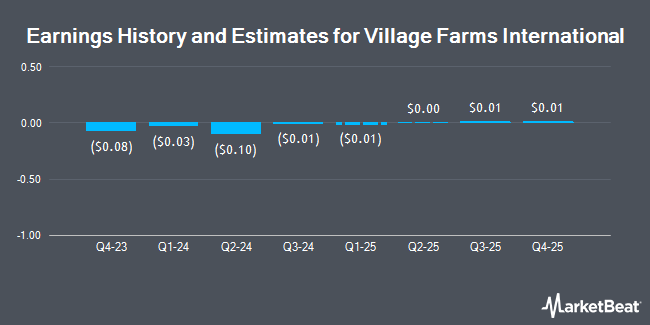

Village Farms International, Inc. (NASDAQ:VFF - Free Report) - Analysts at Atb Cap Markets lowered their FY2027 EPS estimates for Village Farms International in a report released on Thursday, March 13th. Atb Cap Markets analyst F. Gomes now expects that the company will post earnings of $0.08 per share for the year, down from their previous estimate of $0.12. The consensus estimate for Village Farms International's current full-year earnings is ($0.15) per share. Atb Cap Markets also issued estimates for Village Farms International's FY2029 earnings at $0.26 EPS.

Village Farms International Price Performance

Shares of NASDAQ VFF traded down $0.02 during mid-day trading on Monday, reaching $0.68. The company had a trading volume of 152,810 shares, compared to its average volume of 561,517. Village Farms International has a 1-year low of $0.66 and a 1-year high of $1.62. The stock has a market cap of $76.73 million, a PE ratio of -1.52 and a beta of 2.16. The company has a current ratio of 2.05, a quick ratio of 1.09 and a debt-to-equity ratio of 0.16. The company has a 50-day moving average price of $0.73 and a two-hundred day moving average price of $0.82.

Institutional Trading of Village Farms International

Several institutional investors and hedge funds have recently bought and sold shares of the stock. Jane Street Group LLC increased its position in shares of Village Farms International by 117.6% in the third quarter. Jane Street Group LLC now owns 407,246 shares of the company's stock worth $379,000 after acquiring an additional 220,105 shares in the last quarter. Tidal Investments LLC grew its position in Village Farms International by 35.7% during the 3rd quarter. Tidal Investments LLC now owns 2,431,488 shares of the company's stock worth $2,261,000 after purchasing an additional 640,148 shares in the last quarter. Sustainable Insight Capital Management LLC acquired a new stake in Village Farms International during the 4th quarter valued at $72,000. Two Sigma Advisers LP raised its stake in Village Farms International by 625.6% during the 4th quarter. Two Sigma Advisers LP now owns 193,000 shares of the company's stock valued at $149,000 after purchasing an additional 166,400 shares during the period. Finally, Lighthouse Financial LLC purchased a new stake in shares of Village Farms International in the fourth quarter valued at $36,000. Institutional investors and hedge funds own 12.15% of the company's stock.

Village Farms International Company Profile

(

Get Free Report)

Village Farms International, Inc, together with its subsidiaries, produces, markets, and sells greenhouse-grown tomatoes, bell peppers, and cucumbers in North America. It operates through four segments: Produce, Cannabis-Canada, Cannabis-U.S., and Energy. The company also produces and supplies cannabis products to other licensed providers and provincial governments in Canada and internationally; develops and sells cannabinoid-based health and wellness products, including ingestible, edibles, and topical applications; and produces power.

Featured Stories

Before you consider Village Farms International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Village Farms International wasn't on the list.

While Village Farms International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.