Assenagon Asset Management S.A. cut its position in shares of IQVIA Holdings Inc. (NYSE:IQV - Free Report) by 18.7% in the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 255,602 shares of the medical research company's stock after selling 58,663 shares during the quarter. Assenagon Asset Management S.A. owned 0.14% of IQVIA worth $50,228,000 at the end of the most recent quarter.

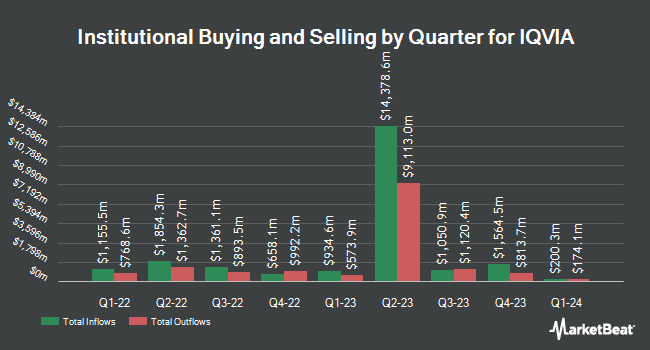

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Private Trust Co. NA raised its holdings in shares of IQVIA by 10.7% during the 3rd quarter. Private Trust Co. NA now owns 485 shares of the medical research company's stock valued at $115,000 after purchasing an additional 47 shares in the last quarter. Clear Harbor Asset Management LLC grew its position in IQVIA by 1.3% during the third quarter. Clear Harbor Asset Management LLC now owns 3,969 shares of the medical research company's stock worth $941,000 after buying an additional 50 shares in the last quarter. Pine Valley Investments Ltd Liability Co lifted its position in IQVIA by 0.5% in the third quarter. Pine Valley Investments Ltd Liability Co now owns 9,481 shares of the medical research company's stock worth $2,247,000 after purchasing an additional 50 shares during the period. Fortitude Family Office LLC lifted its holdings in shares of IQVIA by 2.9% during the 3rd quarter. Fortitude Family Office LLC now owns 1,977 shares of the medical research company's stock worth $468,000 after acquiring an additional 56 shares during the period. Finally, Huntington National Bank boosted its holdings in IQVIA by 7.4% during the third quarter. Huntington National Bank now owns 809 shares of the medical research company's stock valued at $192,000 after purchasing an additional 56 shares in the last quarter. Institutional investors and hedge funds own 89.62% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts have weighed in on IQV shares. BTIG Research decreased their price objective on shares of IQVIA from $290.00 to $260.00 and set a "buy" rating on the stock in a research note on Friday, November 1st. The Goldman Sachs Group cut their price target on shares of IQVIA from $280.00 to $250.00 and set a "buy" rating on the stock in a research report on Friday, November 1st. Evercore ISI dropped their price target on IQVIA from $270.00 to $265.00 and set an "outperform" rating on the stock in a research report on Tuesday, October 8th. Deutsche Bank Aktiengesellschaft cut their price objective on shares of IQVIA from $270.00 to $265.00 and set a "buy" rating on the stock in a research report on Friday, November 1st. Finally, William Blair reaffirmed an "outperform" rating on shares of IQVIA in a research report on Wednesday, December 11th. Four analysts have rated the stock with a hold rating, seventeen have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, IQVIA presently has an average rating of "Moderate Buy" and a consensus target price of $255.82.

View Our Latest Stock Analysis on IQV

IQVIA Price Performance

Shares of NYSE:IQV traded up $1.61 during mid-day trading on Thursday, reaching $197.71. The stock had a trading volume of 1,208,107 shares, compared to its average volume of 1,297,661. The company has a market cap of $35.89 billion, a P/E ratio of 25.95, a price-to-earnings-growth ratio of 2.09 and a beta of 1.48. IQVIA Holdings Inc. has a 1 year low of $187.62 and a 1 year high of $261.73. The business's 50 day moving average price is $200.93 and its 200 day moving average price is $221.44. The company has a current ratio of 0.81, a quick ratio of 0.81 and a debt-to-equity ratio of 1.76.

IQVIA Profile

(

Free Report)

IQVIA Holdings Inc engages in the provision of advanced analytics, technology solutions, and clinical research services to the life sciences industry in the Americas, Europe, Africa, and the Asia-Pacific. It operates through three segments: Technology & Analytics Solutions, Research & Development Solutions, and Contract Sales & Medical Solutions.

Recommended Stories

Before you consider IQVIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IQVIA wasn't on the list.

While IQVIA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.