Arrowstreet Capital Limited Partnership reduced its holdings in Consolidated Edison, Inc. (NYSE:ED - Free Report) by 78.4% during the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 31,292 shares of the utilities provider's stock after selling 113,575 shares during the quarter. Arrowstreet Capital Limited Partnership's holdings in Consolidated Edison were worth $2,792,000 at the end of the most recent reporting period.

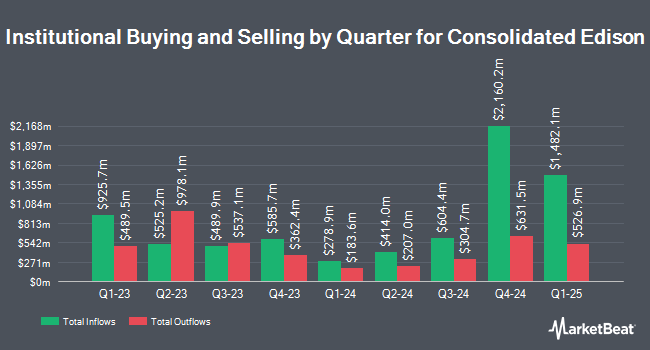

Several other institutional investors and hedge funds have also recently modified their holdings of the business. Wilmington Savings Fund Society FSB bought a new position in Consolidated Edison in the third quarter valued at $776,000. JPMorgan Chase & Co. boosted its holdings in shares of Consolidated Edison by 4.0% in the 3rd quarter. JPMorgan Chase & Co. now owns 2,145,128 shares of the utilities provider's stock worth $223,373,000 after purchasing an additional 82,985 shares in the last quarter. Hennessy Advisors Inc. increased its position in shares of Consolidated Edison by 2.8% during the 4th quarter. Hennessy Advisors Inc. now owns 143,136 shares of the utilities provider's stock valued at $12,772,000 after purchasing an additional 3,900 shares during the last quarter. Gateway Investment Advisers LLC increased its position in shares of Consolidated Edison by 102.7% during the 4th quarter. Gateway Investment Advisers LLC now owns 430,279 shares of the utilities provider's stock valued at $38,394,000 after purchasing an additional 217,981 shares during the last quarter. Finally, Jones Financial Companies Lllp raised its holdings in shares of Consolidated Edison by 81.4% during the 4th quarter. Jones Financial Companies Lllp now owns 9,921 shares of the utilities provider's stock valued at $885,000 after buying an additional 4,451 shares in the last quarter. Hedge funds and other institutional investors own 66.29% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts have commented on ED shares. Scotiabank lifted their price target on shares of Consolidated Edison from $100.00 to $101.00 and gave the stock a "sector perform" rating in a research note on Monday, February 24th. Barclays lifted their target price on shares of Consolidated Edison from $92.00 to $95.00 and gave the stock an "underweight" rating in a research report on Monday, February 24th. UBS Group upped their price target on shares of Consolidated Edison from $110.00 to $113.00 and gave the company a "neutral" rating in a research report on Friday, March 21st. Evercore ISI downgraded Consolidated Edison from a "strong-buy" rating to a "hold" rating in a report on Tuesday, January 21st. Finally, Morgan Stanley increased their target price on Consolidated Edison from $85.00 to $91.00 and gave the company an "underweight" rating in a report on Thursday, March 20th. Two research analysts have rated the stock with a sell rating, seven have given a hold rating, two have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $102.80.

Get Our Latest Research Report on Consolidated Edison

Consolidated Edison Trading Up 0.5 %

ED traded up $0.60 during midday trading on Tuesday, reaching $112.85. 188,218 shares of the company's stock traded hands, compared to its average volume of 2,836,922. Consolidated Edison, Inc. has a 52 week low of $87.28 and a 52 week high of $114.87. The company has a debt-to-equity ratio of 1.07, a current ratio of 1.01 and a quick ratio of 0.93. The firm has a fifty day moving average of $103.50 and a two-hundred day moving average of $98.96. The stock has a market capitalization of $40.65 billion, a price-to-earnings ratio of 21.53, a P/E/G ratio of 3.05 and a beta of 0.27.

Consolidated Edison (NYSE:ED - Get Free Report) last announced its earnings results on Thursday, February 20th. The utilities provider reported $0.98 EPS for the quarter, beating analysts' consensus estimates of $0.97 by $0.01. The company had revenue of $3.67 billion during the quarter, compared to the consensus estimate of $3.63 billion. Consolidated Edison had a return on equity of 8.62% and a net margin of 11.93%. On average, equities analysts anticipate that Consolidated Edison, Inc. will post 5.62 earnings per share for the current fiscal year.

Consolidated Edison Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, March 14th. Stockholders of record on Wednesday, February 19th were paid a dividend of $0.85 per share. This is a positive change from Consolidated Edison's previous quarterly dividend of $0.83. The ex-dividend date of this dividend was Wednesday, February 19th. This represents a $3.40 dividend on an annualized basis and a dividend yield of 3.01%. Consolidated Edison's payout ratio is presently 64.89%.

About Consolidated Edison

(

Free Report)

Consolidated Edison, Inc, through its subsidiaries, engages in the regulated electric, gas, and steam delivery businesses in the United States. It offers electric services to approximately 3.7 million customers in New York City and Westchester County; gas to approximately 1.1 million customers in Manhattan, the Bronx, parts of Queens, and Westchester County; and steam to approximately 1,530 customers in parts of Manhattan.

Read More

Before you consider Consolidated Edison, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Consolidated Edison wasn't on the list.

While Consolidated Edison currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.