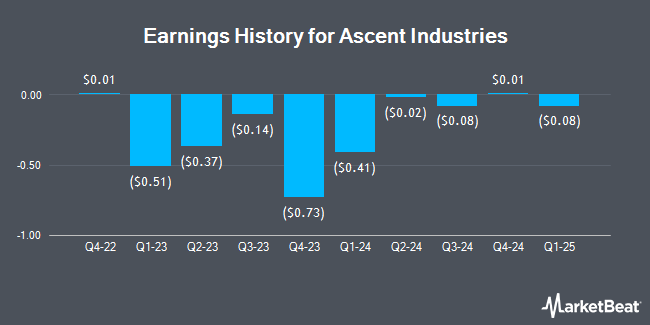

Ascent Industries (NASDAQ:ACNT - Get Free Report) posted its quarterly earnings data on Tuesday. The company reported $0.01 earnings per share for the quarter, Zacks reports. Ascent Industries had a negative return on equity of 12.48% and a negative net margin of 0.80%. The business had revenue of $40.67 million during the quarter.

Ascent Industries Trading Up 3.2 %

Shares of NASDAQ:ACNT traded up $0.37 during trading on Thursday, reaching $11.95. The stock had a trading volume of 22,511 shares, compared to its average volume of 26,234. The company has a debt-to-equity ratio of 0.01, a quick ratio of 1.81 and a current ratio of 3.77. The firm's fifty day moving average is $11.21 and its 200 day moving average is $10.47. Ascent Industries has a 52 week low of $8.16 and a 52 week high of $12.51. The stock has a market cap of $120.56 million, a price-to-earnings ratio of -70.24 and a beta of 0.83.

Insider Transactions at Ascent Industries

In other Ascent Industries news, VP Ravi Ramesh Srinivas purchased 4,000 shares of the business's stock in a transaction on Friday, December 20th. The shares were purchased at an average cost of $11.21 per share, for a total transaction of $44,840.00. Following the acquisition, the vice president now owns 4,000 shares of the company's stock, valued at approximately $44,840. This represents a ∞ increase in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Corporate insiders own 12.85% of the company's stock.

About Ascent Industries

(

Get Free Report)

Ascent Industries Co an industrials company, produces and distributes stainless steel pipe and tube and specialty chemicals in the United States and internationally. The company operates through two segments, Tubular Products and Specialty Chemicals. It manufactures welded pipes and tubes, primarily from stainless steel, duplex, and nickel alloys; and ornamental stainless steel tubes for automotive, commercial transportation, marine, food services, construction, furniture, healthcare, and other industries.

Recommended Stories

Before you consider Ascent Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ascent Industries wasn't on the list.

While Ascent Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.