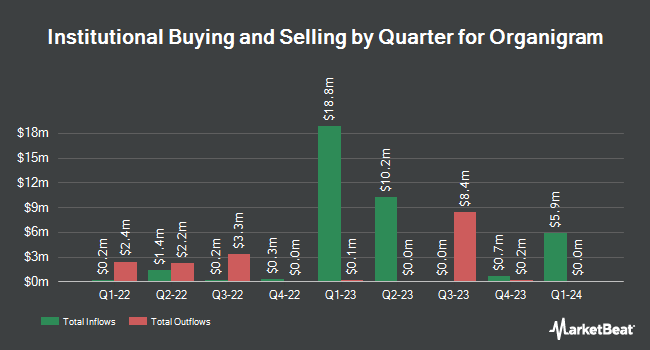

Arrowstreet Capital Limited Partnership bought a new position in Organigram Holdings Inc. (NASDAQ:OGI - Free Report) in the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 721,330 shares of the company's stock, valued at approximately $1,153,000. Arrowstreet Capital Limited Partnership owned about 0.57% of Organigram at the end of the most recent reporting period.

Several other hedge funds have also recently made changes to their positions in the company. Clear Harbor Asset Management LLC raised its holdings in Organigram by 37.4% during the 4th quarter. Clear Harbor Asset Management LLC now owns 45,000 shares of the company's stock valued at $72,000 after acquiring an additional 12,250 shares during the period. Toronto Dominion Bank lifted its holdings in Organigram by 803.7% during the 3rd quarter. Toronto Dominion Bank now owns 16,727 shares of the company's stock worth $30,000 after purchasing an additional 14,876 shares in the last quarter. Finally, Tidal Investments LLC boosted its stake in Organigram by 8.3% in the 3rd quarter. Tidal Investments LLC now owns 1,948,188 shares of the company's stock worth $3,526,000 after purchasing an additional 149,171 shares during the period. 34.63% of the stock is currently owned by institutional investors.

Organigram Stock Performance

Shares of Organigram stock remained flat at $1.04 on Tuesday. 399,772 shares of the stock were exchanged, compared to its average volume of 777,374. The stock's 50-day moving average price is $1.13 and its 200 day moving average price is $1.45. Organigram Holdings Inc. has a 52-week low of $0.85 and a 52-week high of $2.17. The stock has a market capitalization of $131.31 million, a P/E ratio of -2.74 and a beta of 1.10.

Organigram (NASDAQ:OGI - Get Free Report) last posted its earnings results on Tuesday, February 11th. The company reported ($0.05) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.03) by ($0.02). Organigram had a negative return on equity of 8.59% and a negative net margin of 31.69%. On average, research analysts forecast that Organigram Holdings Inc. will post -0.19 EPS for the current fiscal year.

Organigram Profile

(

Free Report)

Organigram Holdings Inc, through its subsidiaries, engages in the production and sale of cannabis and cannabis-derived products in Canada. It offers medical cannabis products, including whole flower, milled flower, pre-rolls, infused pre-rolls, vapes, gummies, and concentrates for medical retailers; adult use recreational cannabis under the SHRED, Holy Mountain, Big Bag O' Buds, Monjour, Trailblazer, SHRED'ems, Edison Cannabis Co, Edison JOLTS, Tremblant, and Laurentian brands.

Further Reading

Before you consider Organigram, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Organigram wasn't on the list.

While Organigram currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.