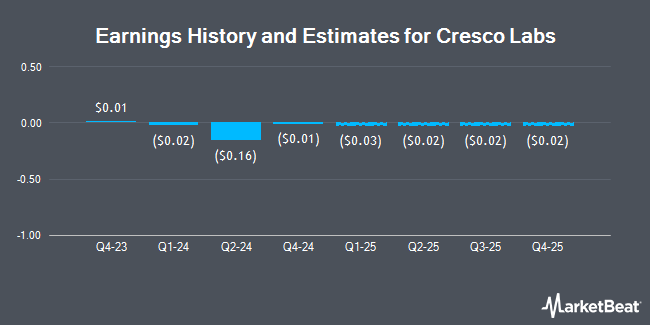

Cresco Labs Inc. (OTCMKTS:CRLBF - Free Report) - Equities research analysts at Atb Cap Markets upped their FY2025 earnings estimates for shares of Cresco Labs in a note issued to investors on Monday, December 9th. Atb Cap Markets analyst F. Gomes now expects that the company will earn ($0.07) per share for the year, up from their previous forecast of ($0.09). Atb Cap Markets currently has a "Hold" rating on the stock. The consensus estimate for Cresco Labs' current full-year earnings is ($0.20) per share.

CRLBF has been the topic of a number of other reports. Roth Capital raised shares of Cresco Labs to a "strong-buy" rating in a research report on Sunday, November 10th. Cormark downgraded shares of Cresco Labs from a "moderate buy" rating to a "hold" rating in a research note on Monday, November 11th. Four research analysts have rated the stock with a hold rating, two have issued a buy rating and two have issued a strong buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $2.50.

View Our Latest Report on CRLBF

Cresco Labs Price Performance

OTCMKTS:CRLBF traded down $0.03 during mid-day trading on Wednesday, reaching $1.04. The stock had a trading volume of 703,391 shares, compared to its average volume of 750,207. The stock has a market capitalization of $507.67 million, a P/E ratio of -5.20 and a beta of 1.73. The firm has a 50 day moving average price of $1.39 and a two-hundred day moving average price of $1.58. The company has a debt-to-equity ratio of 1.80, a quick ratio of 1.39 and a current ratio of 1.97. Cresco Labs has a one year low of $1.02 and a one year high of $2.65.

About Cresco Labs

(

Get Free Report)

Cresco Labs Inc, together with its subsidiaries, cultivates, manufactures, and sells retail and medical cannabis products in the United States. It provides cannabis in flowers, vape pens, live resins, disposable pens, and extracts under the Cresco brand; vape carts, vape pens, flower, popcorn, shake, pre-rolls, shorties, and concentrates under the High Supply brand; vapes and gummies under the Good News brand; vapes and edibles under the Wonder Wellness Co brand; and tinctures, capsules, salves, and sublingual oils under the Remedi brand.

Read More

Before you consider Cresco Labs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cresco Labs wasn't on the list.

While Cresco Labs currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.