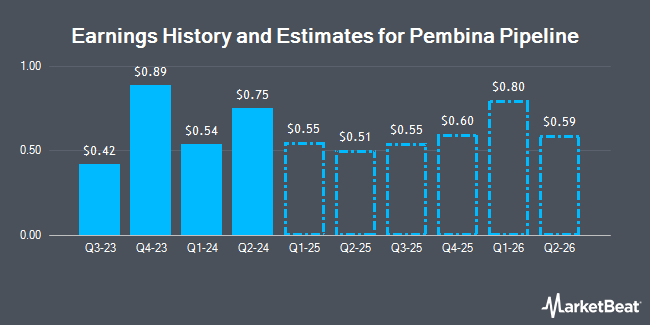

Pembina Pipeline Co. (NYSE:PBA - Free Report) TSE: PPL - Equities research analysts at Atb Cap Markets decreased their FY2025 earnings per share (EPS) estimates for Pembina Pipeline in a note issued to investors on Sunday, March 2nd. Atb Cap Markets analyst N. Heywood now forecasts that the pipeline company will post earnings per share of $2.21 for the year, down from their previous forecast of $2.28. The consensus estimate for Pembina Pipeline's current full-year earnings is $2.15 per share. Atb Cap Markets also issued estimates for Pembina Pipeline's Q4 2025 earnings at $0.60 EPS, Q2 2026 earnings at $0.58 EPS and Q3 2026 earnings at $0.60 EPS.

Several other equities analysts have also recently issued reports on the company. Wells Fargo & Company cut Pembina Pipeline from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, December 18th. Barclays initiated coverage on Pembina Pipeline in a research report on Thursday, December 12th. They issued an "overweight" rating on the stock. Finally, TD Securities began coverage on Pembina Pipeline in a research report on Wednesday, January 15th. They issued a "buy" rating on the stock. Five research analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and an average price target of $56.50.

Get Our Latest Analysis on PBA

Pembina Pipeline Stock Performance

PBA traded down $0.05 during trading hours on Wednesday, hitting $37.66. 1,303,942 shares of the stock were exchanged, compared to its average volume of 1,099,845. The stock has a 50-day simple moving average of $36.81 and a 200-day simple moving average of $39.37. Pembina Pipeline has a 12 month low of $33.83 and a 12 month high of $43.44. The stock has a market cap of $21.87 billion, a price-to-earnings ratio of 15.56 and a beta of 1.25. The company has a debt-to-equity ratio of 0.79, a current ratio of 0.65 and a quick ratio of 0.51.

Institutional Inflows and Outflows

Large investors have recently modified their holdings of the business. PDT Partners LLC bought a new position in Pembina Pipeline during the third quarter valued at about $1,329,000. Van ECK Associates Corp boosted its stake in Pembina Pipeline by 8.0% during the fourth quarter. Van ECK Associates Corp now owns 225,684 shares of the pipeline company's stock valued at $8,335,000 after buying an additional 16,762 shares in the last quarter. JPMorgan Chase & Co. boosted its stake in Pembina Pipeline by 18.2% during the third quarter. JPMorgan Chase & Co. now owns 4,049,470 shares of the pipeline company's stock valued at $167,000,000 after buying an additional 624,958 shares in the last quarter. Jennison Associates LLC boosted its stake in Pembina Pipeline by 32.3% during the fourth quarter. Jennison Associates LLC now owns 616,992 shares of the pipeline company's stock valued at $22,786,000 after buying an additional 150,689 shares in the last quarter. Finally, FMR LLC boosted its stake in Pembina Pipeline by 1,396.8% during the third quarter. FMR LLC now owns 547,448 shares of the pipeline company's stock valued at $22,573,000 after buying an additional 510,873 shares in the last quarter. 55.37% of the stock is owned by institutional investors and hedge funds.

Pembina Pipeline Cuts Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, March 31st. Stockholders of record on Monday, March 17th will be issued a dividend of $0.4783 per share. This represents a $1.91 dividend on an annualized basis and a dividend yield of 5.08%. The ex-dividend date of this dividend is Monday, March 17th. Pembina Pipeline's dividend payout ratio (DPR) is 86.30%.

Pembina Pipeline Company Profile

(

Get Free Report)

Pembina Pipeline Corporation provides energy transportation and midstream services. It operates through three segments: Pipelines, Facilities, and Marketing & New Ventures. The Pipelines segment operates conventional, oil sands and heavy oil, and transmission assets with a transportation capacity of 2.9 millions of barrels of oil equivalent per day, the ground storage capacity of 10 millions of barrels, and rail terminalling capacity of approximately 105 thousands of barrels of oil equivalent per day serving markets and basins across North America.

Further Reading

Before you consider Pembina Pipeline, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pembina Pipeline wasn't on the list.

While Pembina Pipeline currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.