legato Capital Management LLC grew its stake in shares of Diamond Hill Investment Group by 5.8% during the fourth quarter. Legato Capital Management LLC now owns 10,441 shares of the asset manager's stock valued at $1,619,000 after buying an additional 571 shares during the last quarter. Finally, BCGM Wealth Management LLC raised its holdings in shares of Diamond Hill Investment Group by 3.3% in the fourth quarter. BCGM Wealth Management LLC now owns 19,534 shares of the asset manager's stock worth $3,030,000 after buying an additional 615 shares during the period. 65.50% of the stock is currently owned by hedge funds and other institutional investors.

Diamond Hill Investment Group Trading Up 0.3 %

Shares of DHIL traded up $0.40 during trading hours on Tuesday, reaching $132.19. 2,177 shares of the company traded hands, compared to its average volume of 17,153. The stock's fifty day moving average price is $143.68 and its 200 day moving average price is $152.57. The firm has a market cap of $368.41 million, a price-to-earnings ratio of 7.49 and a beta of 0.83. Diamond Hill Investment Group, Inc. has a 12-month low of $128.89 and a 12-month high of $173.25.

Diamond Hill Investment Group (NASDAQ:DHIL - Get Free Report) last released its quarterly earnings data on Wednesday, February 26th. The asset manager reported $3.66 earnings per share (EPS) for the quarter. The company had revenue of $39.12 million during the quarter. Diamond Hill Investment Group had a net margin of 33.88% and a return on equity of 20.00%.

Diamond Hill Investment Group Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, March 21st. Shareholders of record on Monday, March 10th were issued a dividend of $1.50 per share. The ex-dividend date of this dividend was Monday, March 10th. This represents a $6.00 annualized dividend and a yield of 4.54%. Diamond Hill Investment Group's payout ratio is currently 38.39%.

Analyst Upgrades and Downgrades

Separately, StockNews.com cut Diamond Hill Investment Group from a "strong-buy" rating to a "buy" rating in a report on Friday, February 28th.

Read Our Latest Analysis on DHIL

Insider Buying and Selling at Diamond Hill Investment Group

In other news, Director Richard Scott Cooley purchased 272 shares of the business's stock in a transaction dated Friday, February 28th. The shares were purchased at an average price of $144.00 per share, for a total transaction of $39,168.00. Following the completion of the purchase, the director now owns 9,659 shares in the company, valued at approximately $1,390,896. This represents a 2.90 % increase in their position. The purchase was disclosed in a filing with the SEC, which can be accessed through this link. Insiders bought a total of 1,422 shares of company stock valued at $205,593 in the last ninety days. Corporate insiders own 4.60% of the company's stock.

About Diamond Hill Investment Group

(

Free Report)

Diamond Hill Investment Group, Inc, through its subsidiary, Diamond Hill Capital Management, Inc, provides investment advisory and fund administration services in the United States. It offers investment advisory and related services to clients through pooled vehicles, such as private fund; separately managed accounts; collective investment trusts; and other pooled vehicles, including sub-advised funds and model delivery programs.

Read More

Before you consider Diamond Hill Investment Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diamond Hill Investment Group wasn't on the list.

While Diamond Hill Investment Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.