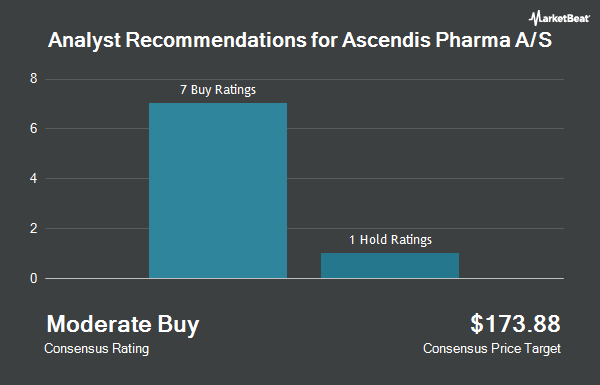

Ascendis Pharma A/S (NASDAQ:ASND - Get Free Report) has earned an average rating of "Moderate Buy" from the thirteen brokerages that are currently covering the company, Marketbeat reports. One analyst has rated the stock with a hold recommendation and twelve have given a buy recommendation to the company. The average 1 year price target among brokerages that have covered the stock in the last year is $191.77.

A number of brokerages have issued reports on ASND. Oppenheimer decreased their price target on Ascendis Pharma A/S from $190.00 to $180.00 and set an "outperform" rating for the company in a report on Friday, November 15th. TD Cowen decreased their target price on shares of Ascendis Pharma A/S from $160.00 to $153.00 and set a "buy" rating for the company in a research note on Friday, November 15th. Cantor Fitzgerald restated an "overweight" rating and set a $170.00 price target on shares of Ascendis Pharma A/S in a research report on Friday, November 15th. Wedbush reaffirmed an "outperform" rating and issued a $181.00 price objective on shares of Ascendis Pharma A/S in a report on Friday, November 15th. Finally, Bank of America increased their target price on shares of Ascendis Pharma A/S from $175.00 to $191.00 and gave the stock a "buy" rating in a research note on Monday, September 23rd.

Check Out Our Latest Research Report on ASND

Institutional Investors Weigh In On Ascendis Pharma A/S

Several institutional investors and hedge funds have recently added to or reduced their stakes in the business. SG Americas Securities LLC boosted its holdings in shares of Ascendis Pharma A/S by 221.0% during the 2nd quarter. SG Americas Securities LLC now owns 6,108 shares of the biotechnology company's stock worth $833,000 after purchasing an additional 4,205 shares during the last quarter. Legato Capital Management LLC boosted its stake in Ascendis Pharma A/S by 167.6% during the second quarter. Legato Capital Management LLC now owns 4,324 shares of the biotechnology company's stock worth $590,000 after buying an additional 2,708 shares during the last quarter. Searle & CO. purchased a new stake in Ascendis Pharma A/S in the 2nd quarter valued at $205,000. Rhumbline Advisers grew its holdings in Ascendis Pharma A/S by 10.3% in the 2nd quarter. Rhumbline Advisers now owns 1,533 shares of the biotechnology company's stock valued at $209,000 after buying an additional 143 shares in the last quarter. Finally, Candriam S.C.A. increased its stake in shares of Ascendis Pharma A/S by 96.6% in the 2nd quarter. Candriam S.C.A. now owns 195,347 shares of the biotechnology company's stock worth $26,640,000 after acquiring an additional 95,972 shares during the last quarter.

Ascendis Pharma A/S Stock Down 0.6 %

Shares of ASND stock traded down $0.77 on Friday, hitting $129.87. The company had a trading volume of 239,540 shares, compared to its average volume of 448,612. Ascendis Pharma A/S has a twelve month low of $111.09 and a twelve month high of $161.00. The firm has a market cap of $7.88 billion, a P/E ratio of -16.07 and a beta of 0.67. The company has a 50-day moving average price of $129.15 and a 200-day moving average price of $132.72.

About Ascendis Pharma A/S

(

Get Free ReportAscendis Pharma A/S, a biopharmaceutical company, focuses on developing therapies for unmet medical needs. It offers SKYTROFA for treating patients with growth hormone deficiency (GHD). The company is also developing a pipeline of three independent endocrinology rare disease product candidates in clinical development, as well as focuses on advancing oncology therapeutic candidates.

Featured Articles

Before you consider Ascendis Pharma A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ascendis Pharma A/S wasn't on the list.

While Ascendis Pharma A/S currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.