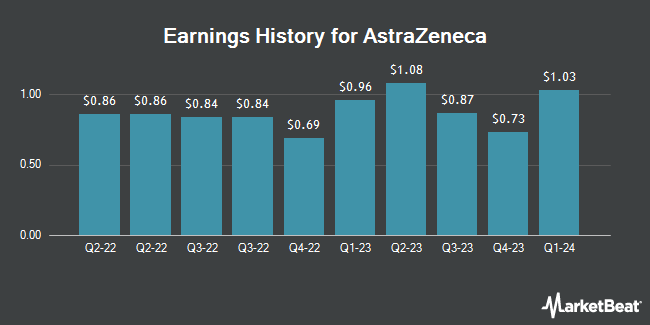

AstraZeneca (NASDAQ:AZN - Get Free Report) is projected to release its Q1 2025 earnings data before the market opens on Tuesday, April 29th. Analysts expect AstraZeneca to post earnings of $1.10 per share and revenue of $13.71 billion for the quarter.

AstraZeneca (NASDAQ:AZN - Get Free Report) last posted its earnings results on Thursday, February 6th. The company reported $1.05 earnings per share for the quarter, missing analysts' consensus estimates of $1.10 by ($0.05). AstraZeneca had a return on equity of 32.23% and a net margin of 13.01%. On average, analysts expect AstraZeneca to post $5 EPS for the current fiscal year and $5 EPS for the next fiscal year.

AstraZeneca Stock Up 0.0 %

AZN traded up $0.02 during midday trading on Friday, reaching $69.57. 6,662,575 shares of the company were exchanged, compared to its average volume of 5,223,437. The company has a market cap of $215.75 billion, a price-to-earnings ratio of 30.78, a price-to-earnings-growth ratio of 1.42 and a beta of 0.49. AstraZeneca has a one year low of $61.24 and a one year high of $87.68. The company's fifty day moving average price is $72.43 and its 200 day moving average price is $70.30. The company has a debt-to-equity ratio of 0.65, a quick ratio of 0.74 and a current ratio of 0.93.

AstraZeneca Increases Dividend

The company also recently disclosed a semi-annual dividend, which was paid on Monday, March 24th. Shareholders of record on Friday, February 21st were given a $1.03 dividend. This represents a yield of 2%. This is an increase from AstraZeneca's previous semi-annual dividend of $0.49. The ex-dividend date of this dividend was Friday, February 21st. AstraZeneca's dividend payout ratio is presently 91.15%.

Institutional Inflows and Outflows

An institutional investor recently raised its position in AstraZeneca stock. Brighton Jones LLC increased its position in AstraZeneca PLC (NASDAQ:AZN - Free Report) by 93.2% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 5,782 shares of the company's stock after acquiring an additional 2,789 shares during the quarter. Brighton Jones LLC's holdings in AstraZeneca were worth $379,000 at the end of the most recent quarter. Hedge funds and other institutional investors own 20.35% of the company's stock.

Wall Street Analyst Weigh In

AZN has been the subject of several recent analyst reports. Morgan Stanley started coverage on AstraZeneca in a report on Wednesday, February 12th. They issued an "overweight" rating for the company. UBS Group upgraded shares of AstraZeneca from a "neutral" rating to a "buy" rating in a research report on Thursday, February 13th. Finally, BNP Paribas began coverage on shares of AstraZeneca in a research report on Tuesday, April 15th. They issued an "outperform" rating and a $75.00 price objective on the stock. One research analyst has rated the stock with a hold rating, eight have given a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat, the stock has an average rating of "Buy" and an average target price of $86.80.

View Our Latest Stock Analysis on AstraZeneca

About AstraZeneca

(

Get Free Report)

AstraZeneca PLC, a biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines. The company's marketed products include Tagrisso, Imfinzi, Lynparza, Calquence, Enhertu, Orpathys, Truqap, Zoladex, Faslodex, Farxiga, Brilinta, Lokelma, Roxadustat, Andexxa, Crestor, Seloken, Onglyza, Bydureon, Fasenra, Breztri, Symbicort, Saphnelo, Tezspire, Pulmicort, Bevespi, and Daliresp for cardiovascular, renal, metabolism, and oncology.

See Also

Before you consider AstraZeneca, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AstraZeneca wasn't on the list.

While AstraZeneca currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.