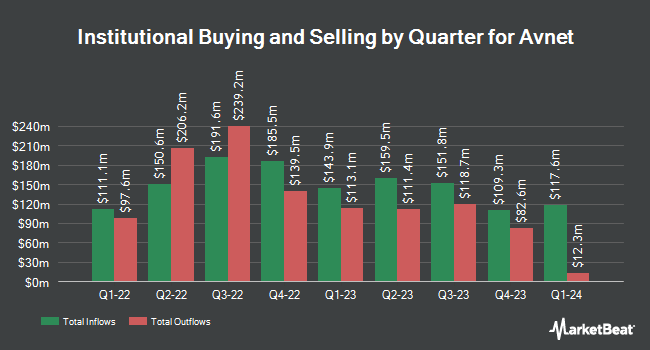

Arrowstreet Capital Limited Partnership lowered its stake in Avnet, Inc. (NASDAQ:AVT - Free Report) by 29.9% in the fourth quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 265,071 shares of the company's stock after selling 112,895 shares during the quarter. Arrowstreet Capital Limited Partnership owned about 0.31% of Avnet worth $13,869,000 as of its most recent filing with the SEC.

A number of other large investors have also modified their holdings of the stock. FMR LLC boosted its position in Avnet by 24.7% in the 3rd quarter. FMR LLC now owns 576,794 shares of the company's stock valued at $31,326,000 after buying an additional 114,217 shares during the last quarter. Captrust Financial Advisors lifted its stake in shares of Avnet by 10.0% in the third quarter. Captrust Financial Advisors now owns 12,717 shares of the company's stock worth $691,000 after acquiring an additional 1,158 shares in the last quarter. Verition Fund Management LLC boosted its holdings in Avnet by 206.2% in the third quarter. Verition Fund Management LLC now owns 18,798 shares of the company's stock valued at $1,021,000 after purchasing an additional 12,659 shares during the last quarter. Hilltop Holdings Inc. grew its stake in Avnet by 14.9% during the 3rd quarter. Hilltop Holdings Inc. now owns 4,688 shares of the company's stock valued at $255,000 after purchasing an additional 607 shares in the last quarter. Finally, Quantinno Capital Management LP increased its holdings in Avnet by 20.2% during the 3rd quarter. Quantinno Capital Management LP now owns 96,218 shares of the company's stock worth $5,226,000 after purchasing an additional 16,154 shares during the last quarter. Institutional investors and hedge funds own 95.78% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts have recently commented on AVT shares. Truist Financial reduced their target price on Avnet from $54.00 to $52.00 and set a "hold" rating for the company in a research note on Thursday, January 30th. Bank of America downgraded shares of Avnet from a "neutral" rating to an "underperform" rating and reduced their price objective for the company from $58.00 to $48.00 in a research note on Thursday, January 30th.

Read Our Latest Report on Avnet

Avnet Stock Up 11.8 %

NASDAQ AVT traded up $4.90 on Wednesday, hitting $46.41. 1,817,196 shares of the stock traded hands, compared to its average volume of 716,527. The company has a current ratio of 2.39, a quick ratio of 1.15 and a debt-to-equity ratio of 0.53. The stock has a 50-day moving average of $48.70 and a 200 day moving average of $52.04. Avnet, Inc. has a twelve month low of $39.22 and a twelve month high of $59.24. The company has a market capitalization of $4.01 billion, a P/E ratio of 13.15, a price-to-earnings-growth ratio of 1.13 and a beta of 1.04.

Avnet (NASDAQ:AVT - Get Free Report) last posted its quarterly earnings results on Wednesday, January 29th. The company reported $0.87 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.88 by ($0.01). Avnet had a net margin of 1.41% and a return on equity of 7.49%. As a group, analysts expect that Avnet, Inc. will post 3.41 earnings per share for the current fiscal year.

Avnet Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Wednesday, March 19th. Investors of record on Wednesday, March 5th were given a dividend of $0.33 per share. This represents a $1.32 dividend on an annualized basis and a dividend yield of 2.84%. The ex-dividend date was Wednesday, March 5th. Avnet's dividend payout ratio is presently 37.39%.

Avnet Profile

(

Free Report)

Avnet, Inc, distributes electronic component technology. The company operates through two segments, Electronic Components and Farnell. The Electronic Components segment markets, sells, and distributes semiconductors; interconnect, passive, and electromechanical components; and other integrated components from electronic component manufacturers.

Featured Stories

Before you consider Avnet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avnet wasn't on the list.

While Avnet currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.