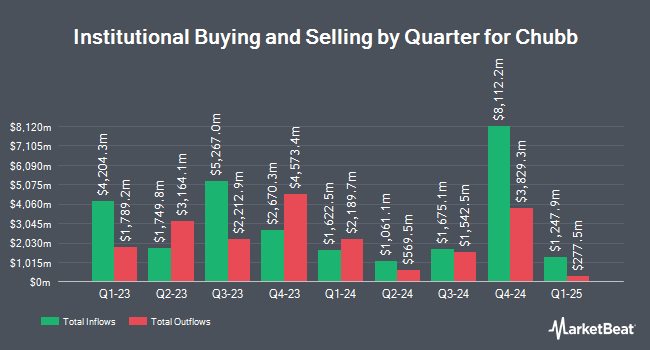

Ascent Group LLC cut its holdings in Chubb Limited (NYSE:CB - Free Report) by 57.5% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 2,955 shares of the financial services provider's stock after selling 3,991 shares during the quarter. Ascent Group LLC's holdings in Chubb were worth $852,000 at the end of the most recent quarter.

A number of other hedge funds have also added to or reduced their stakes in the stock. Ironwood Investment Counsel LLC increased its stake in Chubb by 2.1% in the 3rd quarter. Ironwood Investment Counsel LLC now owns 1,721 shares of the financial services provider's stock worth $496,000 after buying an additional 35 shares in the last quarter. Parkside Financial Bank & Trust lifted its holdings in shares of Chubb by 0.5% in the 2nd quarter. Parkside Financial Bank & Trust now owns 7,516 shares of the financial services provider's stock valued at $1,917,000 after acquiring an additional 40 shares during the last quarter. Steigerwald Gordon & Koch Inc. lifted its holdings in shares of Chubb by 1.9% in the 2nd quarter. Steigerwald Gordon & Koch Inc. now owns 2,127 shares of the financial services provider's stock valued at $543,000 after acquiring an additional 40 shares during the last quarter. LVW Advisors LLC lifted its stake in Chubb by 0.3% in the third quarter. LVW Advisors LLC now owns 11,754 shares of the financial services provider's stock worth $3,390,000 after purchasing an additional 40 shares during the last quarter. Finally, Wealth Effects LLC lifted its stake in Chubb by 3.0% in the third quarter. Wealth Effects LLC now owns 1,370 shares of the financial services provider's stock worth $395,000 after purchasing an additional 40 shares during the last quarter. 83.81% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

CB has been the topic of a number of research reports. Barclays initiated coverage on shares of Chubb in a research report on Wednesday, September 4th. They set an "overweight" rating and a $349.00 target price on the stock. Jefferies Financial Group lifted their price objective on shares of Chubb from $294.00 to $295.00 and gave the company a "hold" rating in a report on Wednesday, October 9th. Keefe, Bruyette & Woods lifted their price objective on shares of Chubb from $305.00 to $320.00 and gave the company an "outperform" rating in a report on Friday, November 1st. Evercore ISI lifted their price objective on shares of Chubb from $289.00 to $293.00 and gave the company an "outperform" rating in a report on Wednesday, October 30th. Finally, Bank of America lifted their price objective on shares of Chubb from $275.00 to $282.00 and gave the company an "underperform" rating in a report on Thursday, October 10th. Two analysts have rated the stock with a sell rating, eleven have assigned a hold rating, seven have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat, Chubb currently has an average rating of "Hold" and a consensus price target of $287.37.

View Our Latest Stock Analysis on CB

Chubb Trading Down 0.6 %

Shares of CB traded down $1.65 during mid-day trading on Wednesday, hitting $284.60. The company had a trading volume of 1,273,457 shares, compared to its average volume of 1,596,716. The business's 50-day simple moving average is $287.07 and its 200-day simple moving average is $276.13. The company has a quick ratio of 0.28, a current ratio of 0.28 and a debt-to-equity ratio of 0.21. Chubb Limited has a 1-year low of $216.90 and a 1-year high of $302.05. The stock has a market cap of $114.72 billion, a PE ratio of 11.65, a P/E/G ratio of 6.75 and a beta of 0.67.

Chubb (NYSE:CB - Get Free Report) last announced its earnings results on Tuesday, October 29th. The financial services provider reported $5.72 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $4.98 by $0.74. Chubb had a return on equity of 15.46% and a net margin of 18.32%. The company had revenue of $13.83 billion for the quarter, compared to analyst estimates of $14.16 billion. During the same period in the prior year, the company posted $4.95 EPS. Chubb's quarterly revenue was up 5.5% on a year-over-year basis. Sell-side analysts forecast that Chubb Limited will post 21.82 earnings per share for the current year.

Chubb Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, January 3rd. Investors of record on Friday, December 13th will be paid a dividend of $0.91 per share. This represents a $3.64 dividend on an annualized basis and a dividend yield of 1.28%. The ex-dividend date is Friday, December 13th. Chubb's dividend payout ratio is currently 14.91%.

Insider Activity at Chubb

In other Chubb news, CEO Evan G. Greenberg sold 30,537 shares of Chubb stock in a transaction that occurred on Friday, September 6th. The stock was sold at an average price of $287.25, for a total value of $8,771,753.25. Following the transaction, the chief executive officer now directly owns 583,982 shares of the company's stock, valued at $167,748,829.50. The trade was a 4.97 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, EVP Joseph F. Wayland sold 6,599 shares of the business's stock in a transaction that occurred on Thursday, September 5th. The shares were sold at an average price of $287.06, for a total value of $1,894,308.94. Following the sale, the executive vice president now owns 84,101 shares in the company, valued at approximately $24,142,033.06. This represents a 7.28 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 67,454 shares of company stock worth $19,446,155 over the last ninety days. 0.86% of the stock is currently owned by corporate insiders.

About Chubb

(

Free Report)

Chubb Limited provides insurance and reinsurance products worldwide. The company's North America Commercial P&C Insurance segment offers commercial property, casualty, workers' compensation, package policies, risk management, financial lines, marine, construction, environmental, medical risk, cyber risk, surety, and casualty; and group accident and health insurance to large, middle market, and small commercial businesses.

Featured Articles

Before you consider Chubb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chubb wasn't on the list.

While Chubb currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.