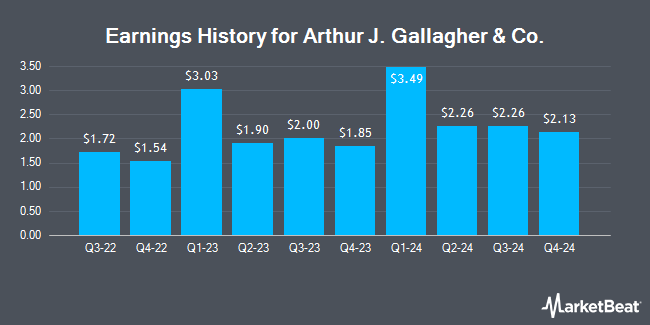

Arthur J. Gallagher & Co. (NYSE:AJG - Get Free Report) is anticipated to post its quarterly earnings results after the market closes on Thursday, January 30th. Analysts expect Arthur J. Gallagher & Co. to post earnings of $2.03 per share and revenue of $2.70 billion for the quarter. Parties interested in registering for the company's conference call can do so using this link.

Arthur J. Gallagher & Co. Stock Performance

NYSE:AJG traded down $2.41 during mid-day trading on Tuesday, hitting $293.59. The stock had a trading volume of 1,781,710 shares, compared to its average volume of 1,963,265. The company has a 50 day simple moving average of $291.79 and a 200-day simple moving average of $288.18. The company has a current ratio of 1.06, a quick ratio of 1.06 and a debt-to-equity ratio of 0.64. The stock has a market capitalization of $73.34 billion, a price-to-earnings ratio of 55.92 and a beta of 0.76. Arthur J. Gallagher & Co. has a 52 week low of $227.43 and a 52 week high of $316.72.

Analysts Set New Price Targets

Several brokerages have weighed in on AJG. Barclays upped their target price on Arthur J. Gallagher & Co. from $300.00 to $308.00 and gave the stock an "equal weight" rating in a research report on Thursday, November 21st. Keefe, Bruyette & Woods raised shares of Arthur J. Gallagher & Co. from an "underperform" rating to a "market perform" rating and reduced their price objective for the company from $292.00 to $286.00 in a research note on Friday, January 10th. Wells Fargo & Company boosted their price target on Arthur J. Gallagher & Co. from $315.00 to $344.00 and gave the stock an "overweight" rating in a research report on Tuesday, December 10th. TD Cowen upgraded Arthur J. Gallagher & Co. from a "hold" rating to a "buy" rating and increased their price target for the company from $295.00 to $377.00 in a report on Friday, January 10th. Finally, The Goldman Sachs Group downgraded shares of Arthur J. Gallagher & Co. from a "buy" rating to a "neutral" rating and set a $313.00 price objective for the company. in a report on Monday, November 25th. Two research analysts have rated the stock with a sell rating, six have assigned a hold rating and six have issued a buy rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus target price of $304.07.

Get Our Latest Analysis on AJG

Arthur J. Gallagher & Co. Company Profile

(

Get Free Report)

Arthur J. Gallagher & Co engages in the provision of insurance brokerage, reinsurance brokerage, consulting, and third-party claims settlement and administration services. It operates through the following business segments: Brokerage, Risk Management, and Corporate. The Brokerage segment consists of retail and wholesale insurance brokerage operations.

Further Reading

Before you consider Arthur J. Gallagher & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arthur J. Gallagher & Co. wasn't on the list.

While Arthur J. Gallagher & Co. currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.