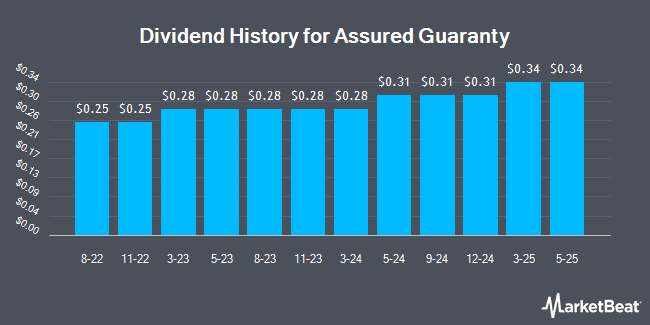

Assured Guaranty Ltd. (NYSE:AGO - Get Free Report) declared a quarterly dividend on Saturday, November 9th,NASDAQ Dividends reports. Investors of record on Friday, November 22nd will be paid a dividend of 0.31 per share by the financial services provider on Friday, December 6th. This represents a $1.24 annualized dividend and a dividend yield of 1.42%. The ex-dividend date is Friday, November 22nd.

Assured Guaranty has raised its dividend payment by an average of 11.9% annually over the last three years. Assured Guaranty has a dividend payout ratio of 19.6% indicating that its dividend is sufficiently covered by earnings. Analysts expect Assured Guaranty to earn $6.75 per share next year, which means the company should continue to be able to cover its $1.24 annual dividend with an expected future payout ratio of 18.4%.

Assured Guaranty Price Performance

Assured Guaranty stock traded up $1.00 during mid-day trading on Friday, hitting $87.53. 353,338 shares of the company were exchanged, compared to its average volume of 380,253. The company has a debt-to-equity ratio of 0.30, a current ratio of 0.96 and a quick ratio of 0.96. Assured Guaranty has a 12-month low of $64.59 and a 12-month high of $96.60. The business's 50 day simple moving average is $82.01 and its two-hundred day simple moving average is $79.32. The company has a market capitalization of $4.61 billion, a P/E ratio of 7.12 and a beta of 1.10.

Assured Guaranty (NYSE:AGO - Get Free Report) last announced its quarterly earnings data on Wednesday, August 7th. The financial services provider reported $1.44 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.39 by $0.05. The business had revenue of $202.00 million for the quarter, compared to the consensus estimate of $193.05 million. Assured Guaranty had a net margin of 61.17% and a return on equity of 13.19%. The company's quarterly revenue was down 43.9% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $0.60 earnings per share. Analysts forecast that Assured Guaranty will post 6.3 earnings per share for the current fiscal year.

Analyst Ratings Changes

AGO has been the topic of a number of research reports. UBS Group raised their price objective on Assured Guaranty from $84.00 to $87.00 and gave the stock a "neutral" rating in a report on Thursday, October 17th. StockNews.com lowered shares of Assured Guaranty from a "hold" rating to a "sell" rating in a research report on Friday, October 18th.

Get Our Latest Stock Analysis on AGO

Insider Transactions at Assured Guaranty

In other Assured Guaranty news, Director Yukiko Omura sold 3,599 shares of the business's stock in a transaction on Thursday, September 26th. The shares were sold at an average price of $79.73, for a total transaction of $286,948.27. Following the completion of the sale, the director now owns 19,285 shares in the company, valued at $1,537,593.05. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. In other Assured Guaranty news, Director Yukiko Omura sold 3,599 shares of the firm's stock in a transaction on Thursday, September 26th. The stock was sold at an average price of $79.73, for a total value of $286,948.27. Following the sale, the director now directly owns 19,285 shares in the company, valued at approximately $1,537,593.05. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, CEO Dominic Frederico sold 31,000 shares of the company's stock in a transaction dated Wednesday, September 4th. The stock was sold at an average price of $80.01, for a total transaction of $2,480,310.00. Following the transaction, the chief executive officer now owns 1,380,119 shares of the company's stock, valued at $110,423,321.19. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders own 5.10% of the company's stock.

About Assured Guaranty

(

Get Free Report)

Assured Guaranty Ltd., together with its subsidiaries, provides credit protection products to public finance, infrastructure, and structured finance markets in the United States and internationally. It operates through two segments: Insurance and Asset Management. The company offers financial guaranty insurance that protects holders of debt instruments and other monetary obligations from defaults in scheduled payments.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Assured Guaranty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Assured Guaranty wasn't on the list.

While Assured Guaranty currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.