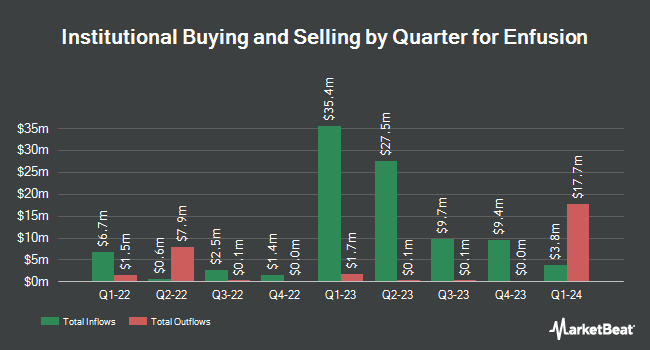

Arrowstreet Capital Limited Partnership acquired a new position in shares of Enfusion, Inc. (NYSE:ENFN - Free Report) during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund acquired 228,898 shares of the company's stock, valued at approximately $2,358,000. Arrowstreet Capital Limited Partnership owned about 0.18% of Enfusion at the end of the most recent reporting period.

Several other institutional investors have also recently made changes to their positions in the company. KLP Kapitalforvaltning AS purchased a new position in Enfusion during the 4th quarter valued at about $75,000. Quantbot Technologies LP purchased a new stake in Enfusion during the fourth quarter valued at about $144,000. Intech Investment Management LLC bought a new stake in Enfusion in the 4th quarter worth approximately $191,000. Centiva Capital LP boosted its stake in shares of Enfusion by 5.0% in the 3rd quarter. Centiva Capital LP now owns 25,596 shares of the company's stock valued at $243,000 after purchasing an additional 1,227 shares in the last quarter. Finally, Fox Run Management L.L.C. bought a new position in shares of Enfusion during the 4th quarter valued at $265,000. Institutional investors own 81.05% of the company's stock.

Enfusion Trading Up 0.8 %

ENFN traded up $0.09 during trading on Tuesday, reaching $10.90. The stock had a trading volume of 161,004 shares, compared to its average volume of 616,761. The company has a market capitalization of $1.41 billion, a price-to-earnings ratio of 272.44, a P/E/G ratio of 1.85 and a beta of 0.92. The stock's 50 day moving average is $11.10 and its two-hundred day moving average is $10.38. Enfusion, Inc. has a one year low of $7.83 and a one year high of $11.80.

Enfusion (NYSE:ENFN - Get Free Report) last released its earnings results on Monday, March 3rd. The company reported $0.01 EPS for the quarter, missing the consensus estimate of $0.03 by ($0.02). The company had revenue of $52.94 million during the quarter, compared to the consensus estimate of $53.98 million. Enfusion had a return on equity of 6.67% and a net margin of 1.70%. On average, equities research analysts predict that Enfusion, Inc. will post 0.06 earnings per share for the current year.

Analyst Ratings Changes

Several research firms recently issued reports on ENFN. Piper Sandler raised their price target on Enfusion from $10.00 to $11.50 and gave the stock a "neutral" rating in a research report on Monday, December 23rd. William Blair reissued a "market perform" rating on shares of Enfusion in a research report on Monday, January 13th. Finally, Stifel Nicolaus lifted their target price on shares of Enfusion from $11.00 to $13.00 and gave the company a "buy" rating in a research note on Wednesday, December 18th.

View Our Latest Research Report on Enfusion

Insiders Place Their Bets

In related news, CFO Bradley Herring sold 4,645 shares of the firm's stock in a transaction that occurred on Wednesday, March 5th. The shares were sold at an average price of $11.38, for a total value of $52,860.10. Following the transaction, the chief financial officer now owns 324,689 shares of the company's stock, valued at approximately $3,694,960.82. This trade represents a 1.41 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, CEO Oleg Movchan sold 2,790 shares of Enfusion stock in a transaction on Monday, March 3rd. The stock was sold at an average price of $11.48, for a total transaction of $32,029.20. Following the transaction, the chief executive officer now owns 643,299 shares in the company, valued at $7,385,072.52. This represents a 0.43 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 66,223 shares of company stock valued at $754,778. Company insiders own 36.44% of the company's stock.

About Enfusion

(

Free Report)

Enfusion, Inc provides software-as-a-service solutions for investment management industry in the United States, Europe, the Middle East, Africa, and the Asia Pacific. The company provides Portfolio Management System, which generates a real-time investment book of record that consists of valuation and risk tools, which allows users to analyze aggregated or decomposed portfolio data for chief investment officers (CIOs) and portfolio managers; and Order and Execution Management System that enables portfolio managers, traders, compliance teams, and analysts to electronically communicate trade orders for a variety of asset classes, manage trade orders, and systemically enforce trading regulations and internal guidelines.

Further Reading

Before you consider Enfusion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enfusion wasn't on the list.

While Enfusion currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.