Asset Management One Co. Ltd. increased its holdings in Dominion Energy, Inc. (NYSE:D - Free Report) by 3.8% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 315,645 shares of the utilities provider's stock after acquiring an additional 11,517 shares during the quarter. Asset Management One Co. Ltd.'s holdings in Dominion Energy were worth $18,241,000 as of its most recent filing with the Securities & Exchange Commission.

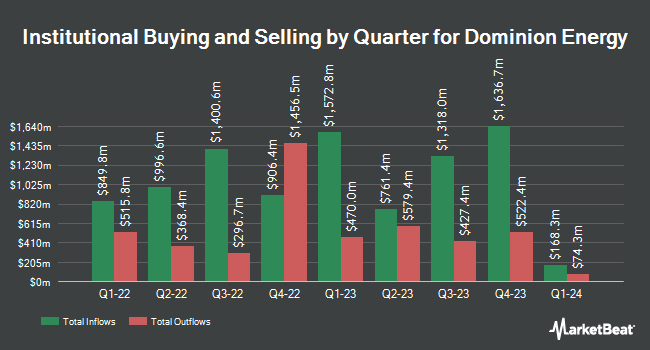

A number of other large investors have also recently modified their holdings of D. Family Firm Inc. purchased a new position in Dominion Energy in the 2nd quarter worth about $27,000. LRI Investments LLC purchased a new position in Dominion Energy in the first quarter worth about $30,000. Triad Wealth Partners LLC bought a new stake in Dominion Energy during the second quarter valued at approximately $33,000. Opal Wealth Advisors LLC purchased a new stake in Dominion Energy during the second quarter valued at approximately $35,000. Finally, Kimelman & Baird LLC purchased a new position in shares of Dominion Energy during the 2nd quarter worth $36,000. Institutional investors own 73.04% of the company's stock.

Dominion Energy Price Performance

Shares of D stock traded down $1.41 during trading hours on Wednesday, hitting $57.18. 4,139,270 shares of the company's stock were exchanged, compared to its average volume of 4,400,902. The firm has a 50 day moving average of $57.94 and a two-hundred day moving average of $54.27. Dominion Energy, Inc. has a fifty-two week low of $43.53 and a fifty-two week high of $61.97. The firm has a market cap of $48.03 billion, a P/E ratio of 20.56, a P/E/G ratio of 1.53 and a beta of 0.59. The company has a quick ratio of 0.78, a current ratio of 0.74 and a debt-to-equity ratio of 1.42.

Dominion Energy (NYSE:D - Get Free Report) last released its earnings results on Friday, November 1st. The utilities provider reported $0.98 earnings per share for the quarter, topping analysts' consensus estimates of $0.93 by $0.05. The business had revenue of $3.94 billion for the quarter, compared to analyst estimates of $4.18 billion. Dominion Energy had a net margin of 16.95% and a return on equity of 8.35%. The business's revenue was up 3.4% on a year-over-year basis. During the same period last year, the company posted $0.77 EPS. Sell-side analysts forecast that Dominion Energy, Inc. will post 2.76 EPS for the current year.

Dominion Energy Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, December 20th. Stockholders of record on Friday, November 29th will be given a dividend of $0.6675 per share. The ex-dividend date of this dividend is Friday, November 29th. This represents a $2.67 annualized dividend and a dividend yield of 4.67%. Dominion Energy's dividend payout ratio is currently 93.68%.

Analysts Set New Price Targets

Several brokerages have recently commented on D. Scotiabank boosted their price objective on Dominion Energy from $48.00 to $58.00 and gave the company a "sector perform" rating in a research report on Tuesday, August 20th. JPMorgan Chase & Co. increased their price target on shares of Dominion Energy from $54.00 to $57.00 and gave the company a "neutral" rating in a report on Monday, August 12th. BMO Capital Markets raised their price objective on Dominion Energy from $53.00 to $57.00 and gave the company a "market perform" rating in a research note on Monday, August 5th. Jefferies Financial Group began coverage on Dominion Energy in a research report on Friday, September 20th. They set a "hold" rating and a $58.00 target price on the stock. Finally, Barclays lifted their price objective on shares of Dominion Energy from $54.00 to $58.00 and gave the stock an "overweight" rating in a research note on Tuesday, October 15th. Nine equities research analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. According to MarketBeat, Dominion Energy has an average rating of "Hold" and an average price target of $55.40.

Read Our Latest Report on D

Dominion Energy Company Profile

(

Free Report)

Dominion Energy, Inc produces and distributes energy in the United States. It operates through three operating segments: Dominion Energy Virginia, Dominion Energy South Carolina, and Contracted Energy. The Dominion Energy Virginia segment generates, transmits, and distributes regulated electricity to approximately 2.8 million residential, commercial, industrial, and governmental customers in Virginia and North Carolina.

Featured Stories

Before you consider Dominion Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dominion Energy wasn't on the list.

While Dominion Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.