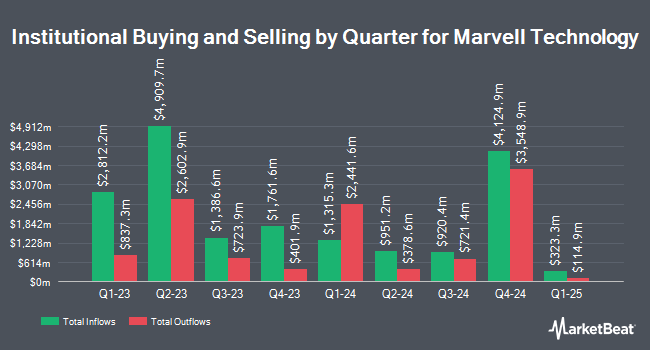

Assetmark Inc. grew its position in Marvell Technology, Inc. (NASDAQ:MRVL - Free Report) by 16.9% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 39,197 shares of the semiconductor company's stock after purchasing an additional 5,657 shares during the period. Assetmark Inc.'s holdings in Marvell Technology were worth $2,827,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds also recently modified their holdings of the company. Strategic Investment Solutions Inc. IL acquired a new stake in Marvell Technology in the 2nd quarter valued at $32,000. Quarry LP bought a new position in shares of Marvell Technology in the 2nd quarter valued at about $32,000. Mark Sheptoff Financial Planning LLC acquired a new stake in shares of Marvell Technology in the first quarter valued at about $35,000. Whittier Trust Co. increased its position in shares of Marvell Technology by 74.5% in the third quarter. Whittier Trust Co. now owns 492 shares of the semiconductor company's stock valued at $35,000 after acquiring an additional 210 shares during the last quarter. Finally, Exchange Traded Concepts LLC raised its holdings in Marvell Technology by 125.4% during the third quarter. Exchange Traded Concepts LLC now owns 604 shares of the semiconductor company's stock worth $44,000 after acquiring an additional 336 shares in the last quarter. 83.51% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of research analysts have weighed in on MRVL shares. StockNews.com downgraded Marvell Technology from a "hold" rating to a "sell" rating in a research note on Friday, October 18th. Benchmark raised their target price on shares of Marvell Technology from $105.00 to $115.00 and gave the company a "buy" rating in a research note on Friday, August 30th. Stifel Nicolaus reissued a "buy" rating and set a $95.00 price target (up previously from $90.00) on shares of Marvell Technology in a research report on Friday, August 30th. Loop Capital initiated coverage on Marvell Technology in a research note on Monday. They issued a "hold" rating and a $95.00 price objective on the stock. Finally, Cantor Fitzgerald reiterated an "overweight" rating and set a $85.00 target price on shares of Marvell Technology in a research note on Friday, August 30th. One analyst has rated the stock with a sell rating, two have assigned a hold rating, twenty have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $91.77.

Get Our Latest Stock Analysis on MRVL

Marvell Technology Price Performance

Shares of NASDAQ MRVL traded up $0.63 during mid-day trading on Thursday, reaching $90.70. The company had a trading volume of 7,435,089 shares, compared to its average volume of 12,148,318. The firm has a market cap of $80.38 billion, a price-to-earnings ratio of -81.14, a PEG ratio of 4.03 and a beta of 1.44. The business's 50-day simple moving average is $78.04 and its 200 day simple moving average is $72.43. Marvell Technology, Inc. has a one year low of $50.35 and a one year high of $95.09. The company has a debt-to-equity ratio of 0.28, a quick ratio of 1.26 and a current ratio of 1.79.

Marvell Technology (NASDAQ:MRVL - Get Free Report) last issued its earnings results on Thursday, August 29th. The semiconductor company reported $0.30 EPS for the quarter, meeting the consensus estimate of $0.30. The company had revenue of $1.27 billion during the quarter, compared to analysts' expectations of $1.25 billion. Marvell Technology had a negative net margin of 18.30% and a positive return on equity of 4.31%. The business's revenue for the quarter was down 5.1% compared to the same quarter last year. During the same period in the previous year, the company earned $0.18 EPS. On average, research analysts predict that Marvell Technology, Inc. will post 0.78 earnings per share for the current fiscal year.

Marvell Technology Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, October 31st. Shareholders of record on Friday, October 11th were issued a $0.06 dividend. This represents a $0.24 dividend on an annualized basis and a dividend yield of 0.26%. The ex-dividend date was Friday, October 11th. Marvell Technology's dividend payout ratio is presently -21.62%.

Insider Activity

In related news, Director Ford Tamer sold 92,000 shares of the company's stock in a transaction on Thursday, September 12th. The stock was sold at an average price of $74.16, for a total transaction of $6,822,720.00. Following the completion of the sale, the director now directly owns 351,193 shares in the company, valued at $26,044,472.88. This represents a 20.76 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. In other news, Director Ford Tamer sold 92,000 shares of the stock in a transaction on Thursday, September 12th. The stock was sold at an average price of $74.16, for a total value of $6,822,720.00. Following the completion of the transaction, the director now directly owns 351,193 shares in the company, valued at approximately $26,044,472.88. This represents a 20.76 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, EVP Chris Koopmans sold 6,000 shares of the business's stock in a transaction on Monday, October 21st. The stock was sold at an average price of $80.77, for a total value of $484,620.00. Following the sale, the executive vice president now owns 109,244 shares in the company, valued at $8,823,637.88. This represents a 5.21 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 259,500 shares of company stock worth $20,230,710. Insiders own 0.33% of the company's stock.

Marvell Technology Company Profile

(

Free Report)

Marvell Technology, Inc, together with its subsidiaries, provides data infrastructure semiconductor solutions, spanning the data center core to network edge. The company develops and scales complex System-on-a-Chip architectures, integrating analog, mixed-signal, and digital signal processing functionality.

Recommended Stories

Before you consider Marvell Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marvell Technology wasn't on the list.

While Marvell Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.