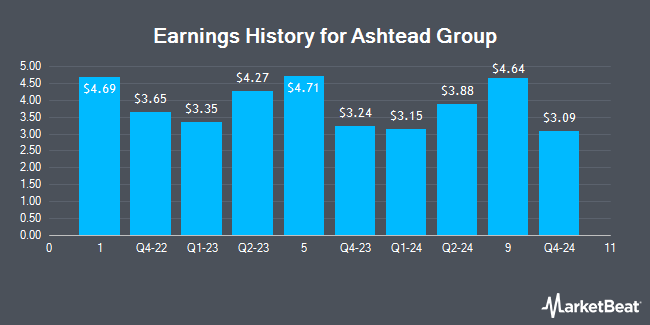

Ashtead Group (OTCMKTS:ASHTY - Get Free Report) released its quarterly earnings results on Tuesday. The company reported $3.09 earnings per share (EPS) for the quarter, missing the consensus estimate of $3.47 by ($0.38), Zacks reports. Ashtead Group had a return on equity of 22.65% and a net margin of 14.78%. The firm had revenue of $2.38 billion for the quarter, compared to analyst estimates of $2.16 billion.

Ashtead Group Trading Up 2.6 %

Shares of OTCMKTS ASHTY traded up $5.94 during midday trading on Friday, reaching $238.19. 15,799 shares of the stock were exchanged, compared to its average volume of 27,302. The company has a current ratio of 1.31, a quick ratio of 1.22 and a debt-to-equity ratio of 1.09. The company has a market capitalization of $25.93 billion, a P/E ratio of 16.88, a P/E/G ratio of 1.49 and a beta of 1.69. The stock has a 50 day moving average price of $255.31 and a 200-day moving average price of $283.51. Ashtead Group has a 52-week low of $223.72 and a 52-week high of $337.95.

Ashtead Group Cuts Dividend

The company also recently declared a dividend, which was paid on Monday, February 24th. Shareholders of record on Friday, January 10th were paid a dividend of $1.44 per share. The ex-dividend date of this dividend was Friday, January 10th. Ashtead Group's dividend payout ratio is currently 19.70%.

Analyst Upgrades and Downgrades

A number of equities analysts have issued reports on ASHTY shares. The Goldman Sachs Group cut shares of Ashtead Group from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, December 10th. Royal Bank of Canada raised Ashtead Group from a "hold" rating to a "moderate buy" rating in a research note on Tuesday, December 3rd.

Get Our Latest Stock Report on Ashtead Group

About Ashtead Group

(

Get Free Report)

Ashtead Group plc, together with its subsidiaries, engages in the construction, industrial, and general equipment rental business in the United States, the United Kingdom, and Canada. It provides pumps, power generation, heating, cooling, scaffolding, traffic management, temporary flooring, trench shoring, and lifting services.

Read More

Before you consider Ashtead Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ashtead Group wasn't on the list.

While Ashtead Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.