Assetmark Inc. increased its stake in shares of Elastic (NYSE:ESTC - Free Report) by 28,132.1% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 7,905 shares of the company's stock after purchasing an additional 7,877 shares during the quarter. Assetmark Inc.'s holdings in Elastic were worth $607,000 at the end of the most recent quarter.

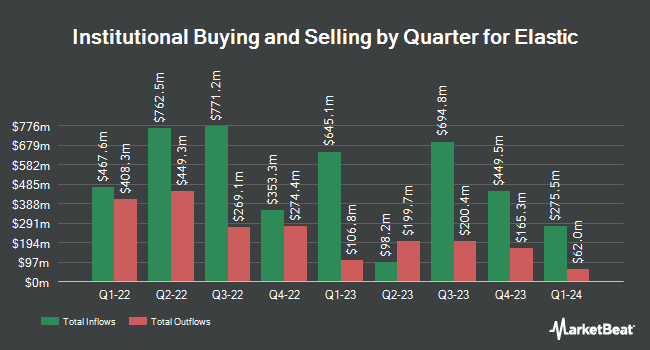

A number of other hedge funds and other institutional investors have also modified their holdings of the stock. Allspring Global Investments Holdings LLC bought a new stake in Elastic during the 1st quarter worth about $64,000. Russell Investments Group Ltd. lifted its holdings in Elastic by 993.0% in the first quarter. Russell Investments Group Ltd. now owns 17,236 shares of the company's stock valued at $1,728,000 after buying an additional 15,659 shares during the period. ProShare Advisors LLC grew its holdings in Elastic by 24.6% during the 1st quarter. ProShare Advisors LLC now owns 2,232 shares of the company's stock worth $224,000 after acquiring an additional 441 shares during the period. State Board of Administration of Florida Retirement System raised its position in shares of Elastic by 0.8% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 86,920 shares of the company's stock valued at $8,713,000 after acquiring an additional 678 shares during the last quarter. Finally, Vanguard Group Inc. lifted its stake in shares of Elastic by 0.5% in the 1st quarter. Vanguard Group Inc. now owns 8,613,723 shares of the company's stock valued at $863,440,000 after purchasing an additional 44,597 shares during the period. Institutional investors and hedge funds own 97.03% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages have commented on ESTC. Scotiabank lowered their target price on shares of Elastic from $135.00 to $92.00 and set a "sector outperform" rating for the company in a research note on Friday, August 30th. TD Cowen dropped their price objective on Elastic from $110.00 to $80.00 and set a "hold" rating on the stock in a research note on Friday, August 30th. Canaccord Genuity Group decreased their target price on Elastic from $125.00 to $110.00 and set a "buy" rating for the company in a research note on Tuesday, September 3rd. DA Davidson dropped their price target on Elastic from $100.00 to $75.00 and set a "neutral" rating on the stock in a research report on Friday, August 30th. Finally, UBS Group lowered their target price on Elastic from $135.00 to $95.00 and set a "buy" rating for the company in a research note on Friday, August 30th. Eight analysts have rated the stock with a hold rating and sixteen have given a buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $104.19.

Get Our Latest Analysis on Elastic

Elastic Stock Performance

ESTC stock traded down $2.91 during trading hours on Friday, hitting $86.32. 1,776,617 shares of the stock were exchanged, compared to its average volume of 1,274,618. Elastic has a 12 month low of $69.00 and a 12 month high of $136.06. The company has a current ratio of 1.91, a quick ratio of 1.91 and a debt-to-equity ratio of 0.75. The firm has a market capitalization of $8.87 billion, a P/E ratio of 156.95 and a beta of 0.94. The company has a 50-day simple moving average of $79.81 and a two-hundred day simple moving average of $97.44.

Elastic (NYSE:ESTC - Get Free Report) last announced its earnings results on Thursday, August 29th. The company reported $0.35 EPS for the quarter, topping the consensus estimate of $0.25 by $0.10. The company had revenue of $347.42 million for the quarter, compared to analysts' expectations of $344.67 million. Elastic had a net margin of 4.62% and a negative return on equity of 17.54%. The business's revenue for the quarter was up 18.3% on a year-over-year basis. During the same period last year, the firm earned ($0.35) earnings per share. On average, analysts forecast that Elastic will post -0.92 earnings per share for the current fiscal year.

Insider Activity

In related news, Director Paul R. Auvil III purchased 20,000 shares of the firm's stock in a transaction that occurred on Tuesday, September 3rd. The shares were bought at an average cost of $74.25 per share, with a total value of $1,485,000.00. Following the acquisition, the director now owns 22,627 shares of the company's stock, valued at $1,680,054.75. This trade represents a 761.32 % increase in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CFO Janesh Moorjani sold 6,941 shares of the stock in a transaction that occurred on Monday, September 9th. The shares were sold at an average price of $70.25, for a total transaction of $487,605.25. Following the completion of the transaction, the chief financial officer now directly owns 195,550 shares of the company's stock, valued at approximately $13,737,387.50. The trade was a 3.43 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 37,406 shares of company stock worth $2,627,772. 15.90% of the stock is currently owned by corporate insiders.

Elastic Company Profile

(

Free Report)

Elastic N.V., a data analytics company, delivers solutions designed to run in public or private clouds in multi-cloud environments. It primarily offers Elastic Stack, a set of software products that ingest and store data from various sources and formats, as well as performs search, analysis, and visualization on that data.

Further Reading

Before you consider Elastic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elastic wasn't on the list.

While Elastic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.