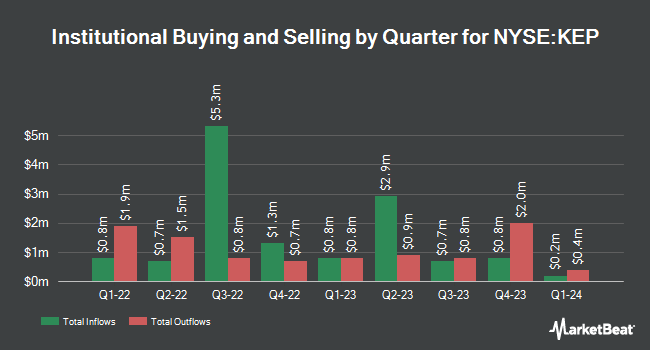

Arrowstreet Capital Limited Partnership grew its stake in Korea Electric Power Co. (NYSE:KEP - Free Report) by 90.6% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 723,844 shares of the utilities provider's stock after buying an additional 344,126 shares during the period. Arrowstreet Capital Limited Partnership owned 0.06% of Korea Electric Power worth $4,980,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also made changes to their positions in KEP. Wilmington Savings Fund Society FSB acquired a new position in Korea Electric Power in the 3rd quarter worth approximately $35,000. Wealthstream Advisors Inc. acquired a new position in Korea Electric Power during the fourth quarter valued at $71,000. Stifel Financial Corp purchased a new stake in Korea Electric Power in the third quarter valued at $96,000. Jane Street Group LLC acquired a new stake in Korea Electric Power during the 3rd quarter worth about $140,000. Finally, EntryPoint Capital LLC purchased a new position in shares of Korea Electric Power during the 4th quarter valued at about $126,000.

Wall Street Analysts Forecast Growth

Separately, StockNews.com raised Korea Electric Power from a "hold" rating to a "buy" rating in a report on Friday.

View Our Latest Stock Report on Korea Electric Power

Korea Electric Power Price Performance

Korea Electric Power stock traded up $0.36 during trading on Friday, reaching $8.16. The company had a trading volume of 172,355 shares, compared to its average volume of 144,180. The company has a debt-to-equity ratio of 2.10, a quick ratio of 0.30 and a current ratio of 0.43. The firm's 50-day simple moving average is $7.55 and its 200 day simple moving average is $7.60. The firm has a market capitalization of $10.47 billion, a PE ratio of 3.78 and a beta of 0.94. Korea Electric Power Co. has a 1-year low of $6.68 and a 1-year high of $9.43.

Korea Electric Power (NYSE:KEP - Get Free Report) last released its earnings results on Tuesday, March 11th. The utilities provider reported $0.57 earnings per share for the quarter, beating the consensus estimate of $0.55 by $0.02. The business had revenue of $16.82 billion for the quarter, compared to the consensus estimate of $17.04 billion. Korea Electric Power had a return on equity of 9.64% and a net margin of 4.03%.

About Korea Electric Power

(

Free Report)

Korea Electric Power Corporation, an integrated electric utility company, engages in the generation, transmission, and distribution of electricity in South Korea and internationally. The company operates through Transmission and Distribution, Nuclear Power Generation, Thermal Power Generation, and Others segments.

Featured Articles

Before you consider Korea Electric Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Korea Electric Power wasn't on the list.

While Korea Electric Power currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.