Assetmark Inc. grew its holdings in Diageo plc (NYSE:DEO - Free Report) by 160.7% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 14,235 shares of the company's stock after purchasing an additional 8,775 shares during the quarter. Assetmark Inc.'s holdings in Diageo were worth $1,998,000 at the end of the most recent quarter.

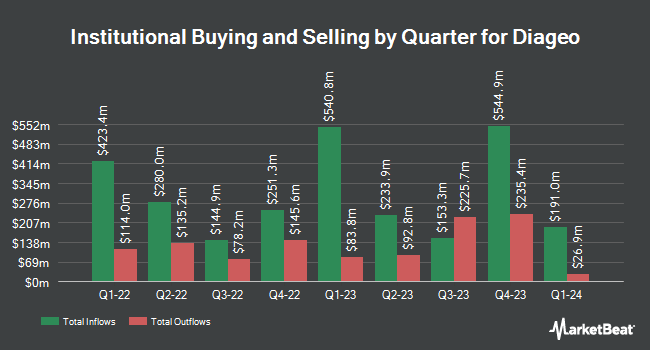

Several other large investors have also modified their holdings of the business. Confluence Investment Management LLC lifted its stake in shares of Diageo by 30.5% during the third quarter. Confluence Investment Management LLC now owns 1,215,786 shares of the company's stock valued at $170,623,000 after buying an additional 284,046 shares during the period. QRG Capital Management Inc. lifted its stake in shares of Diageo by 16.4% during the first quarter. QRG Capital Management Inc. now owns 7,185 shares of the company's stock valued at $1,069,000 after buying an additional 1,011 shares during the period. Cetera Investment Advisers lifted its stake in shares of Diageo by 461.4% during the first quarter. Cetera Investment Advisers now owns 70,630 shares of the company's stock valued at $10,506,000 after buying an additional 58,048 shares during the period. International Assets Investment Management LLC purchased a new position in shares of Diageo during the third quarter valued at approximately $9,769,000. Finally, Eldred Rock Partners LLC lifted its stake in shares of Diageo by 120.5% during the third quarter. Eldred Rock Partners LLC now owns 54,769 shares of the company's stock valued at $7,752,000 after buying an additional 29,928 shares during the period. 8.97% of the stock is currently owned by institutional investors and hedge funds.

Diageo Trading Up 0.6 %

Shares of DEO stock traded up $0.70 during mid-day trading on Thursday, reaching $119.85. The company's stock had a trading volume of 929,159 shares, compared to its average volume of 757,626. The company's 50 day simple moving average is $131.91 and its 200-day simple moving average is $132.03. Diageo plc has a 12-month low of $117.84 and a 12-month high of $154.71. The company has a quick ratio of 0.55, a current ratio of 1.53 and a debt-to-equity ratio of 1.62. The firm has a market capitalization of $66.67 billion, a PE ratio of 16.93, a price-to-earnings-growth ratio of 3.41 and a beta of 0.71.

Analyst Ratings Changes

A number of equities analysts have weighed in on the stock. Bank of America raised shares of Diageo from a "neutral" rating to a "buy" rating in a research note on Thursday, September 12th. Royal Bank of Canada raised shares of Diageo from an "underperform" rating to a "sector perform" rating in a research note on Monday, August 12th. Three investment analysts have rated the stock with a sell rating, three have assigned a hold rating and two have given a buy rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Hold".

Check Out Our Latest Stock Analysis on DEO

Diageo Company Profile

(

Free Report)

Diageo plc, together with its subsidiaries, engages in the production, marketing, and sale of alcoholic beverages. The company offers scotch, gin, vodka, rum, raki, liqueur, wine, tequila, Chinese white spirits, cachaça, and brandy, as well as beer, including cider and flavored malt beverages. It also provides Chinese, Canadian, Irish, American, and Indian-Made Foreign Liquor whiskies, as well as flavored malt beverages, ready to drink, and non-alcoholic products.

Recommended Stories

Before you consider Diageo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diageo wasn't on the list.

While Diageo currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.