AXQ Capital LP lifted its stake in AstraZeneca PLC (NASDAQ:AZN - Free Report) by 152.5% in the 4th quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 15,768 shares of the company's stock after buying an additional 9,524 shares during the period. AXQ Capital LP's holdings in AstraZeneca were worth $1,033,000 at the end of the most recent reporting period.

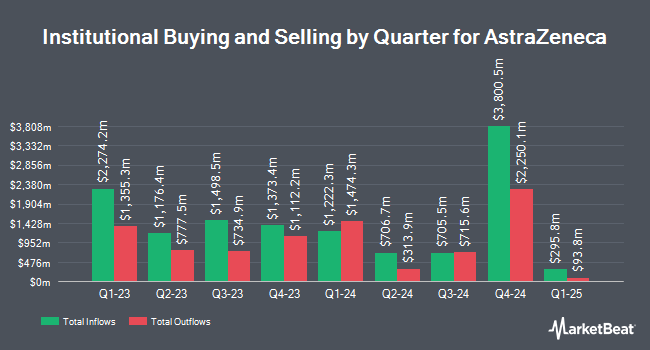

A number of other institutional investors have also added to or reduced their stakes in AZN. FMR LLC lifted its position in shares of AstraZeneca by 1.1% in the 3rd quarter. FMR LLC now owns 23,117,447 shares of the company's stock worth $1,801,080,000 after acquiring an additional 258,477 shares during the period. Franklin Resources Inc. lifted its position in AstraZeneca by 8.7% in the third quarter. Franklin Resources Inc. now owns 19,122,675 shares of the company's stock worth $1,492,649,000 after purchasing an additional 1,522,715 shares during the period. Jennison Associates LLC boosted its stake in AstraZeneca by 3.1% during the fourth quarter. Jennison Associates LLC now owns 15,430,963 shares of the company's stock worth $1,011,037,000 after buying an additional 466,416 shares in the last quarter. Fisher Asset Management LLC increased its holdings in AstraZeneca by 4.6% in the 4th quarter. Fisher Asset Management LLC now owns 10,959,852 shares of the company's stock valued at $718,090,000 after buying an additional 479,692 shares during the period. Finally, Manning & Napier Advisors LLC raised its stake in shares of AstraZeneca by 17.7% in the 4th quarter. Manning & Napier Advisors LLC now owns 3,745,531 shares of the company's stock valued at $245,407,000 after buying an additional 564,297 shares in the last quarter. 20.35% of the stock is owned by institutional investors and hedge funds.

AstraZeneca Price Performance

Shares of NASDAQ:AZN traded down $0.33 during trading on Wednesday, reaching $72.72. The stock had a trading volume of 6,516,136 shares, compared to its average volume of 4,953,231. The stock has a market capitalization of $225.52 billion, a PE ratio of 32.18, a P/E/G ratio of 1.42 and a beta of 0.41. AstraZeneca PLC has a 52 week low of $62.75 and a 52 week high of $87.68. The business's 50-day moving average price is $73.29 and its 200 day moving average price is $71.78. The company has a debt-to-equity ratio of 0.65, a current ratio of 0.93 and a quick ratio of 0.74.

AstraZeneca (NASDAQ:AZN - Get Free Report) last issued its quarterly earnings data on Thursday, February 6th. The company reported $1.05 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.10 by ($0.05). AstraZeneca had a net margin of 13.01% and a return on equity of 32.23%. As a group, equities analysts predict that AstraZeneca PLC will post 4.51 earnings per share for the current year.

AstraZeneca Increases Dividend

The business also recently declared a semi-annual dividend, which was paid on Monday, March 24th. Stockholders of record on Friday, February 21st were paid a dividend of $1.03 per share. This is a boost from AstraZeneca's previous semi-annual dividend of $0.49. This represents a dividend yield of 2%. The ex-dividend date was Friday, February 21st. AstraZeneca's dividend payout ratio is 91.15%.

Analyst Ratings Changes

AZN has been the topic of several recent research reports. UBS Group upgraded shares of AstraZeneca from a "neutral" rating to a "buy" rating in a research report on Thursday, February 13th. Morgan Stanley started coverage on AstraZeneca in a research note on Wednesday, February 12th. They issued an "overweight" rating on the stock. One research analyst has rated the stock with a hold rating, seven have assigned a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Buy" and an average target price of $89.75.

Get Our Latest Stock Report on AZN

About AstraZeneca

(

Free Report)

AstraZeneca PLC, a biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines. The company's marketed products include Tagrisso, Imfinzi, Lynparza, Calquence, Enhertu, Orpathys, Truqap, Zoladex, Faslodex, Farxiga, Brilinta, Lokelma, Roxadustat, Andexxa, Crestor, Seloken, Onglyza, Bydureon, Fasenra, Breztri, Symbicort, Saphnelo, Tezspire, Pulmicort, Bevespi, and Daliresp for cardiovascular, renal, metabolism, and oncology.

See Also

Before you consider AstraZeneca, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AstraZeneca wasn't on the list.

While AstraZeneca currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.