Mount Lucas Management LP cut its stake in shares of Assurant, Inc. (NYSE:AIZ - Free Report) by 59.9% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 9,927 shares of the financial services provider's stock after selling 14,859 shares during the quarter. Mount Lucas Management LP's holdings in Assurant were worth $1,974,000 at the end of the most recent reporting period.

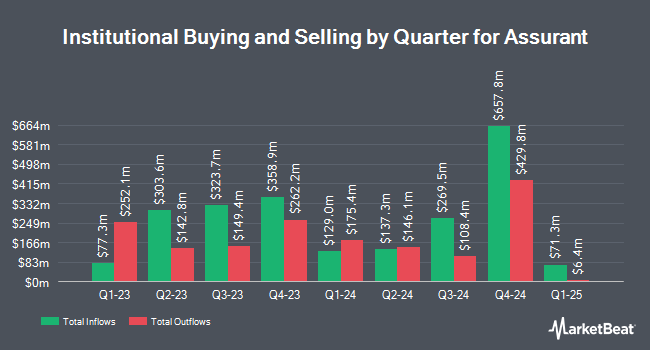

A number of other hedge funds and other institutional investors have also recently modified their holdings of AIZ. Janney Montgomery Scott LLC grew its position in Assurant by 5.2% in the first quarter. Janney Montgomery Scott LLC now owns 3,816 shares of the financial services provider's stock worth $718,000 after acquiring an additional 189 shares in the last quarter. Sei Investments Co. lifted its stake in Assurant by 62.6% in the first quarter. Sei Investments Co. now owns 24,284 shares of the financial services provider's stock worth $4,571,000 after acquiring an additional 9,346 shares during the period. Mitsubishi UFJ Asset Management Co. Ltd. boosted its stake in shares of Assurant by 12.3% during the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 60,372 shares of the financial services provider's stock valued at $11,364,000 after purchasing an additional 6,621 shares in the last quarter. Blair William & Co. IL boosted its position in Assurant by 0.6% during the 1st quarter. Blair William & Co. IL now owns 17,297 shares of the financial services provider's stock valued at $3,256,000 after acquiring an additional 100 shares in the last quarter. Finally, Ontario Teachers Pension Plan Board grew its stake in Assurant by 24.0% in the first quarter. Ontario Teachers Pension Plan Board now owns 10,591 shares of the financial services provider's stock valued at $1,994,000 after purchasing an additional 2,048 shares during the last quarter. 92.65% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of equities research analysts recently commented on AIZ shares. UBS Group increased their target price on shares of Assurant from $217.00 to $224.00 and gave the company a "buy" rating in a research report on Monday, September 23rd. Truist Financial raised their price objective on Assurant from $220.00 to $240.00 and gave the stock a "buy" rating in a research report on Thursday, November 7th. Piper Sandler boosted their target price on Assurant from $200.00 to $217.00 and gave the stock a "neutral" rating in a research note on Wednesday, October 2nd. Keefe, Bruyette & Woods increased their price target on Assurant from $194.00 to $212.00 and gave the company a "market perform" rating in a research note on Tuesday, November 12th. Finally, Bank of America boosted their price target on Assurant from $228.00 to $233.00 and gave the stock a "buy" rating in a research note on Thursday, October 10th. Three investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat, Assurant presently has an average rating of "Moderate Buy" and a consensus target price of $225.20.

Check Out Our Latest Stock Analysis on AIZ

Assurant Stock Performance

Shares of NYSE AIZ traded up $3.34 during mid-day trading on Friday, hitting $218.82. The stock had a trading volume of 488,411 shares, compared to its average volume of 339,065. The company has a debt-to-equity ratio of 0.40, a quick ratio of 0.42 and a current ratio of 0.42. The company has a 50 day moving average of $197.03 and a two-hundred day moving average of $182.78. The firm has a market cap of $11.22 billion, a PE ratio of 15.61, a PEG ratio of 2.18 and a beta of 0.57. Assurant, Inc. has a twelve month low of $159.32 and a twelve month high of $219.05.

Assurant (NYSE:AIZ - Get Free Report) last posted its earnings results on Tuesday, November 5th. The financial services provider reported $3.00 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.52 by $0.48. The company had revenue of $2.97 billion during the quarter, compared to the consensus estimate of $2.94 billion. Assurant had a net margin of 6.31% and a return on equity of 17.42%. The firm's quarterly revenue was up 7.0% on a year-over-year basis. During the same period in the previous year, the firm posted $4.29 earnings per share. Research analysts predict that Assurant, Inc. will post 15.05 EPS for the current fiscal year.

Insider Activity

In other Assurant news, CAO Dimitry Dirienzo sold 550 shares of the business's stock in a transaction that occurred on Monday, August 19th. The shares were sold at an average price of $188.44, for a total transaction of $103,642.00. Following the completion of the transaction, the chief accounting officer now owns 3,152 shares in the company, valued at $593,962.88. The trade was a 14.86 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, EVP Biju Nair sold 3,000 shares of Assurant stock in a transaction dated Friday, November 8th. The stock was sold at an average price of $209.18, for a total value of $627,540.00. Following the sale, the executive vice president now directly owns 20,658 shares of the company's stock, valued at $4,321,240.44. This trade represents a 12.68 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 0.53% of the company's stock.

Assurant Profile

(

Free Report)

Assurant, Inc, together with its subsidiaries, provides business services that supports, protects, and connects consumer purchases in North America, Latin America, Europe, and the Asia Pacific. The company operates through two segments: Global Lifestyle and Global Housing. The Global Lifestyle segment offers mobile device solutions, and extended service contracts and related services for consumer electronics and appliances, and credit and other insurance products; and vehicle protection, commercial equipment, and other related services.

Featured Stories

Before you consider Assurant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Assurant wasn't on the list.

While Assurant currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.