Assenagon Asset Management S.A. lessened its stake in Old Dominion Freight Line, Inc. (NASDAQ:ODFL - Free Report) by 44.4% during the 4th quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 11,167 shares of the transportation company's stock after selling 8,911 shares during the period. Assenagon Asset Management S.A.'s holdings in Old Dominion Freight Line were worth $1,970,000 as of its most recent SEC filing.

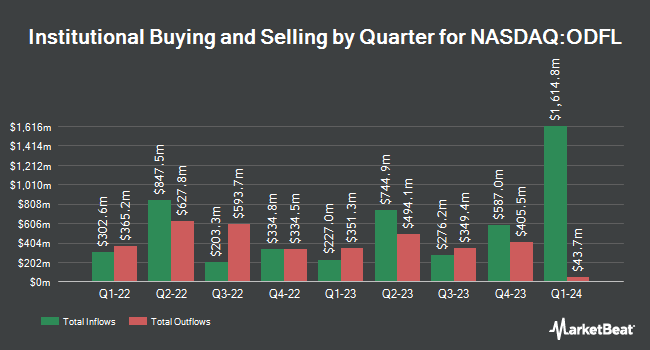

A number of other institutional investors have also modified their holdings of ODFL. RPg Family Wealth Advisory LLC acquired a new stake in shares of Old Dominion Freight Line in the 3rd quarter worth $45,000. Brown Brothers Harriman & Co. raised its holdings in Old Dominion Freight Line by 398.1% during the third quarter. Brown Brothers Harriman & Co. now owns 269 shares of the transportation company's stock worth $53,000 after purchasing an additional 215 shares in the last quarter. Quarry LP acquired a new stake in Old Dominion Freight Line in the second quarter valued at about $60,000. Versant Capital Management Inc boosted its holdings in Old Dominion Freight Line by 45.5% in the 4th quarter. Versant Capital Management Inc now owns 352 shares of the transportation company's stock valued at $62,000 after purchasing an additional 110 shares in the last quarter. Finally, Ashton Thomas Securities LLC acquired a new position in Old Dominion Freight Line during the 3rd quarter worth approximately $64,000. Institutional investors and hedge funds own 77.82% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts have commented on the company. Evercore ISI reduced their target price on Old Dominion Freight Line from $199.00 to $188.00 and set an "in-line" rating for the company in a report on Thursday, October 3rd. Stifel Nicolaus raised their price objective on shares of Old Dominion Freight Line from $176.00 to $193.00 and gave the company a "hold" rating in a research note on Thursday. Robert W. Baird lowered their target price on shares of Old Dominion Freight Line from $204.00 to $200.00 and set an "outperform" rating on the stock in a research report on Thursday, October 24th. BMO Capital Markets dropped their target price on shares of Old Dominion Freight Line from $210.00 to $205.00 and set a "market perform" rating for the company in a report on Thursday, October 24th. Finally, JPMorgan Chase & Co. boosted their price target on Old Dominion Freight Line from $186.00 to $205.00 and gave the stock a "neutral" rating in a research note on Friday, December 6th. One analyst has rated the stock with a sell rating, sixteen have assigned a hold rating, three have given a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, Old Dominion Freight Line currently has a consensus rating of "Hold" and a consensus target price of $202.44.

Get Our Latest Report on Old Dominion Freight Line

Insiders Place Their Bets

In other news, Director Greg C. Gantt sold 7,000 shares of the stock in a transaction that occurred on Monday, October 28th. The stock was sold at an average price of $200.07, for a total value of $1,400,490.00. Following the completion of the transaction, the director now directly owns 97,890 shares of the company's stock, valued at approximately $19,584,852.30. This represents a 6.67 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director Leo H. Suggs sold 3,000 shares of the stock in a transaction on Friday, November 8th. The stock was sold at an average price of $225.44, for a total value of $676,320.00. Following the transaction, the director now owns 7,383 shares of the company's stock, valued at $1,664,423.52. This represents a 28.89 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 9.90% of the company's stock.

Old Dominion Freight Line Stock Up 1.5 %

ODFL traded up $2.75 on Thursday, reaching $191.54. 1,178,043 shares of the company traded hands, compared to its average volume of 1,282,346. The company has a market cap of $40.89 billion, a price-to-earnings ratio of 33.49, a PEG ratio of 5.07 and a beta of 1.05. The company has a debt-to-equity ratio of 0.01, a current ratio of 1.33 and a quick ratio of 1.33. The stock's 50 day moving average price is $197.39 and its 200-day moving average price is $197.86. Old Dominion Freight Line, Inc. has a 52-week low of $165.49 and a 52-week high of $233.26.

Old Dominion Freight Line (NASDAQ:ODFL - Get Free Report) last posted its quarterly earnings results on Wednesday, October 23rd. The transportation company reported $1.43 earnings per share for the quarter, topping analysts' consensus estimates of $1.42 by $0.01. The company had revenue of $1.47 billion during the quarter, compared to the consensus estimate of $1.49 billion. Old Dominion Freight Line had a return on equity of 29.40% and a net margin of 21.03%. The business's quarterly revenue was down 3.0% on a year-over-year basis. During the same period last year, the business earned $1.54 EPS. On average, sell-side analysts expect that Old Dominion Freight Line, Inc. will post 5.42 EPS for the current fiscal year.

Old Dominion Freight Line Profile

(

Free Report)

Old Dominion Freight Line, Inc operates as a less-than-truckload motor carrier in the United States and North America. The company offers regional, inter-regional, and national less-than-truckload services, as well as expedited transportation. It also provides various value-added services, including container drayage, truckload brokerage, and supply chain consulting.

Featured Articles

Before you consider Old Dominion Freight Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Old Dominion Freight Line wasn't on the list.

While Old Dominion Freight Line currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.