Boston Partners lifted its holdings in Assured Guaranty Ltd. (NYSE:AGO - Free Report) by 46.0% during the 4th quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 806,821 shares of the financial services provider's stock after buying an additional 254,063 shares during the quarter. Boston Partners owned approximately 1.59% of Assured Guaranty worth $72,904,000 at the end of the most recent quarter.

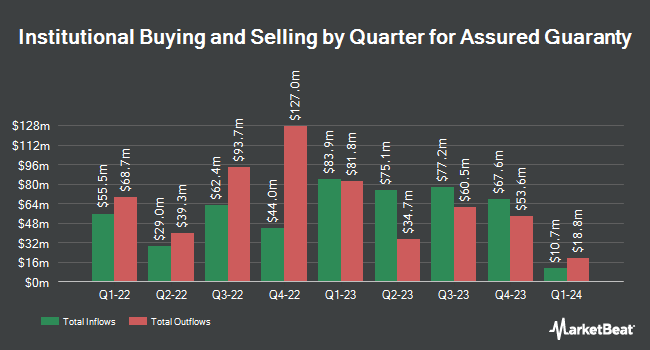

Several other institutional investors and hedge funds have also made changes to their positions in AGO. Proficio Capital Partners LLC purchased a new stake in shares of Assured Guaranty in the fourth quarter valued at approximately $25,000. True Wealth Design LLC purchased a new stake in shares of Assured Guaranty in the 3rd quarter worth $38,000. EverSource Wealth Advisors LLC grew its position in shares of Assured Guaranty by 46.3% during the 4th quarter. EverSource Wealth Advisors LLC now owns 471 shares of the financial services provider's stock worth $42,000 after buying an additional 149 shares in the last quarter. Venturi Wealth Management LLC increased its stake in shares of Assured Guaranty by 100.6% during the fourth quarter. Venturi Wealth Management LLC now owns 684 shares of the financial services provider's stock valued at $62,000 after buying an additional 343 shares during the period. Finally, Heck Capital Advisors LLC bought a new stake in shares of Assured Guaranty in the fourth quarter valued at about $97,000. 92.22% of the stock is currently owned by institutional investors.

Assured Guaranty Stock Up 2.7 %

Assured Guaranty stock traded up $2.33 during midday trading on Monday, hitting $87.71. 418,970 shares of the company's stock were exchanged, compared to its average volume of 346,339. The company has a debt-to-equity ratio of 0.29, a quick ratio of 0.91 and a current ratio of 0.91. The company has a market cap of $4.39 billion, a PE ratio of 6.82 and a beta of 1.11. The firm has a 50-day moving average of $90.03 and a two-hundred day moving average of $87.51. Assured Guaranty Ltd. has a 12 month low of $72.57 and a 12 month high of $96.50.

Assured Guaranty (NYSE:AGO - Get Free Report) last released its quarterly earnings data on Thursday, February 27th. The financial services provider reported $1.27 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.34 by ($0.07). The business had revenue of $199.00 million for the quarter, compared to the consensus estimate of $199.56 million. Assured Guaranty had a net margin of 70.37% and a return on equity of 11.58%. As a group, analysts expect that Assured Guaranty Ltd. will post 7.3 earnings per share for the current fiscal year.

Assured Guaranty Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Wednesday, March 19th. Stockholders of record on Wednesday, March 5th were paid a dividend of $0.34 per share. This is a positive change from Assured Guaranty's previous quarterly dividend of $0.31. The ex-dividend date was Wednesday, March 5th. This represents a $1.36 dividend on an annualized basis and a dividend yield of 1.55%. Assured Guaranty's payout ratio is presently 19.94%.

Assured Guaranty Company Profile

(

Free Report)

Assured Guaranty Ltd., together with its subsidiaries, provides credit protection products to public finance, infrastructure, and structured finance markets in the United States and internationally. It operates through two segments: Insurance and Asset Management. The company offers financial guaranty insurance that protects holders of debt instruments and other monetary obligations from defaults in scheduled payments.

Recommended Stories

Before you consider Assured Guaranty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Assured Guaranty wasn't on the list.

While Assured Guaranty currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.