ASE Technology (NYSE:ASX - Get Free Report) is anticipated to release its Q1 2025 earnings data before the market opens on Thursday, April 24th. Analysts expect the company to announce earnings of $0.12 per share and revenue of $143.62 billion for the quarter.

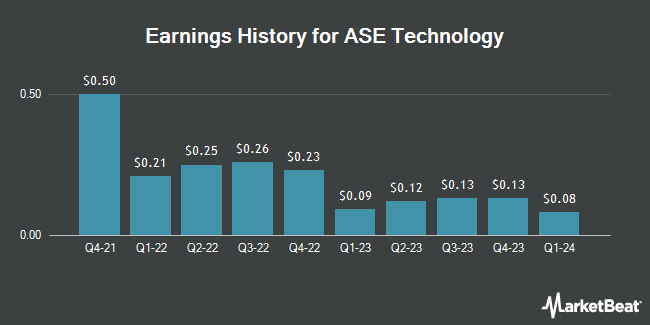

ASE Technology (NYSE:ASX - Get Free Report) last released its earnings results on Thursday, February 13th. The semiconductor company reported $0.13 earnings per share for the quarter, missing analysts' consensus estimates of $0.16 by ($0.03). ASE Technology had a return on equity of 9.86% and a net margin of 5.44%.

ASE Technology Price Performance

Shares of NYSE:ASX traded up $0.14 on Tuesday, hitting $8.15. The stock had a trading volume of 15,536,088 shares, compared to its average volume of 8,574,005. The company has a market capitalization of $17.99 billion, a price-to-earnings ratio of 18.11, a price-to-earnings-growth ratio of 0.47 and a beta of 1.21. ASE Technology has a twelve month low of $6.94 and a twelve month high of $12.86. The firm's 50 day moving average price is $9.35 and its 200-day moving average price is $9.85. The company has a debt-to-equity ratio of 0.40, a quick ratio of 0.93 and a current ratio of 1.19.

About ASE Technology

(

Get Free Report)

ASE Technology Holding Co, Ltd., together with its subsidiaries, provides semiconductors packaging and testing, and electronic manufacturing services in the United States, Taiwan, Asia, Europe, and internationally. It develops, constructs, sells, leases, and manages real estate properties; produces substrates; offers information software, equipment leasing, investment advisory, and warehousing management services; commercial complex, after-sales, and support services; manages parking lot services; processes and sells computer and communication peripherals, electronic components, telecommunications equipment, and motherboards; and imports and exports goods and technology.

Featured Stories

Before you consider ASE Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ASE Technology wasn't on the list.

While ASE Technology currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.