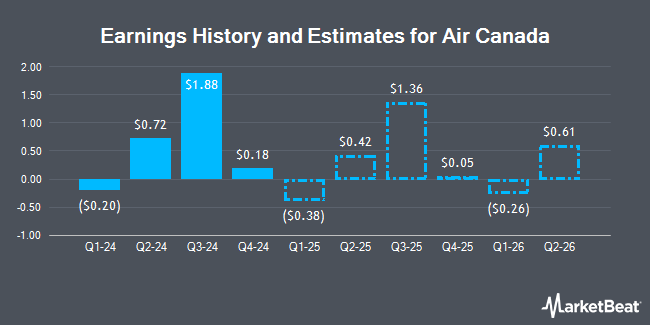

Air Canada (OTCMKTS:ACDVF - Free Report) - Research analysts at Atb Cap Markets upped their FY2024 earnings per share estimates for shares of Air Canada in a research note issued to investors on Sunday, November 3rd. Atb Cap Markets analyst C. Murray now forecasts that the company will post earnings of $2.29 per share for the year, up from their prior estimate of $1.38. The consensus estimate for Air Canada's current full-year earnings is $1.65 per share. Atb Cap Markets also issued estimates for Air Canada's Q4 2024 earnings at ($0.03) EPS, Q1 2025 earnings at ($0.36) EPS, Q2 2025 earnings at $0.31 EPS, Q3 2025 earnings at $1.53 EPS, Q4 2025 earnings at ($0.14) EPS and FY2026 earnings at $1.61 EPS.

Air Canada (OTCMKTS:ACDVF - Get Free Report) last announced its quarterly earnings results on Friday, November 1st. The company reported $1.88 EPS for the quarter, topping analysts' consensus estimates of $1.16 by $0.72. The business had revenue of $4.48 billion for the quarter, compared to analysts' expectations of $4.48 billion. Air Canada had a return on equity of 133.91% and a net margin of 11.53%.

Separately, Stifel Canada raised shares of Air Canada from a "hold" rating to a "strong-buy" rating in a report on Sunday.

Get Our Latest Stock Analysis on Air Canada

Air Canada Trading Up 3.9 %

Shares of OTCMKTS ACDVF traded up $0.62 during mid-day trading on Wednesday, hitting $16.62. The stock had a trading volume of 166,174 shares, compared to its average volume of 231,756. The business has a 50 day moving average price of $12.59 and a two-hundred day moving average price of $12.66. Air Canada has a 1 year low of $10.16 and a 1 year high of $16.65. The company has a debt-to-equity ratio of 9.32, a quick ratio of 0.81 and a current ratio of 0.85. The firm has a market cap of $5.96 billion, a P/E ratio of 3.43 and a beta of 2.05.

About Air Canada

(

Get Free Report)

Air Canada provides domestic, U.S. transborder, and international airline services. The company provides scheduled passenger services under the Air Canada Vacations and Air Canada Rouge brand names in the Canadian market, the Canada-U.S. transborder market, and in the international market to and from Canada, as well as through capacity purchase agreements on other regional carriers.

Featured Articles

Before you consider Air Canada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Air Canada wasn't on the list.

While Air Canada currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.