Arrowstreet Capital Limited Partnership acquired a new stake in shares of Bristow Group Inc. (NYSE:VTOL - Free Report) in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 29,090 shares of the company's stock, valued at approximately $998,000. Arrowstreet Capital Limited Partnership owned about 0.10% of Bristow Group as of its most recent filing with the Securities and Exchange Commission (SEC).

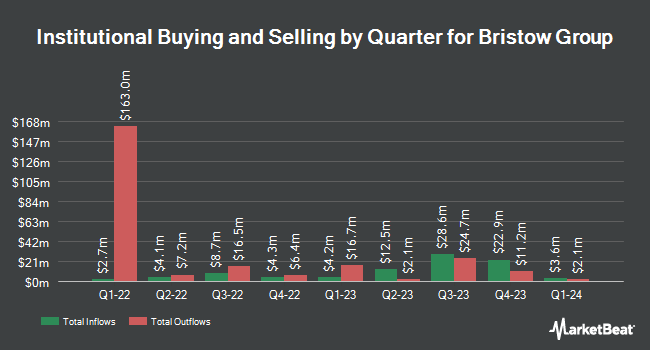

A number of other hedge funds also recently bought and sold shares of VTOL. KLP Kapitalforvaltning AS purchased a new stake in Bristow Group in the 4th quarter worth approximately $34,000. Wolverine Asset Management LLC increased its stake in shares of Bristow Group by 105.3% in the fourth quarter. Wolverine Asset Management LLC now owns 1,725 shares of the company's stock worth $59,000 after purchasing an additional 34,400 shares in the last quarter. Counterpoint Mutual Funds LLC raised its position in shares of Bristow Group by 82.8% during the 4th quarter. Counterpoint Mutual Funds LLC now owns 11,637 shares of the company's stock valued at $399,000 after purchasing an additional 5,270 shares during the period. Birnam Oak Advisors LP purchased a new position in shares of Bristow Group during the 4th quarter valued at $468,000. Finally, Franklin Resources Inc. purchased a new position in shares of Bristow Group during the 3rd quarter valued at $572,000. Hedge funds and other institutional investors own 93.29% of the company's stock.

Insiders Place Their Bets

In related news, major shareholder Alternative Asset Manage Solus sold 9,875 shares of the company's stock in a transaction dated Wednesday, March 19th. The shares were sold at an average price of $32.08, for a total transaction of $316,790.00. Following the transaction, the insider now directly owns 3,166,821 shares in the company, valued at approximately $101,591,617.68. This represents a 0.31 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Lorin L. Brass sold 2,700 shares of the company's stock in a transaction that occurred on Friday, February 28th. The shares were sold at an average price of $37.00, for a total value of $99,900.00. Following the transaction, the director now directly owns 28,104 shares in the company, valued at approximately $1,039,848. This represents a 8.77 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 35,027 shares of company stock valued at $1,149,792 in the last three months. Corporate insiders own 14.90% of the company's stock.

Bristow Group Price Performance

Shares of NYSE:VTOL traded up $0.18 during trading on Tuesday, hitting $28.10. 170,815 shares of the company's stock were exchanged, compared to its average volume of 130,638. The business's 50-day simple moving average is $32.52 and its 200 day simple moving average is $34.30. The company has a market cap of $804.44 million, a price-to-earnings ratio of 15.11 and a beta of 1.14. Bristow Group Inc. has a 52-week low of $24.33 and a 52-week high of $41.50. The company has a debt-to-equity ratio of 0.68, a current ratio of 1.83 and a quick ratio of 1.49.

Bristow Group (NYSE:VTOL - Get Free Report) last announced its quarterly earnings results on Wednesday, February 26th. The company reported $1.07 EPS for the quarter, topping the consensus estimate of $0.61 by $0.46. The business had revenue of $353.53 million for the quarter, compared to analysts' expectations of $367.00 million. Bristow Group had a net margin of 3.93% and a return on equity of 6.50%.

About Bristow Group

(

Free Report)

Bristow Group Inc provides vertical flight solutions. The company primarily offers aviation services to integrated, national, and independent offshore energy companies and government agencies. It also provides personnel transportation, search and rescue, medevac, ad hoc helicopter, fixed wing transportation, unmanned systems, and ad-hoc helicopter services, as well as logistical and maintenance support, training services, and flight and maintenance crews.

Recommended Stories

Before you consider Bristow Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bristow Group wasn't on the list.

While Bristow Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.