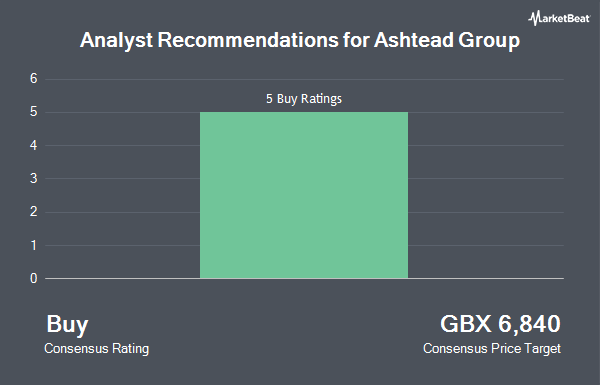

Ashtead Group (LON:AHT - Get Free Report)'s stock had its "buy" rating reissued by stock analysts at Jefferies Financial Group in a report released on Monday, Marketbeat.com reports. They presently have a GBX 6,800 ($86.27) price objective on the stock. Jefferies Financial Group's price objective indicates a potential upside of 32.45% from the company's current price.

AHT has been the subject of several other research reports. Berenberg Bank reiterated a "buy" rating and set a GBX 7,000 ($88.81) price objective on shares of Ashtead Group in a research note on Monday, October 14th. Deutsche Bank Aktiengesellschaft reaffirmed a "buy" rating and set a GBX 6,500 ($82.47) price target on shares of Ashtead Group in a research report on Wednesday, September 4th. Finally, JPMorgan Chase & Co. raised their price objective on Ashtead Group from GBX 6,600 ($83.74) to GBX 7,300 ($92.62) and gave the stock an "overweight" rating in a research report on Friday, December 6th. One research analyst has rated the stock with a hold rating and five have given a buy rating to the company. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of GBX 6,550 ($83.10).

Get Our Latest Stock Analysis on Ashtead Group

Ashtead Group Stock Down 1.2 %

AHT stock traded down GBX 62 ($0.79) during trading on Monday, reaching GBX 5,134 ($65.14). 1,247,562 shares of the company traded hands, compared to its average volume of 1,068,487. The company has a market capitalization of £22.42 billion, a price-to-earnings ratio of 1,937.36, a price-to-earnings-growth ratio of 1.32 and a beta of 1.22. The company has a debt-to-equity ratio of 145.75, a quick ratio of 1.13 and a current ratio of 1.17. The business has a 50 day simple moving average of GBX 5,985.87 and a 200 day simple moving average of GBX 5,599.50. Ashtead Group has a 12 month low of GBX 4,711 ($59.77) and a 12 month high of GBX 6,448 ($81.81).

Insider Buying and Selling

In other Ashtead Group news, insider Brendan Horgan bought 4,000 shares of Ashtead Group stock in a transaction that occurred on Wednesday, December 11th. The stock was purchased at an average price of GBX 5,320 ($67.50) per share, with a total value of £212,800 ($269,982.24). Also, insider Lucinda Riches sold 1,000 shares of the business's stock in a transaction on Thursday, October 17th. The shares were sold at an average price of GBX 5,880 ($74.60), for a total transaction of £58,800 ($74,600.36). 0.64% of the stock is currently owned by company insiders.

Ashtead Group Company Profile

(

Get Free Report)

Ashtead Group plc, together with its subsidiaries, engages in the construction, industrial, and general equipment rental business in the United States, the United Kingdom, and Canada. It provides pumps, power generation, heating, cooling, scaffolding, traffic management, temporary flooring, trench shoring, and lifting services.

Read More

Before you consider Ashtead Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ashtead Group wasn't on the list.

While Ashtead Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.